Description

Features

- Unlimited use within your practice

- All updates to the file after purchase

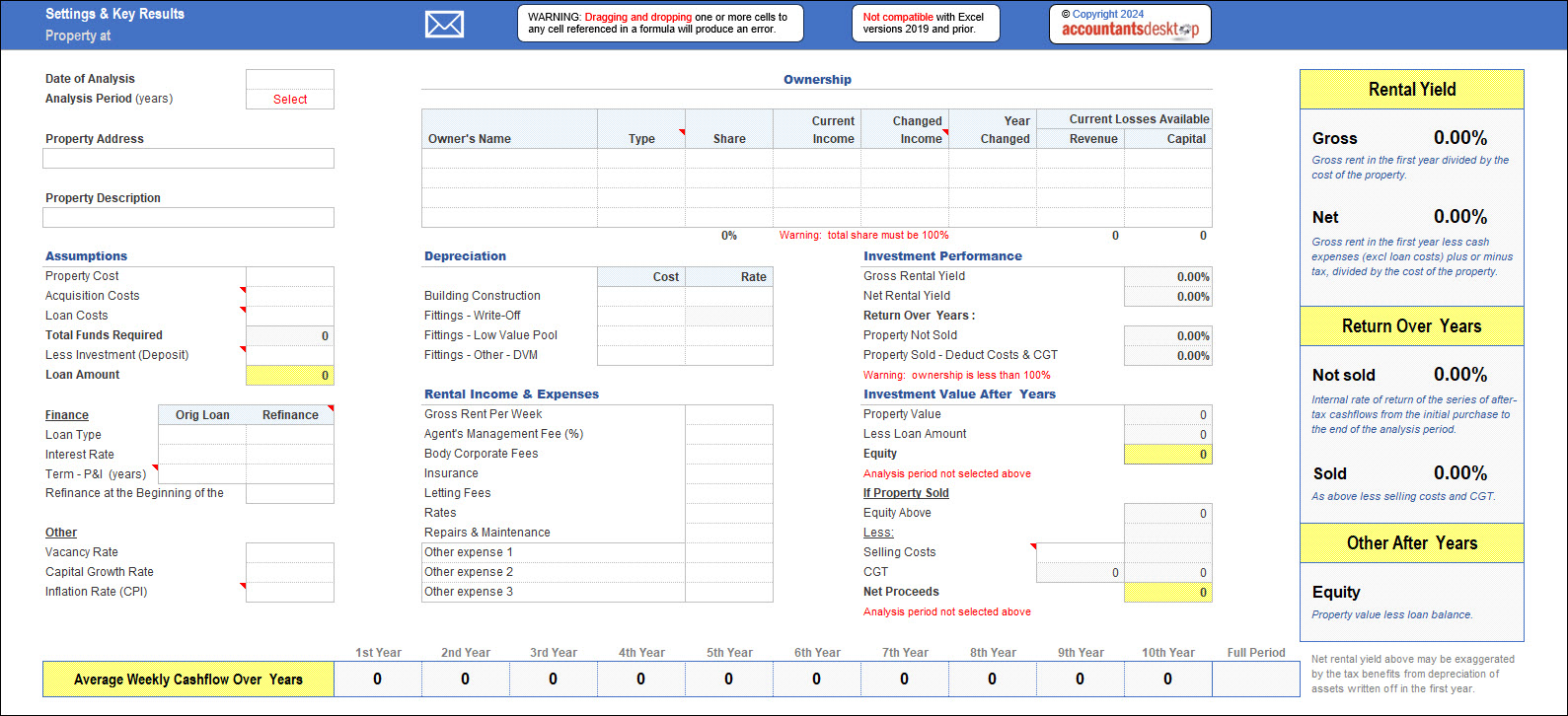

- Use for proposed purchases in the 2025 FY

