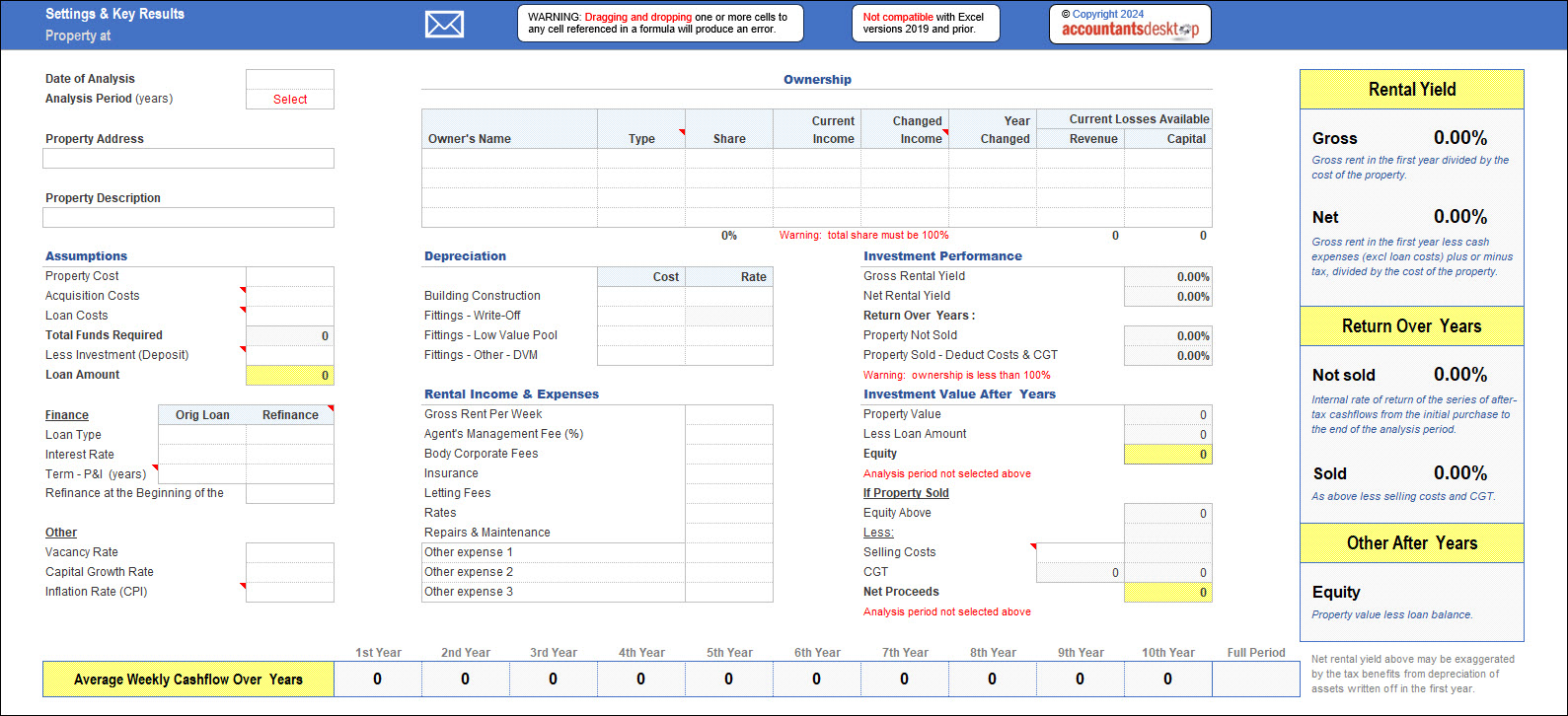

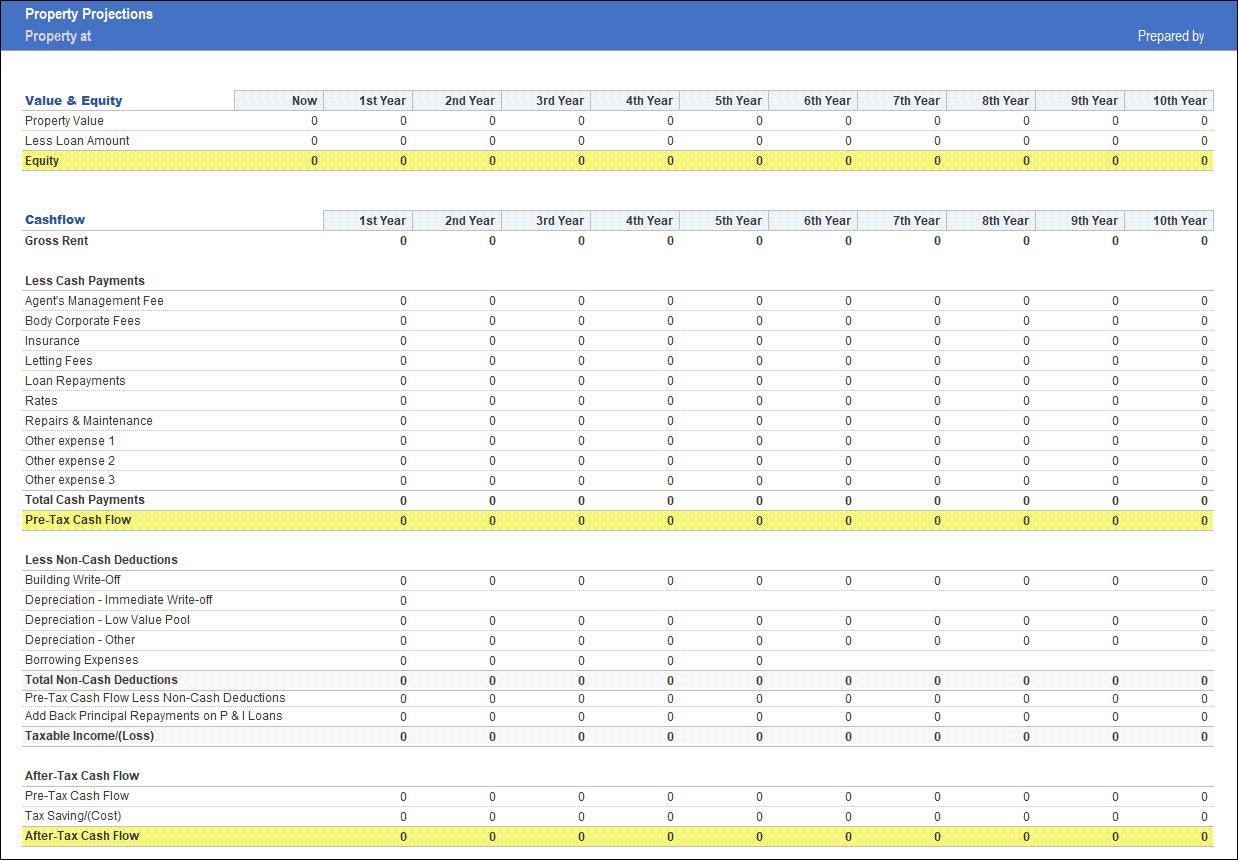

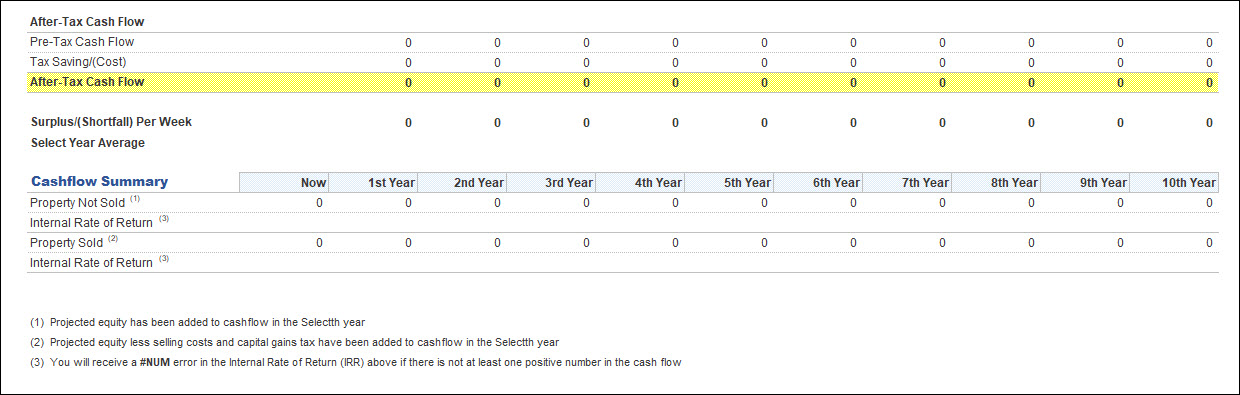

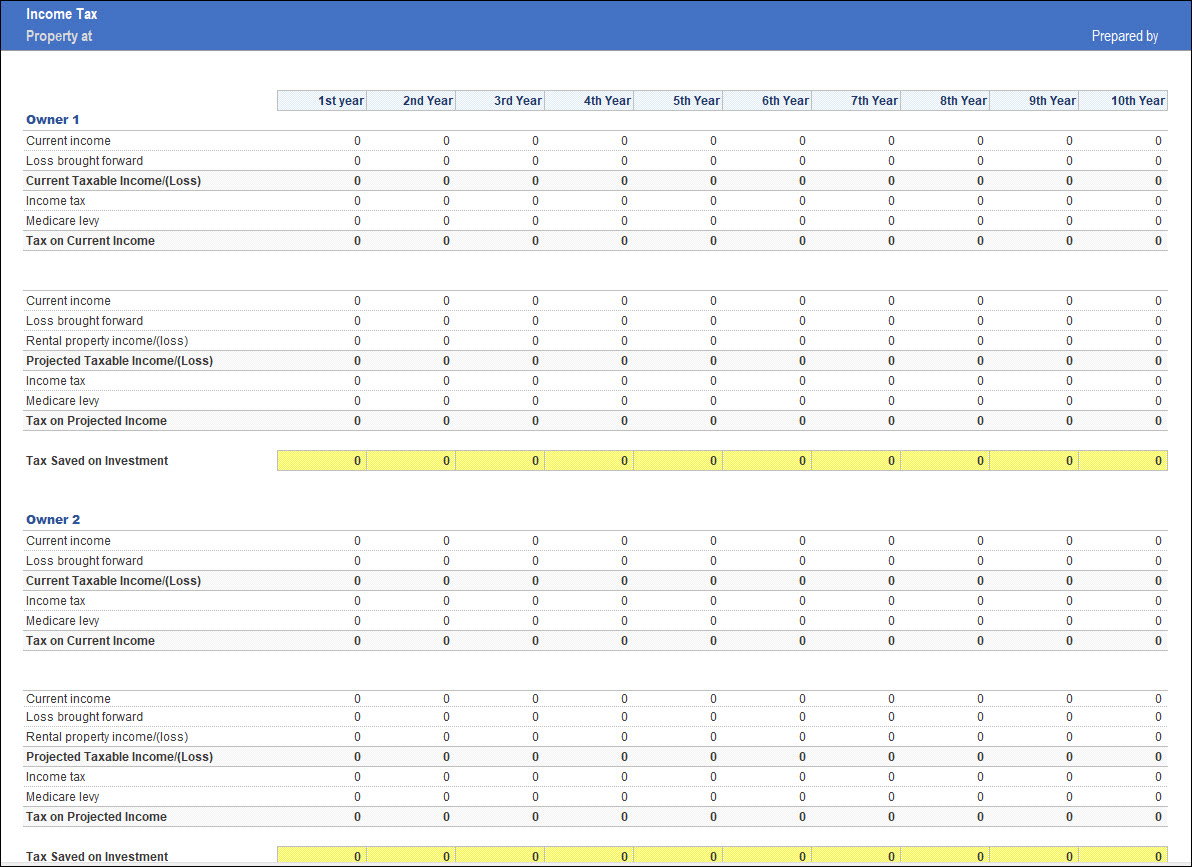

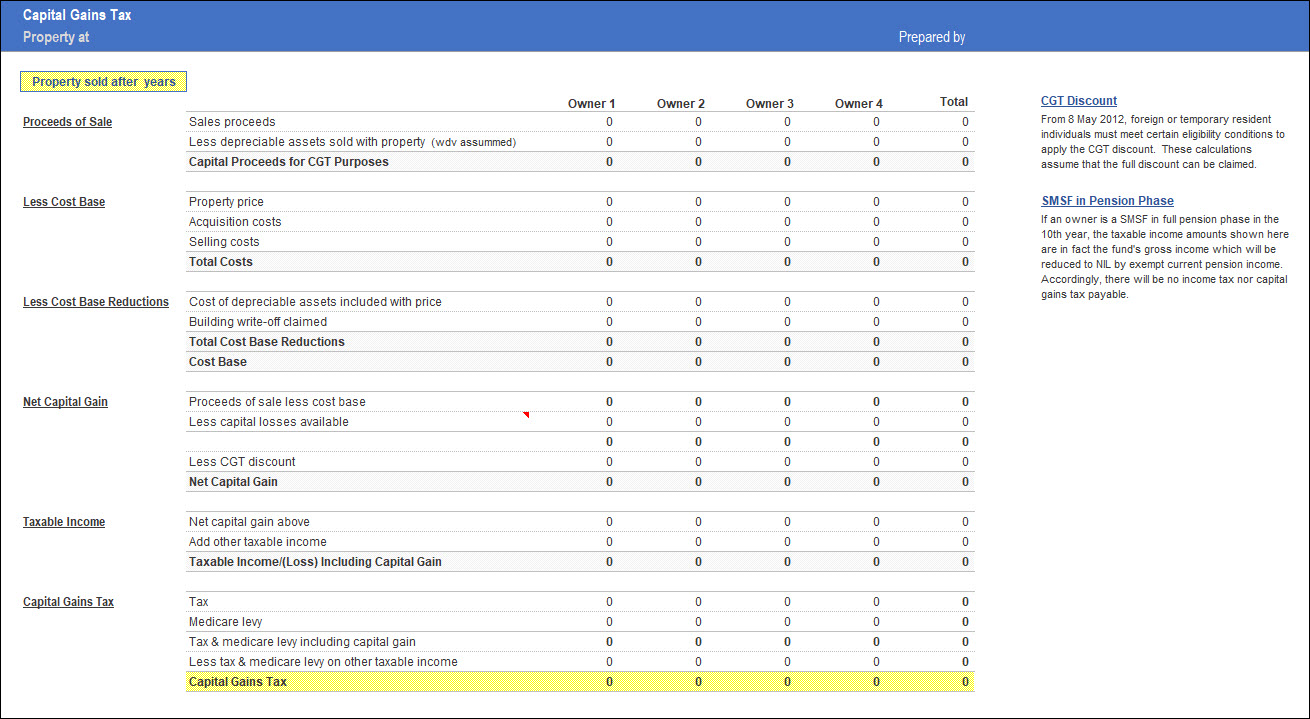

