Description

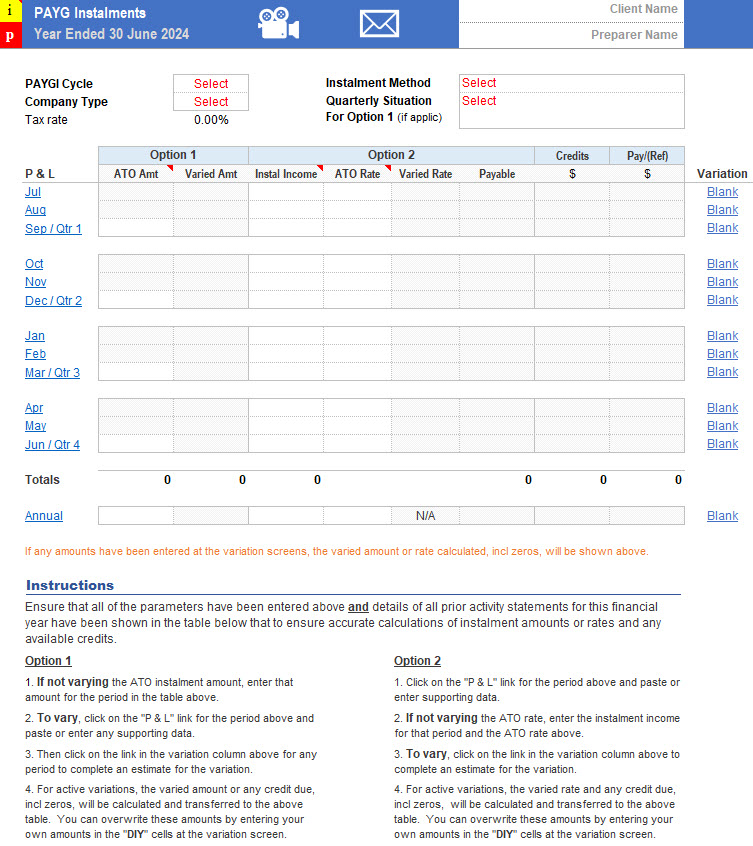

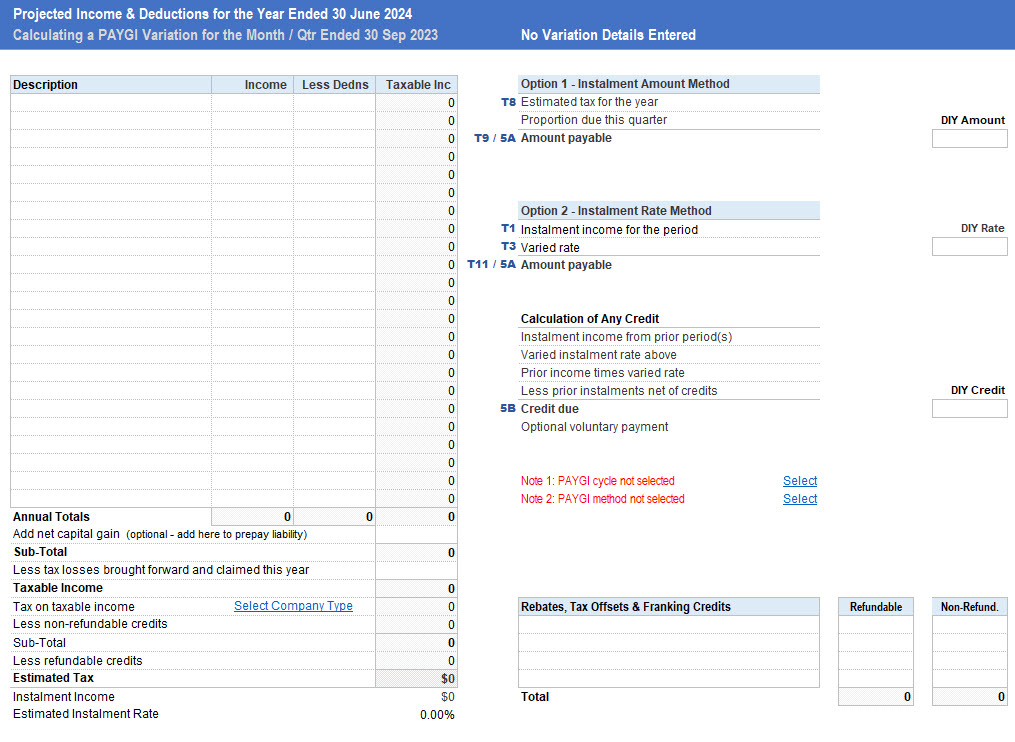

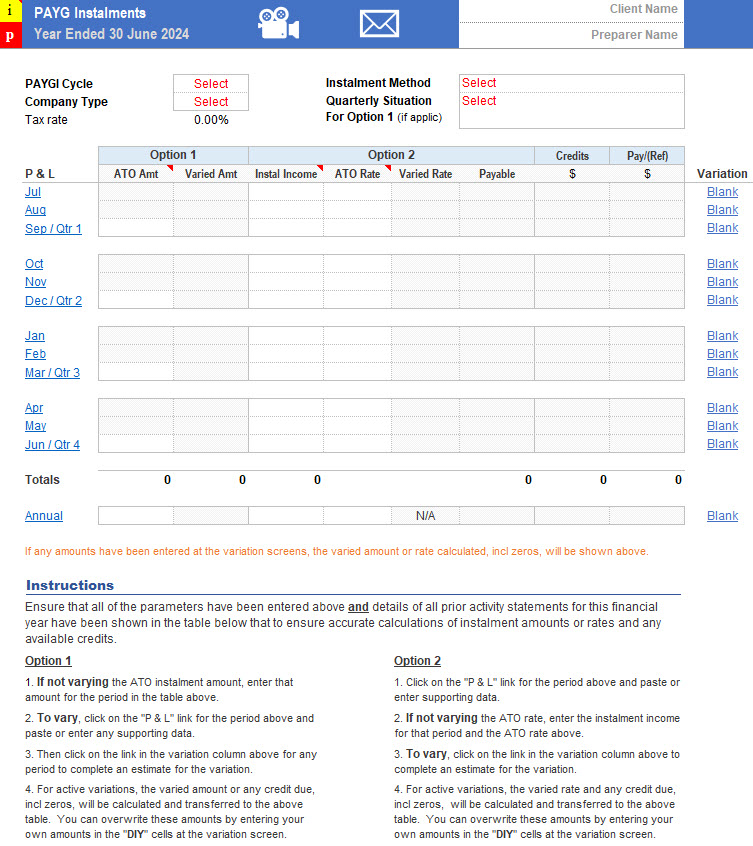

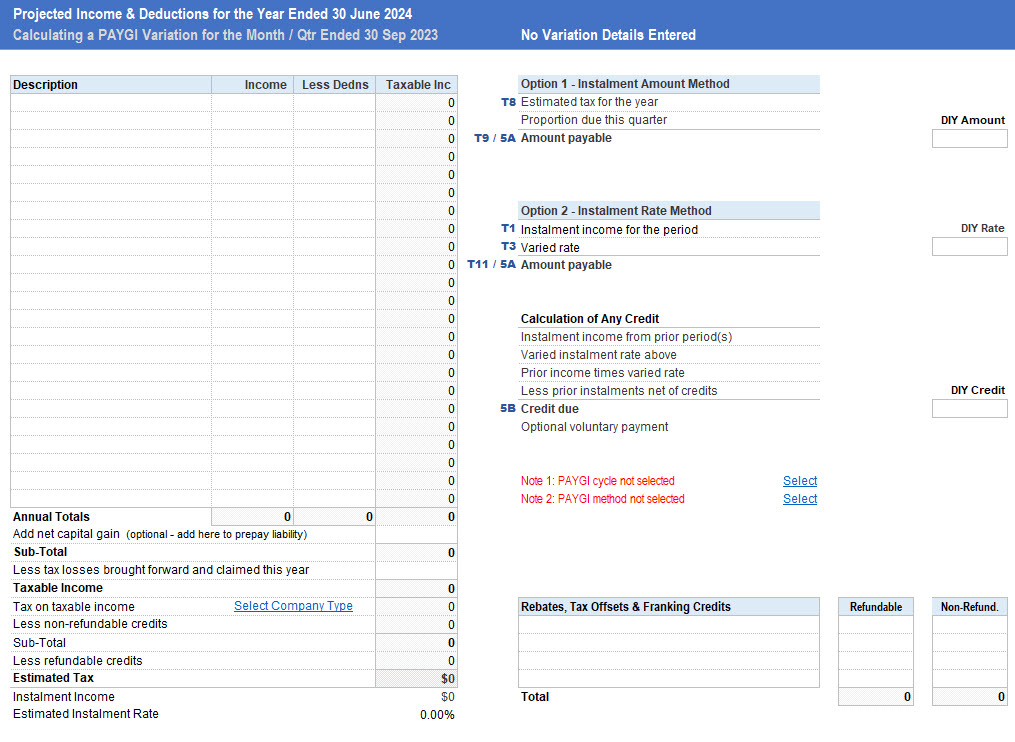

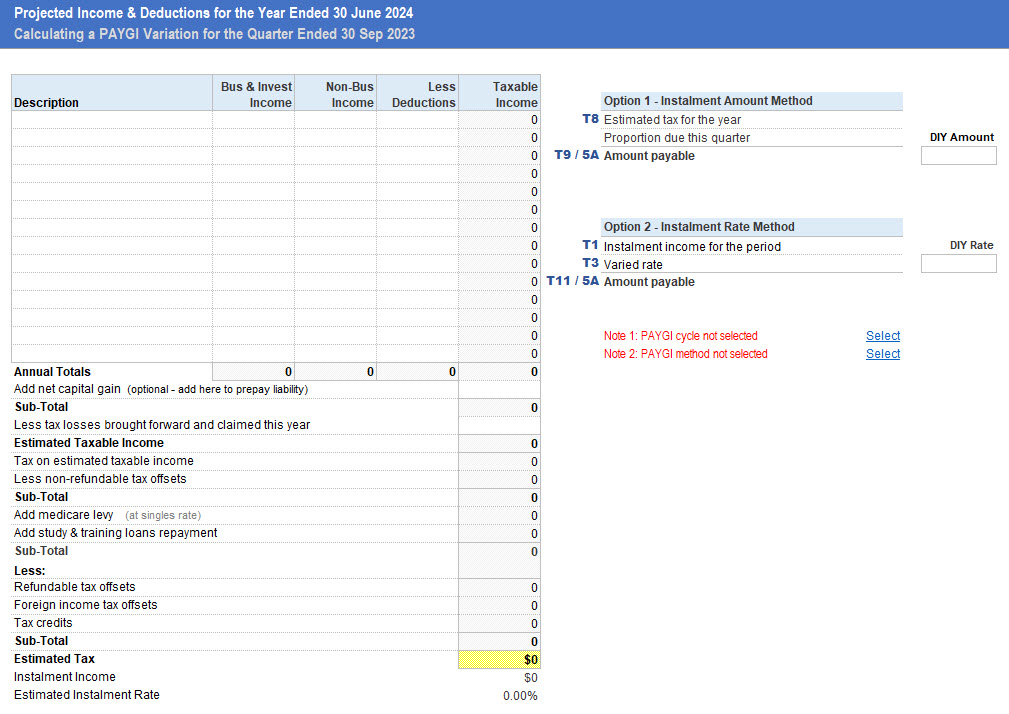