- Or profile the ideal property for your client

- Investment term between 1 and 10 years

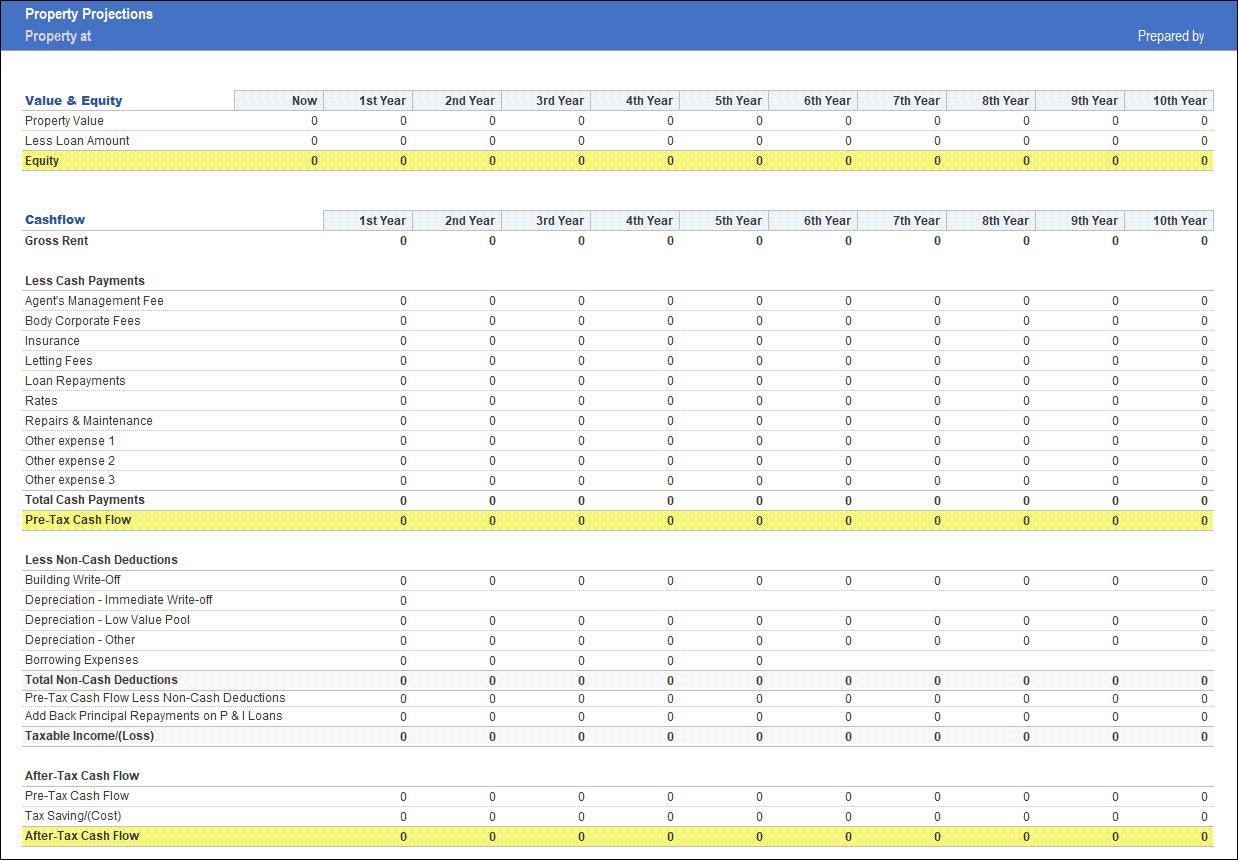

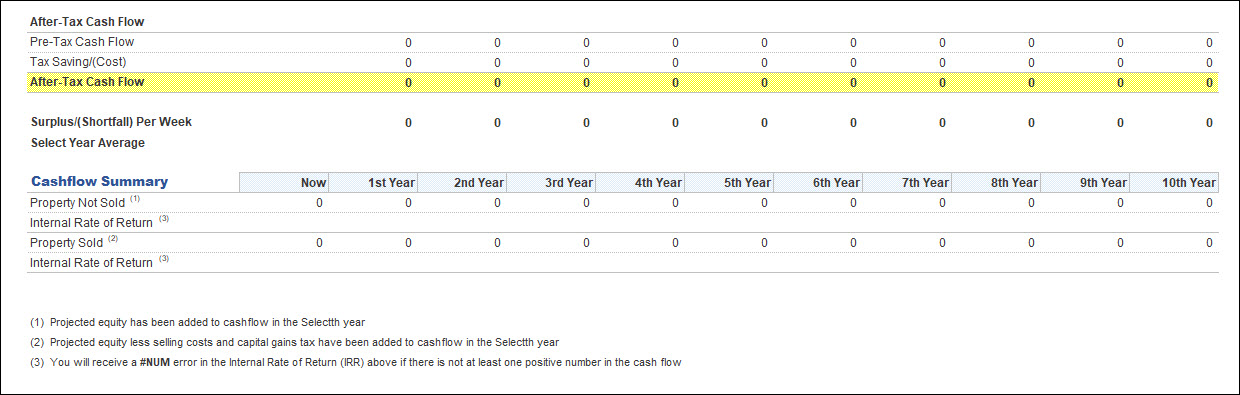

- Pre-tax cashflow

