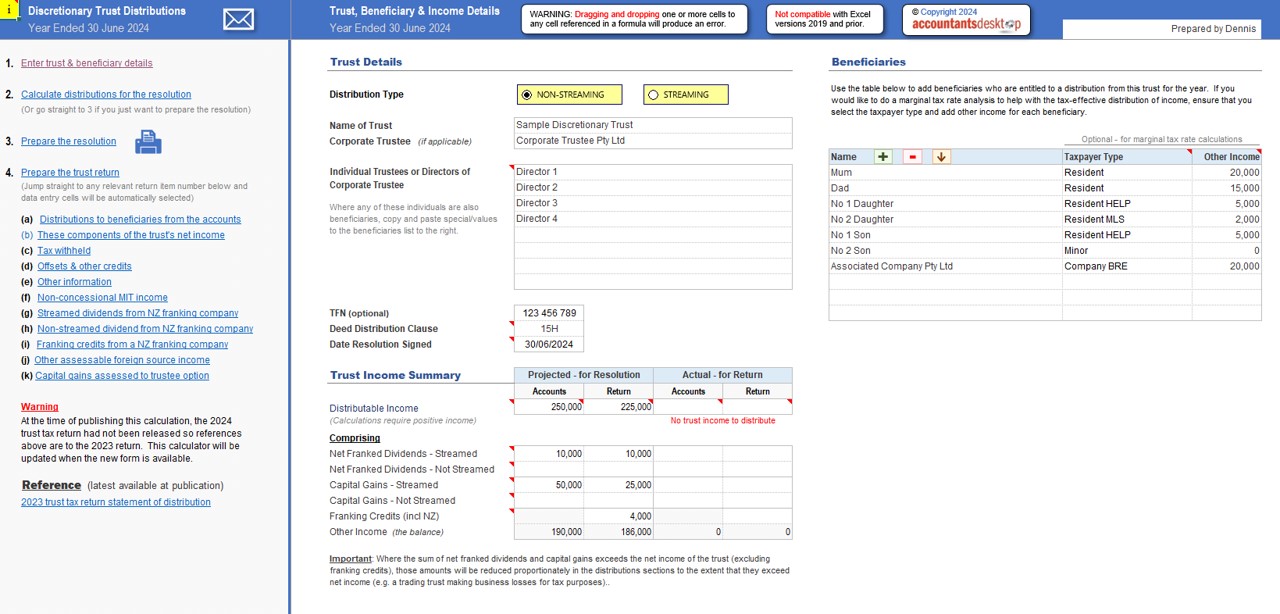

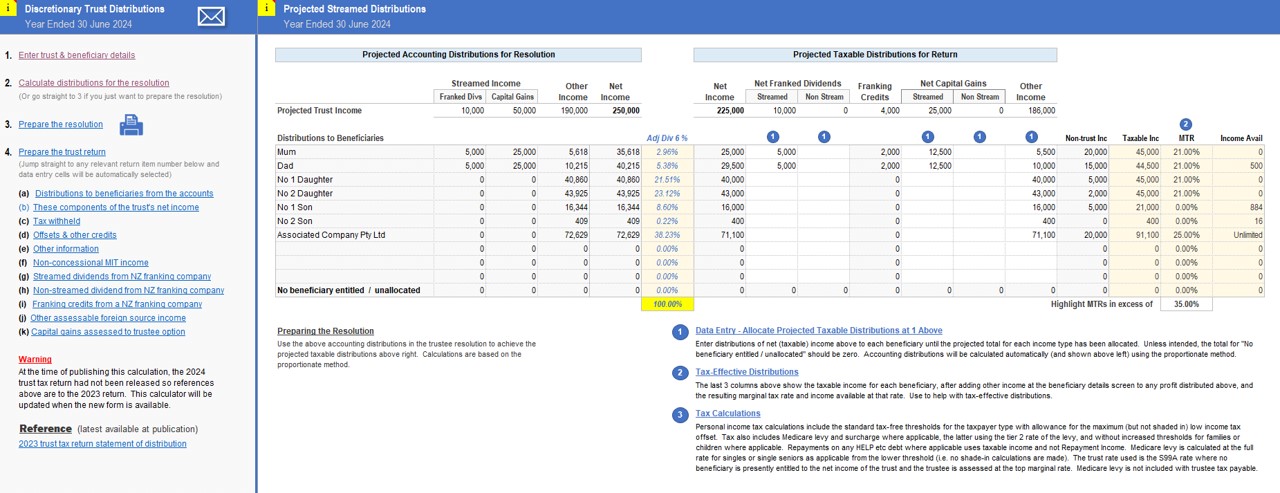

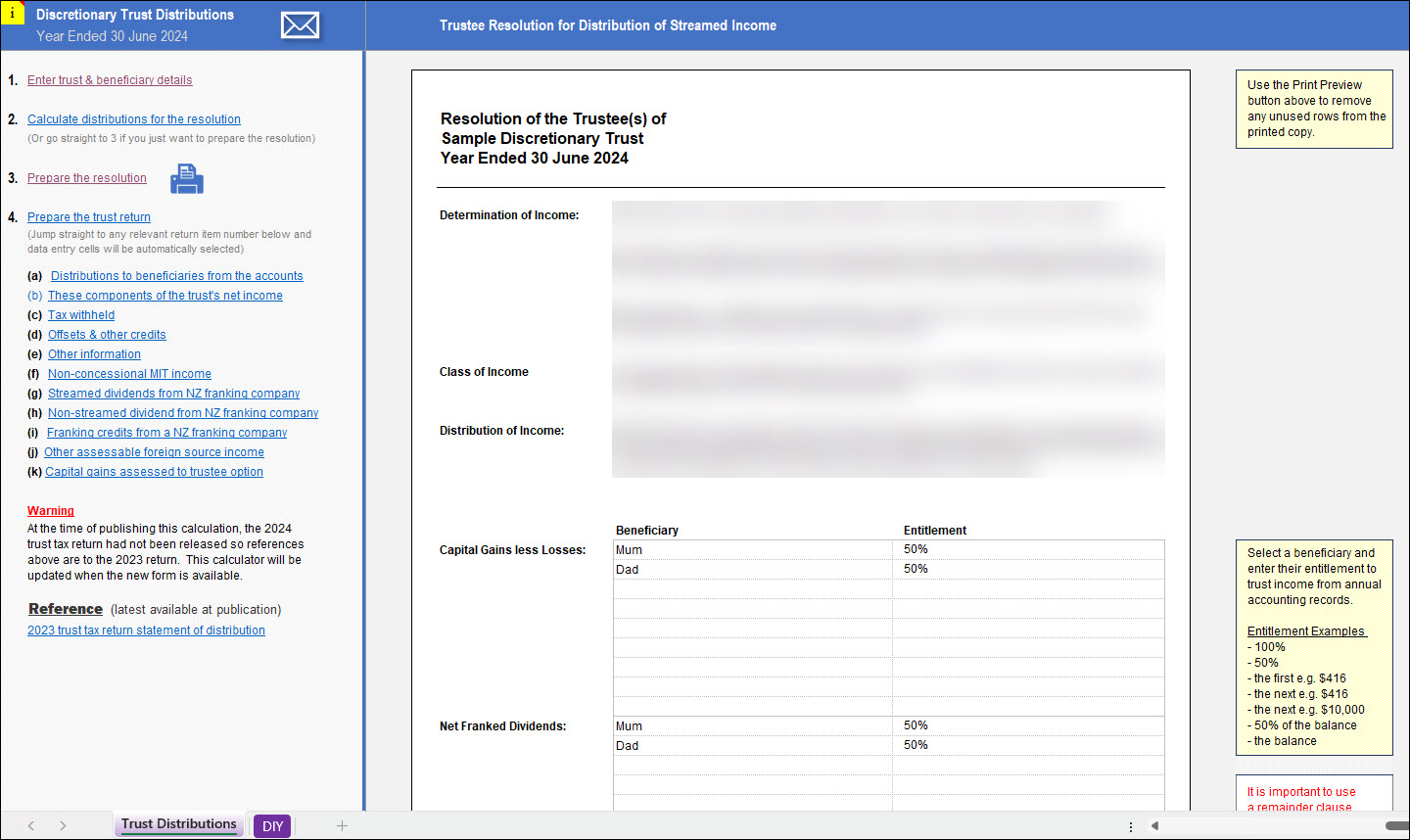

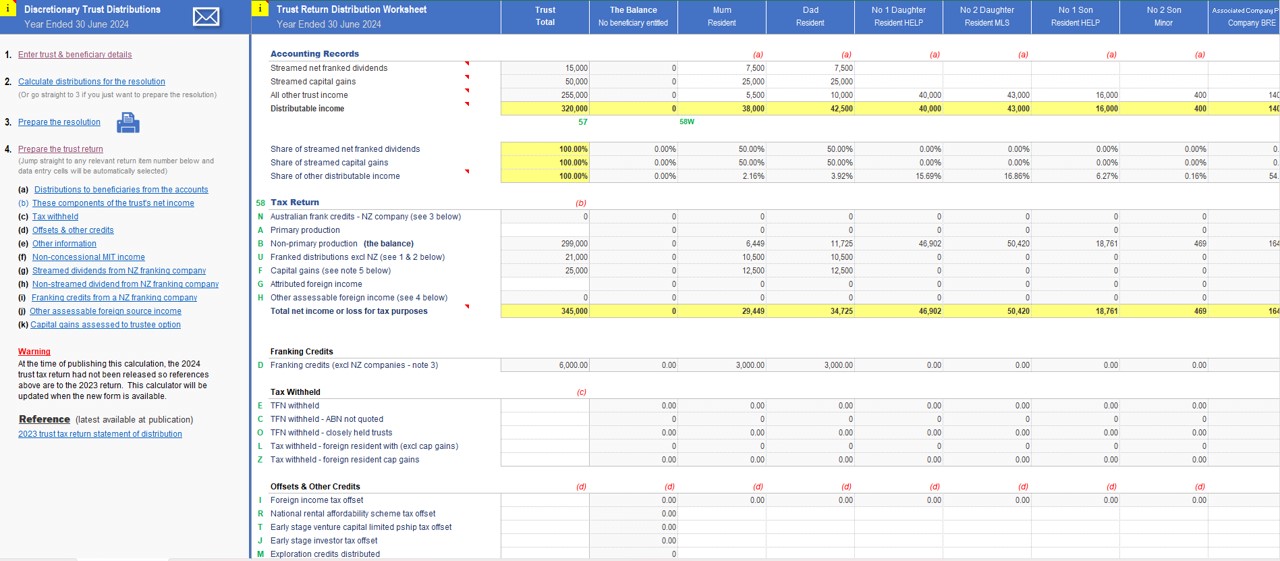

Save precious time and use our trust distribution workbook for your discretionary trust distributions for the year ended 30 June 2024. Using projected net (taxable) income for the year, you can view the marginal tax rates and income available at those rates for each beneficiary to make tax-effective distributions. The worksheet will convert those taxable distributions to accounting distributions for the trustee resolution. The resolution forms part of this workbook. And when the time comes to prepare the trust tax return, you can enter actual accounting distributions to calculate the individual (taxable) amounts to be shown at each return label for the beneficiaries on the trust return. Warning: this file is not compatible with Microsoft Excel versions 2019 and earlier. For more information, read on and watch our videos below for a demonstration of the calculator in action and go on a brief tour of our website to find more of our solutions for your practice.

OR

To access all of our content

$1,295.00 P.A. for 5 users!

Monthly plans available