Description

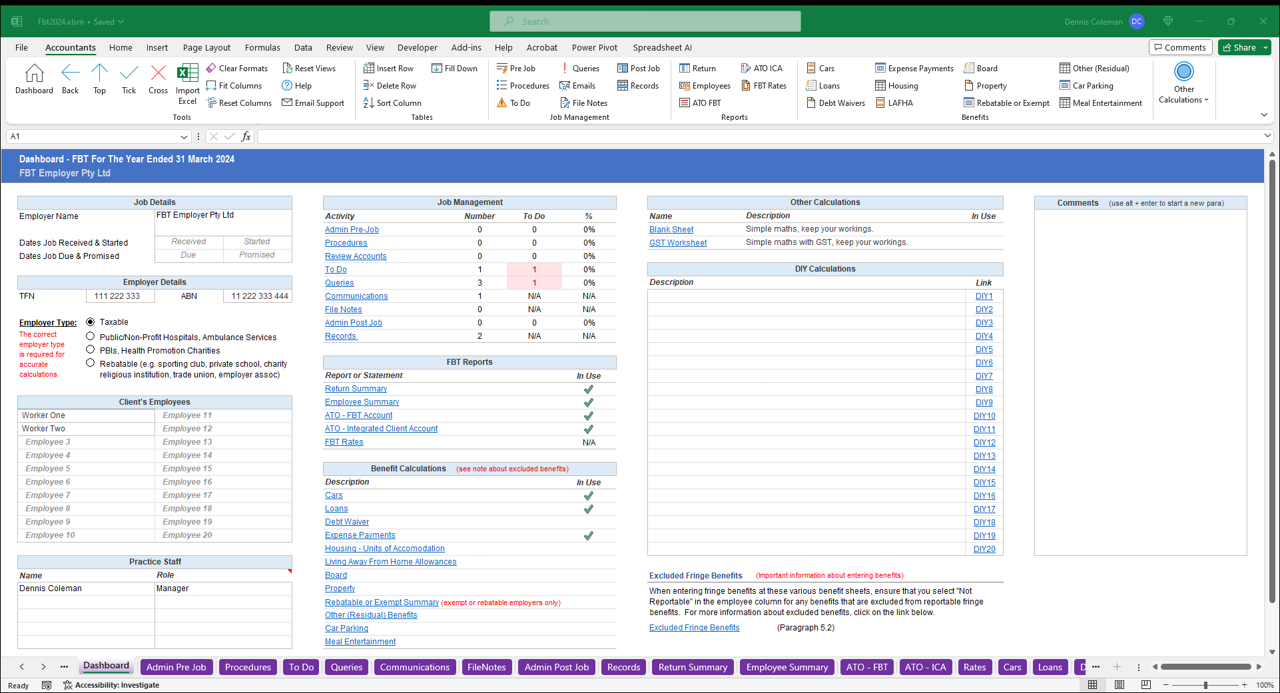

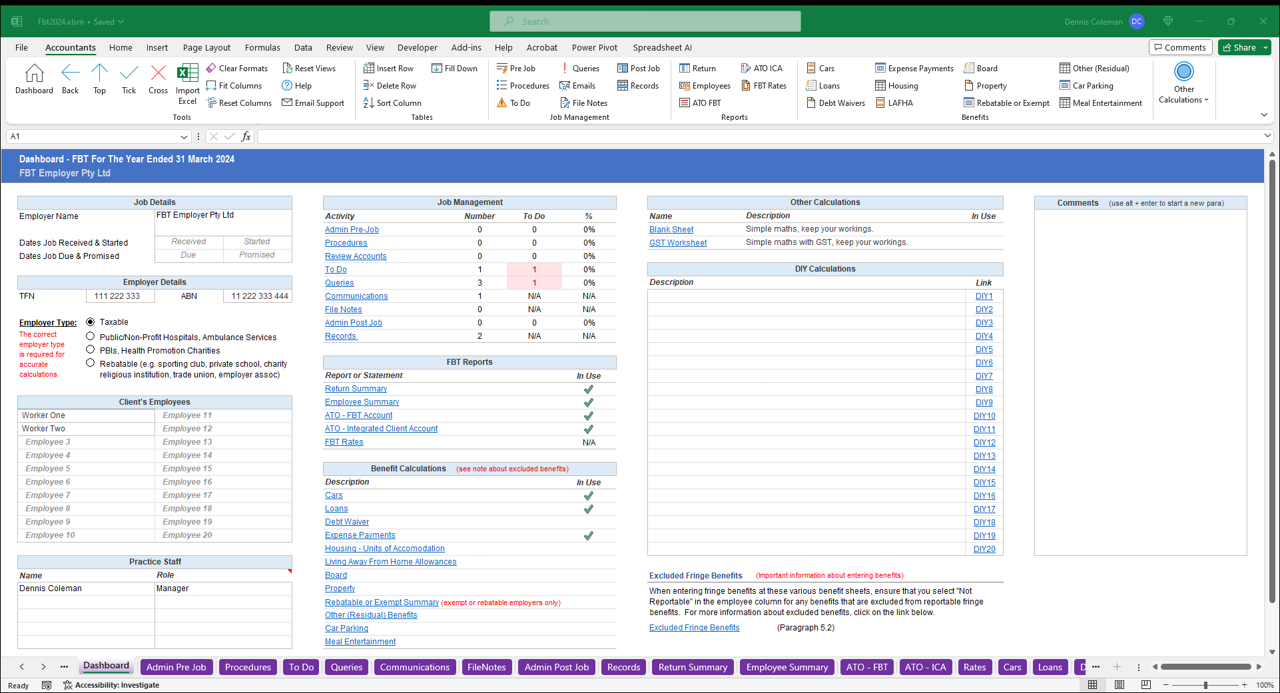

Preview – Dashboard Sheet

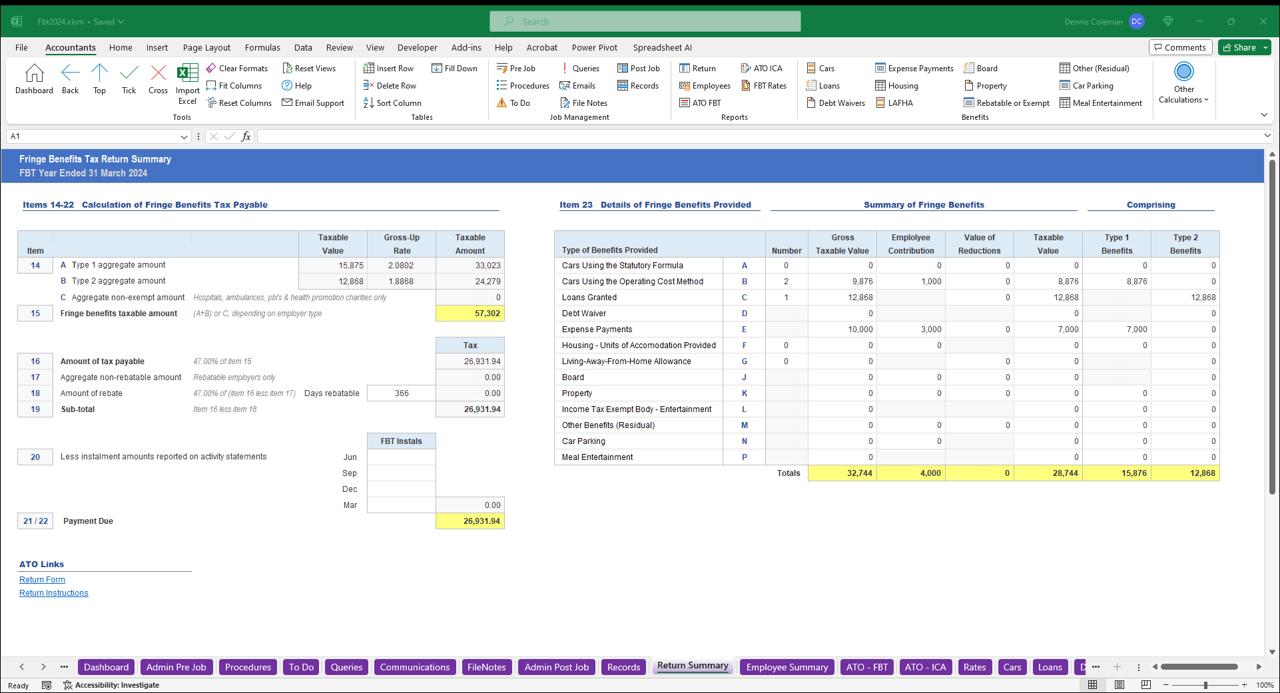

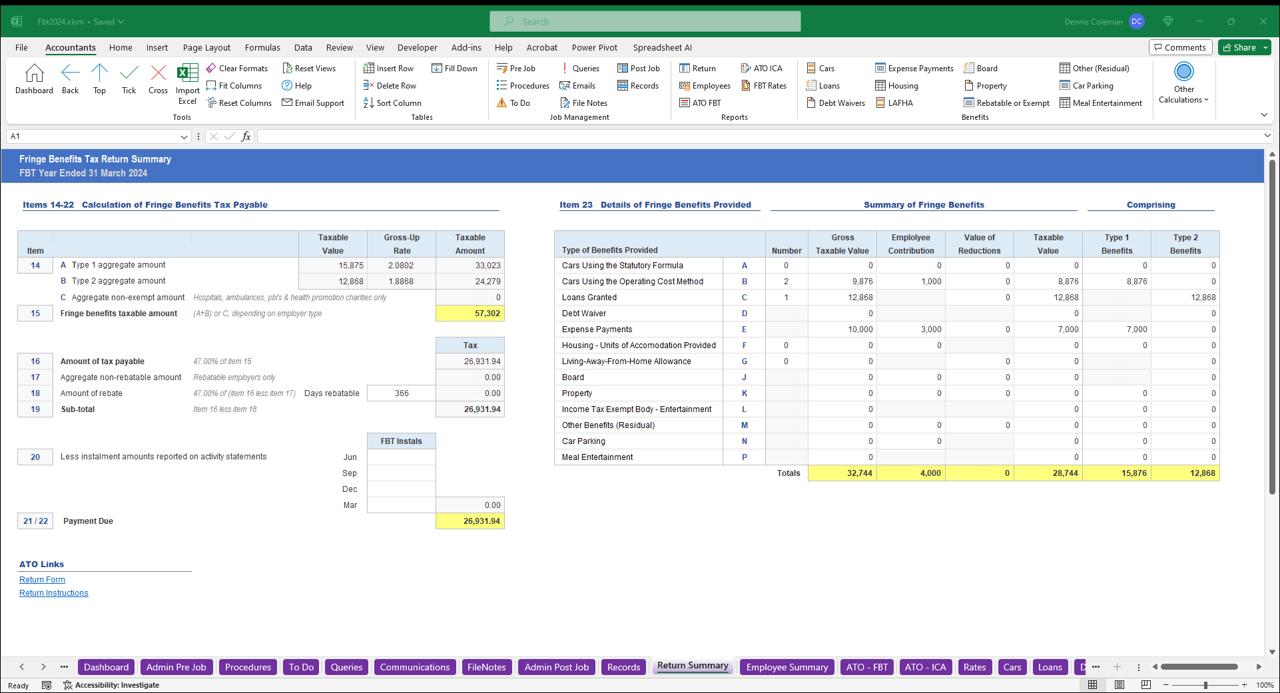

Preview – FBT Return Summary

Whether you need to prepare an FBT return or calculate the value of a benefit for an employee contribution in your clients’ accounts, our FBT workpapers have you covered. You can use either our comprehensive calculator for all benefit and employer types or just use our car benefit calculator for the most common situations.

To access all of our content

$1,295.00 P.A. for 5 users!

Monthly plans available

Just fill in the form below and you will get access to our samples page with free downloads.

"*" indicates required fields

(02) 9542 4655

info@accountantsdesktop.com.au

PO BOX 507 Sutherland NSW 1499