- Projected equity

- IRR if not sold

- IRR if sold

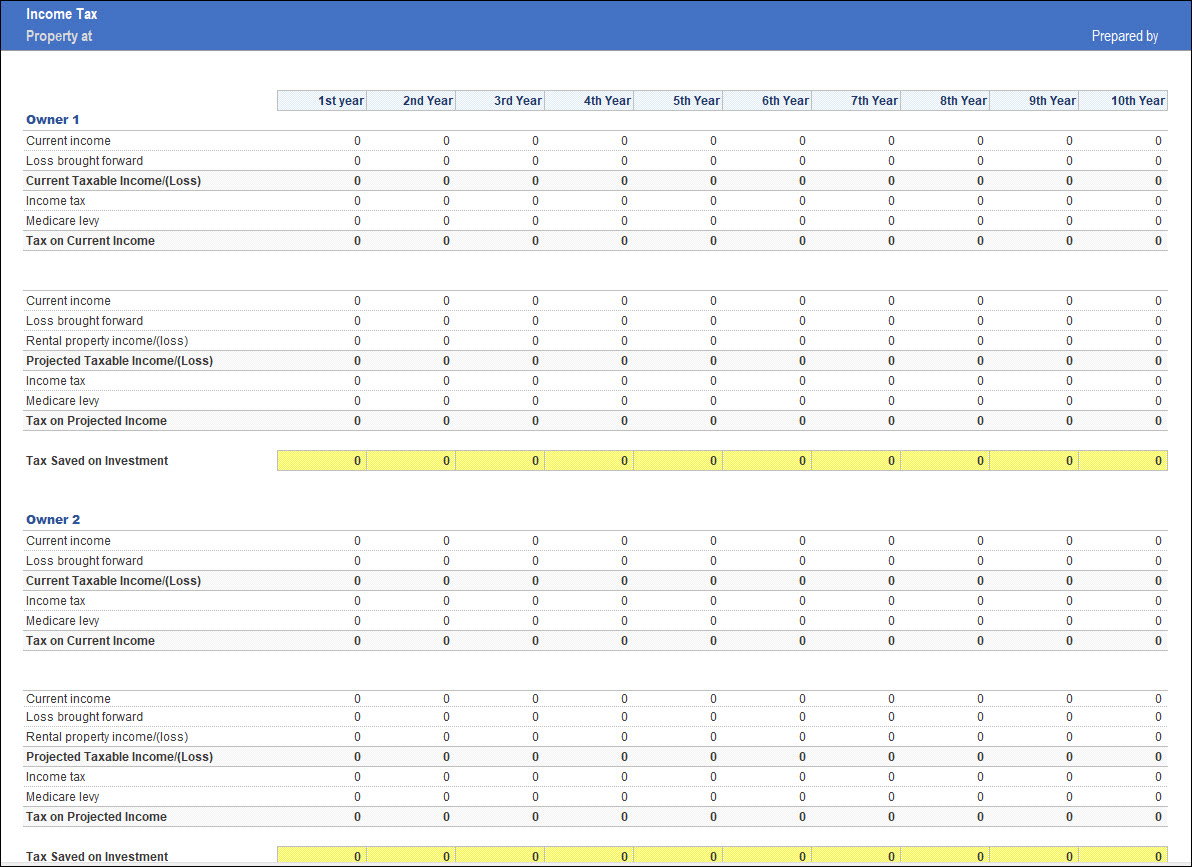

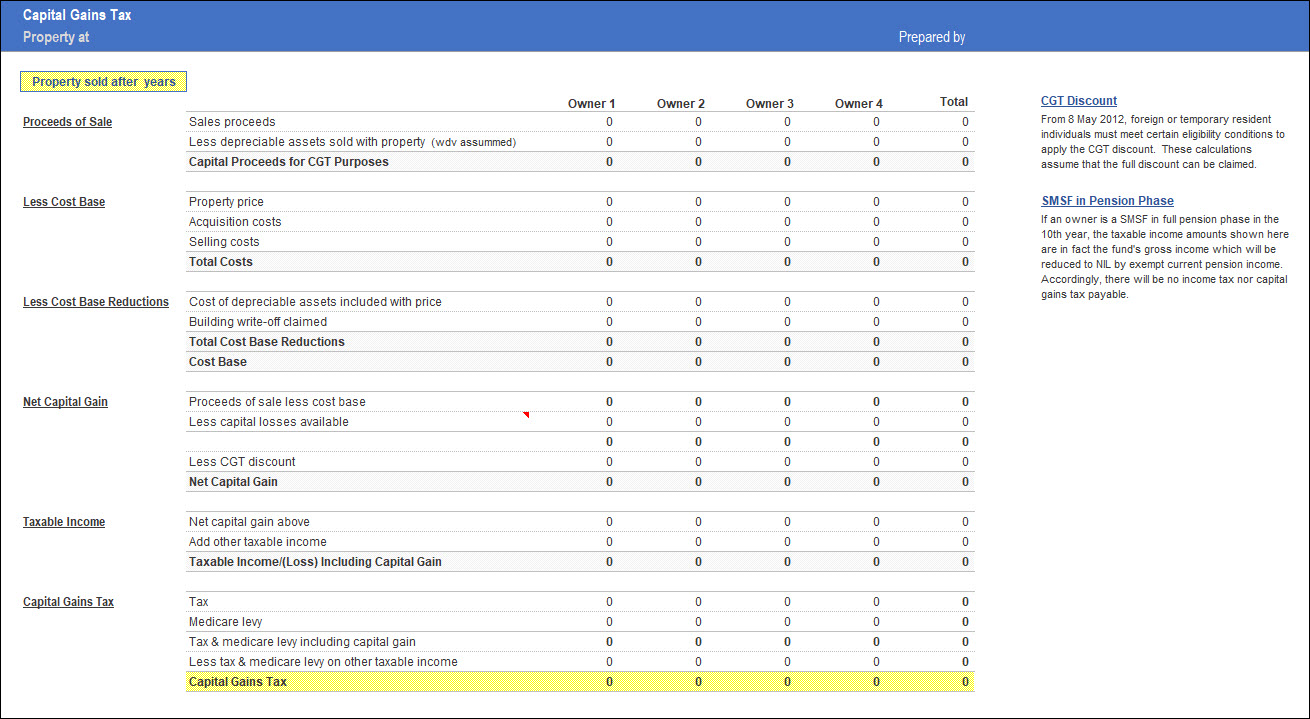

- Use for individuals, companies & SMSFs

- Allow one income change per owner