Sheet Preview – PAYGI Variation for a Company

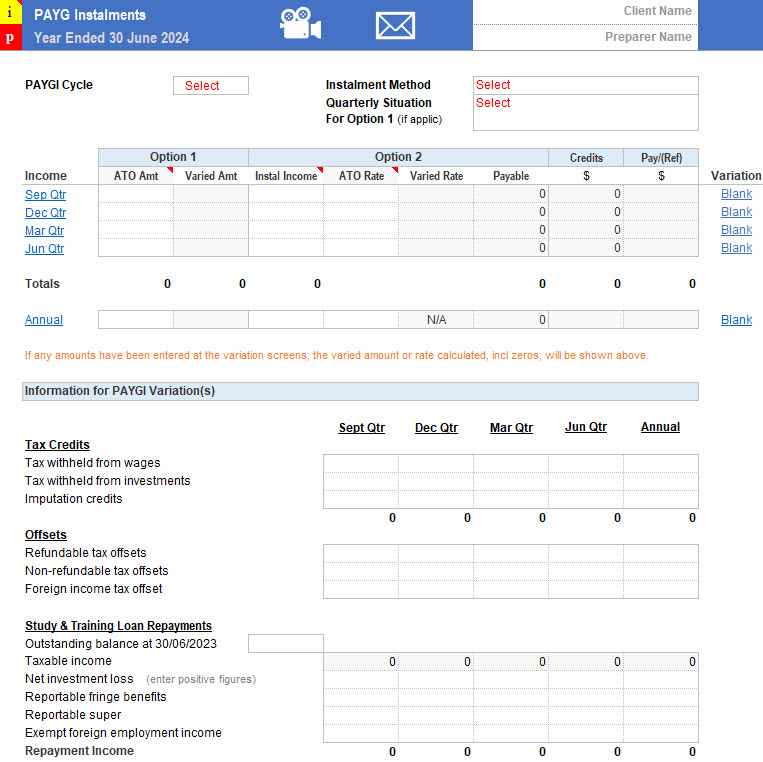

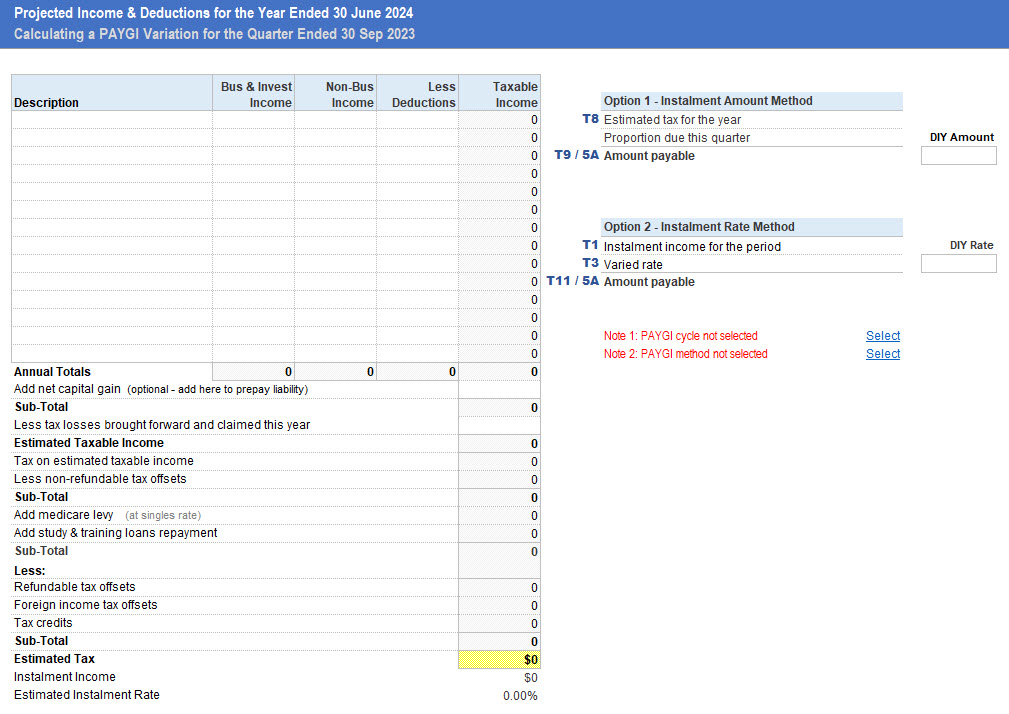

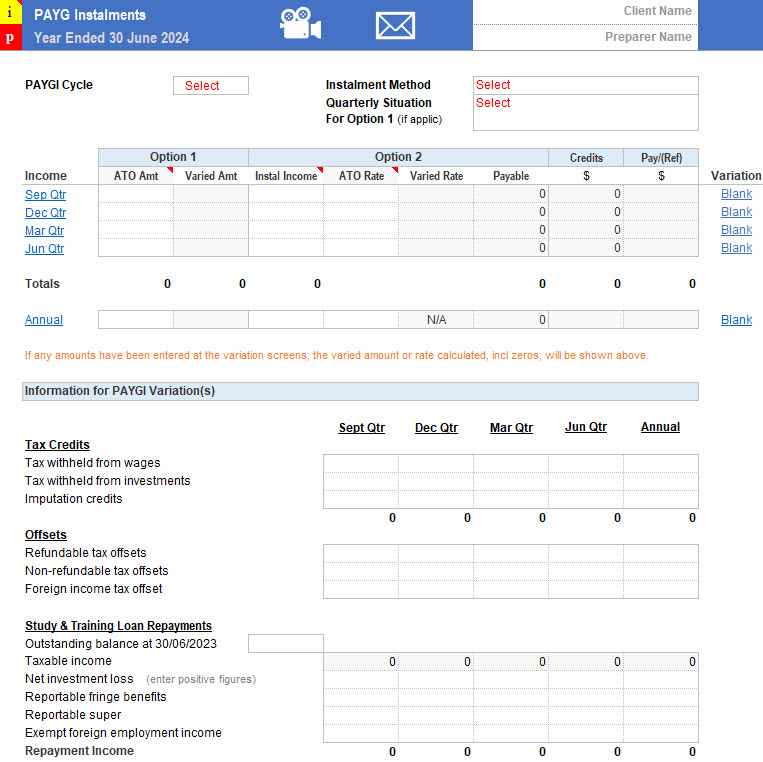

Sheet Preview – PAYGI Variation for an Individual