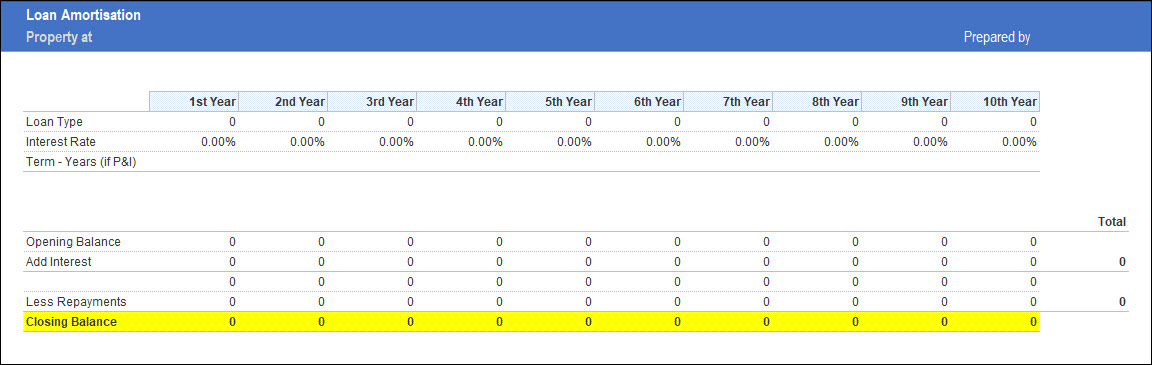

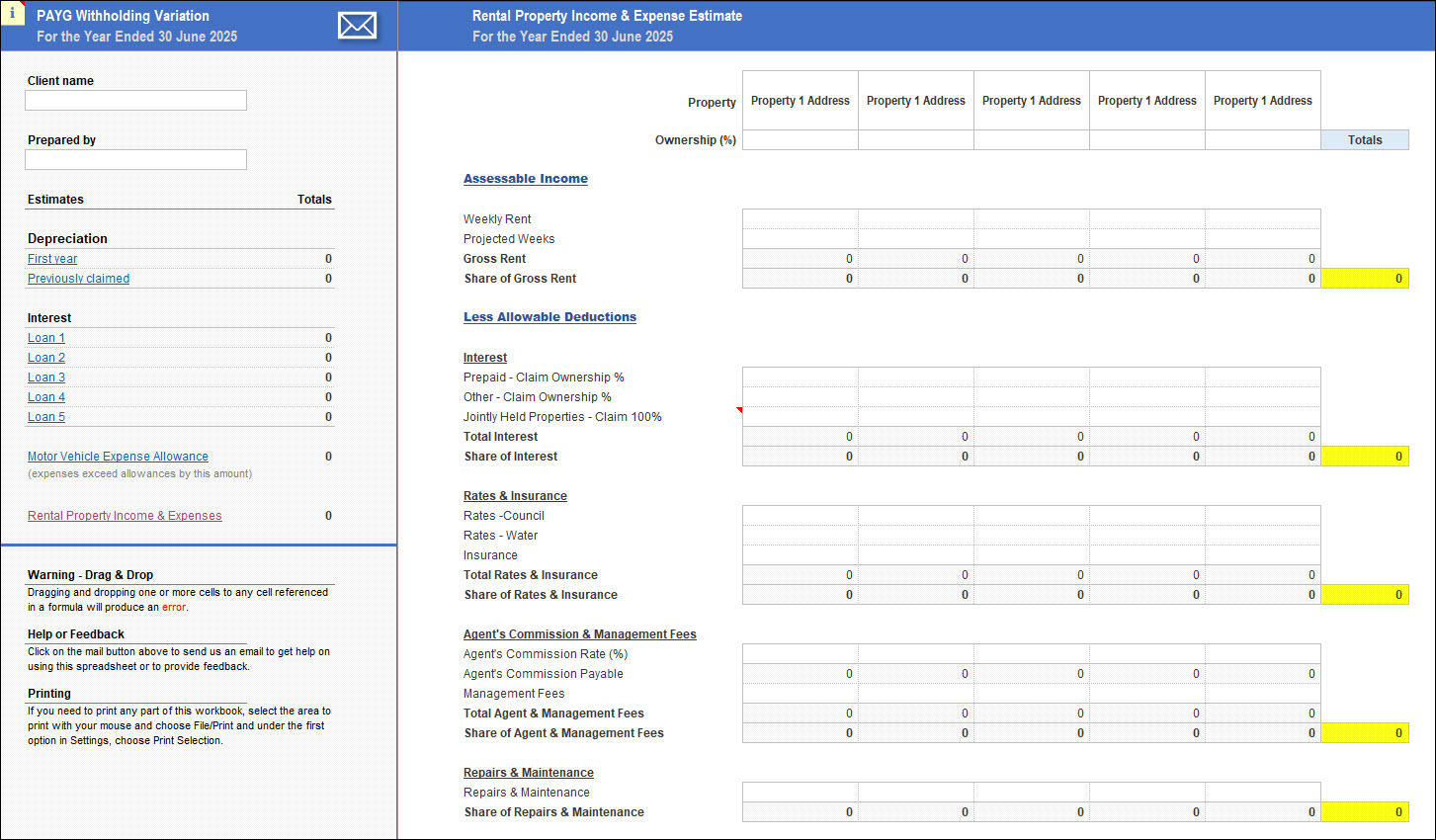

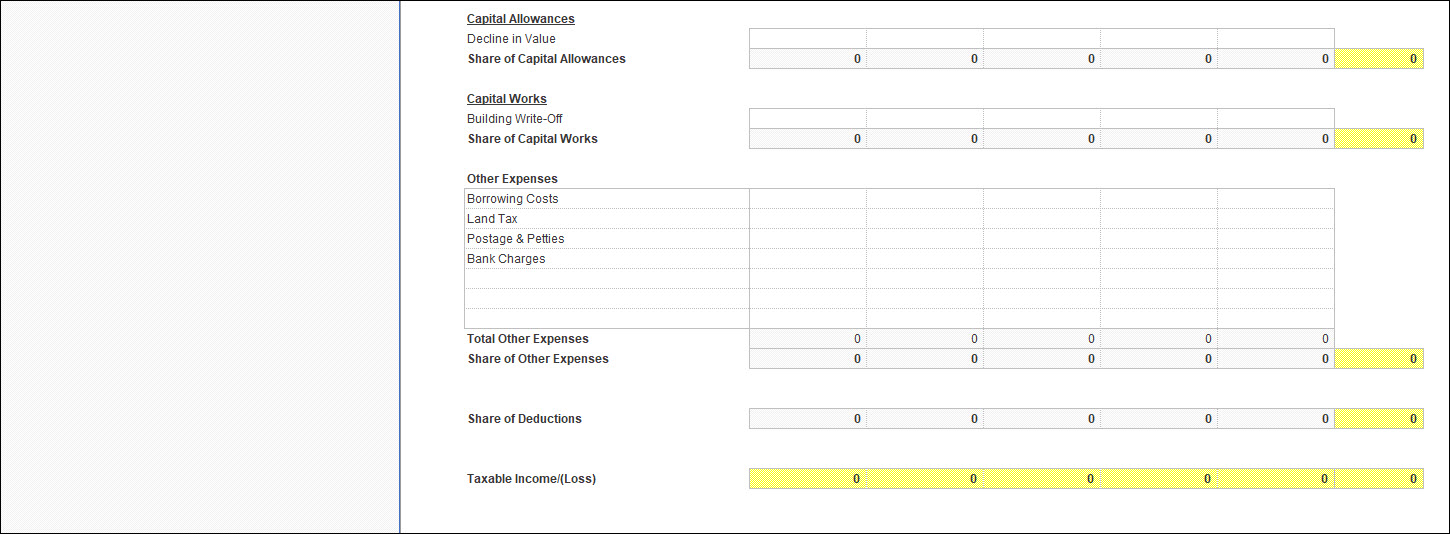

Use this workbook to advise your client on the financial impact of a proposed investment property acquisition by up to 4 individuals, companies or SMSFs. Calculate before and after tax cashflow (for affordability), investment yield and return and CGT and equity for any ownership period from 1 to 10 years. To ensure correct tax calculations, this workbook cannot be used after 30/06/2025. This calculator comes with a bonus PAYGW variation calculator to help you estimate rental income and deductions, interest on investment loans, motor vehicle expenses and depreciation on related assets for 2025 for a PAYG withholding variation. Warning: this file is not compatible with Microsoft Excel versions 2019 and earlier. For more information, read on and watch our videos below to watch a demo of this calculator and to be taken on a brief tour of our website.

OR

To access all of our content

$1,295.00 P.A. for 5 users!

Monthly plans available