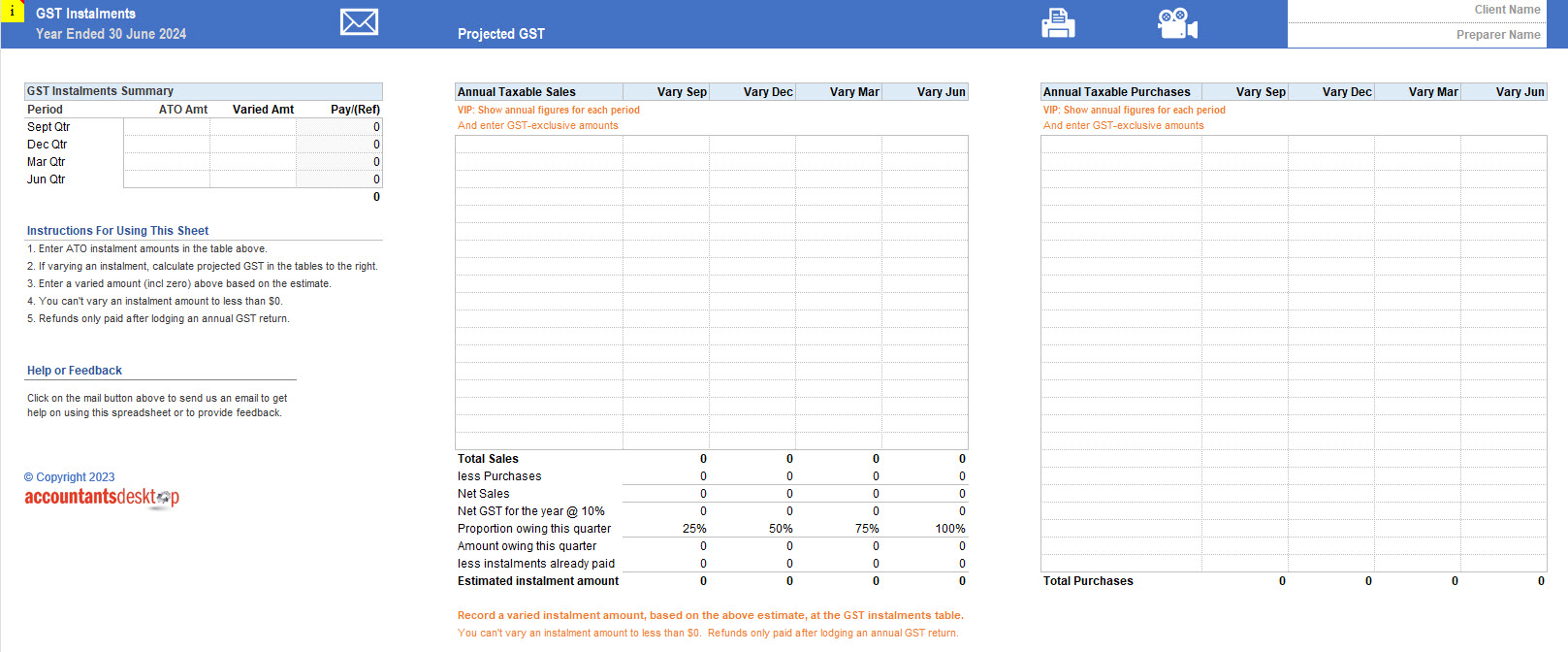

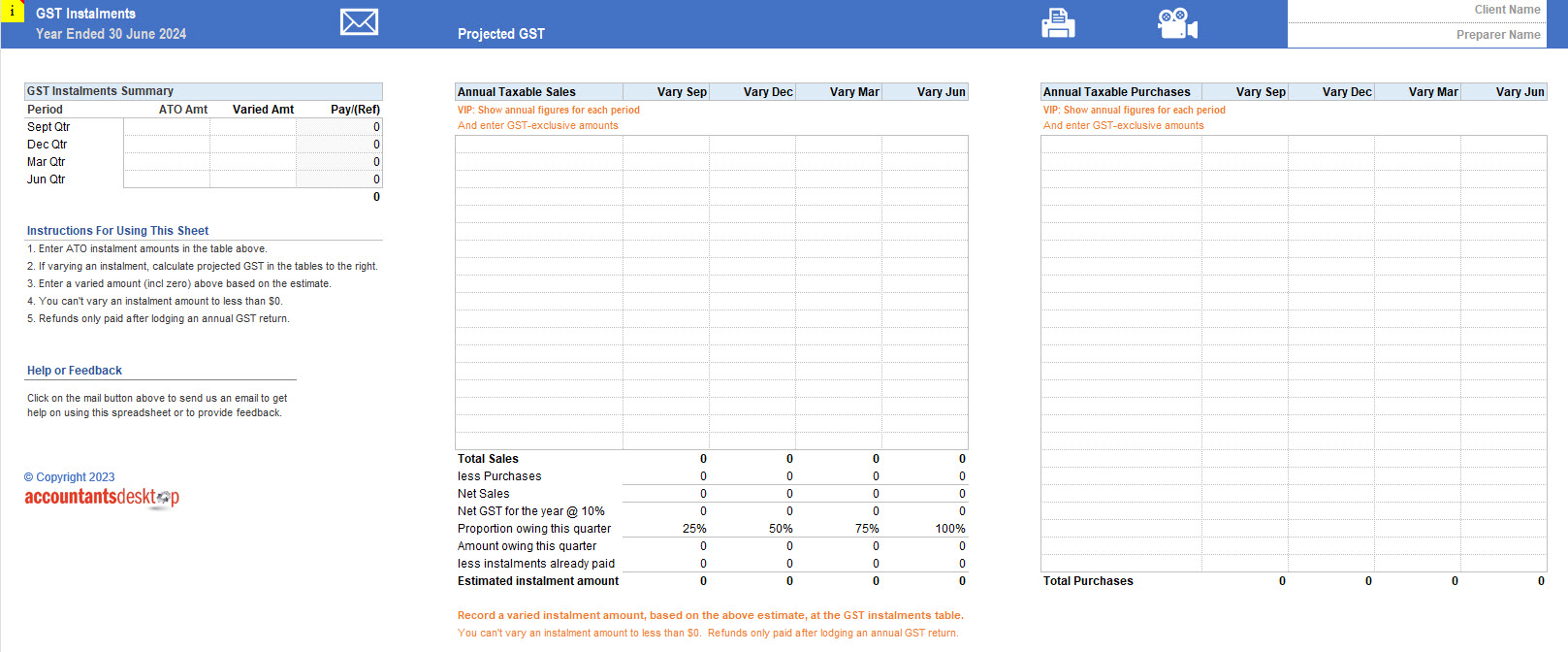

Sheet Preview – GST Instalment Variation

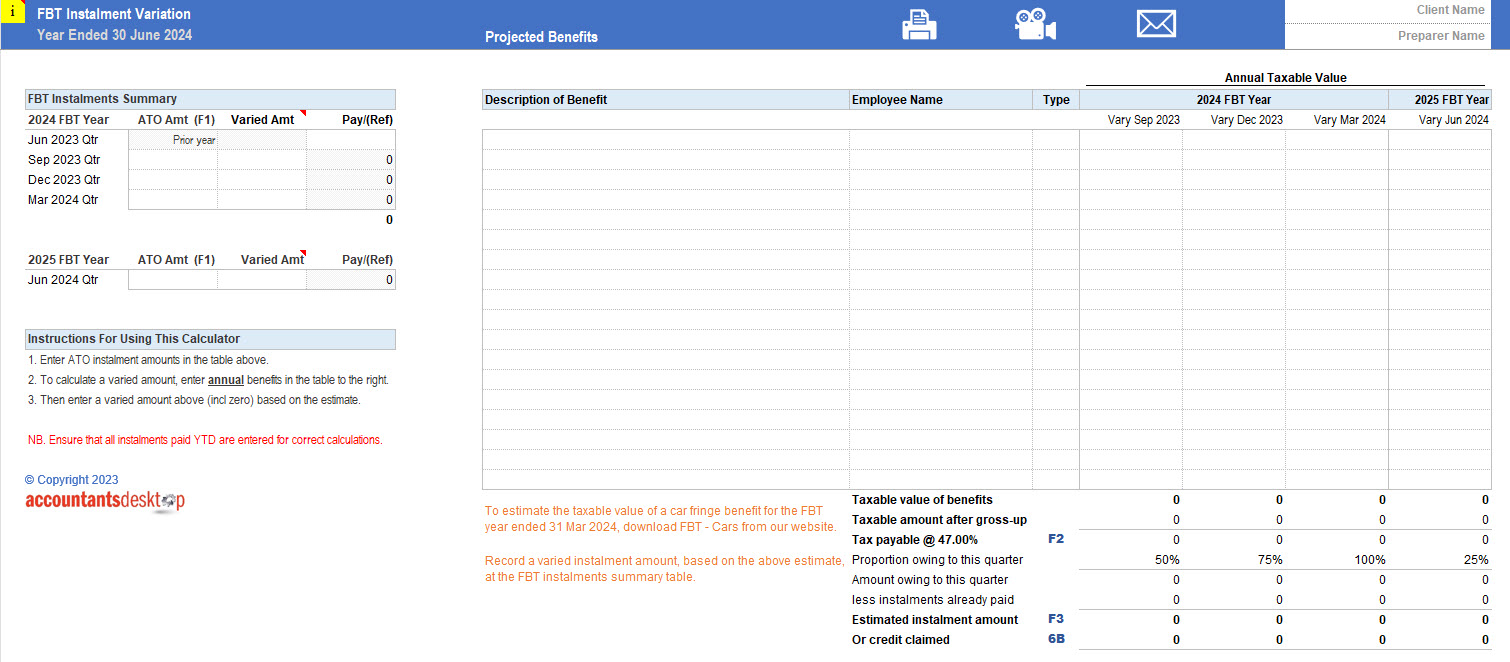

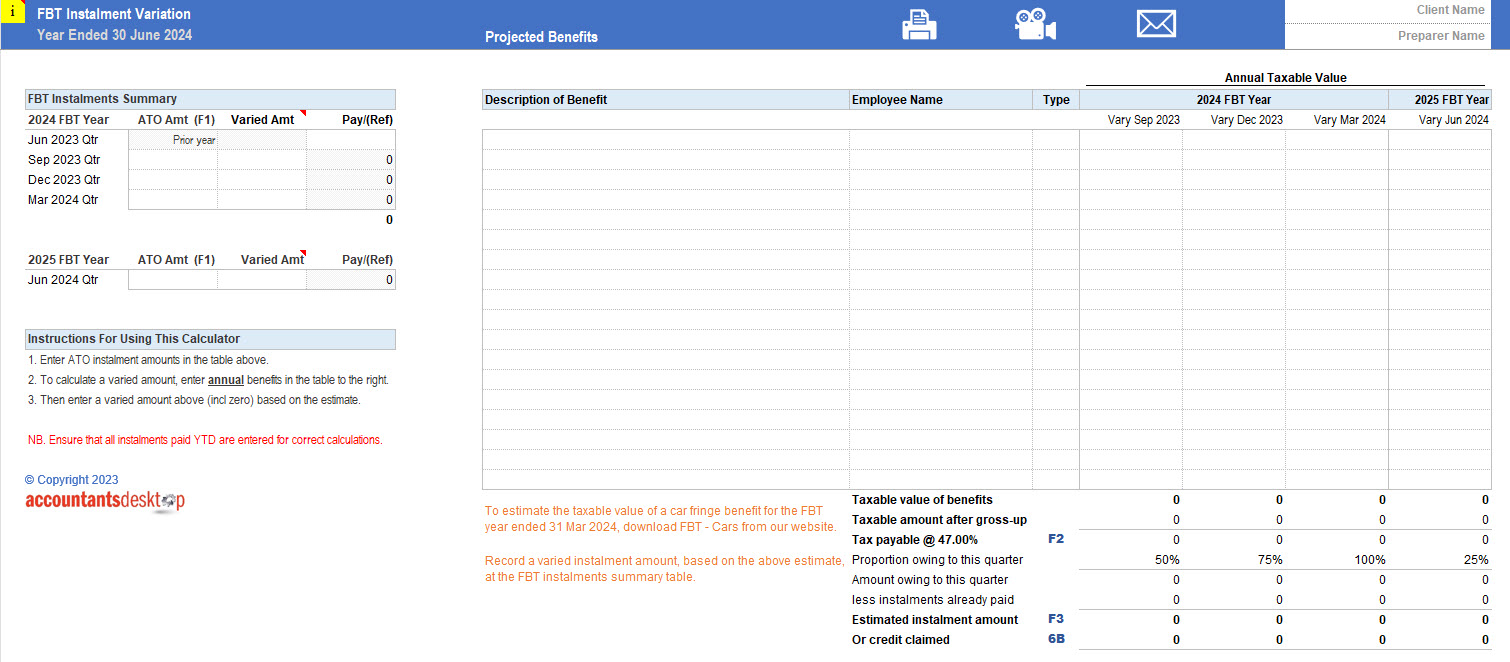

Sheet Preview – FBT Instalment Variation

Calculate variations to instalments raised in activity statements for the year ended 30 June 2024 for PAYG (individuals and companies), GST and FBT. This package includes the following 4 Excel files – PAYG Instalment Variation – Individual 2024 PAYG Instalment Variation – Company 2024 GST Instalment Variation 2024 FBT Instalment Variation 2024 As with all of our calculation packages, these files are downloaded to your system and are available for unlimited use within your practice. As well, you will be provided with any future updates to either the files or the calculation package. Warning: these files are not compatible with Microsoft Excel versions 2016 and earlier. For more information, read on and watch our 3 videos below to see a demonstration of these calculators as well as a brief tour of our website.

To access all of our content

$1,295.00 P.A. for 5 users!

Monthly plans available

Just fill in the form below and you will get access to our samples page with free downloads.

"*" indicates required fields

(02) 9542 4655

info@accountantsdesktop.com.au

PO BOX 507 Sutherland NSW 1499