- Account for revenue & capital losses

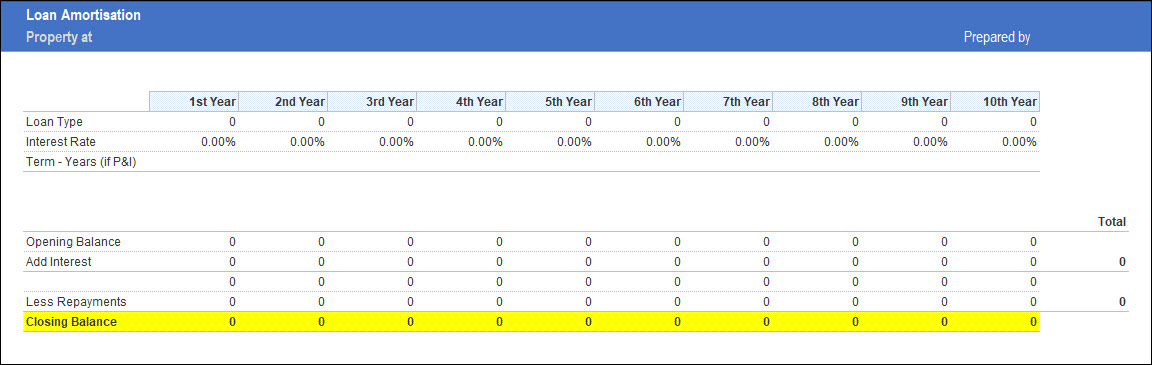

- Allow one refinance

- SMSFs go into pension mode any year

- Stress test by changing assumptions

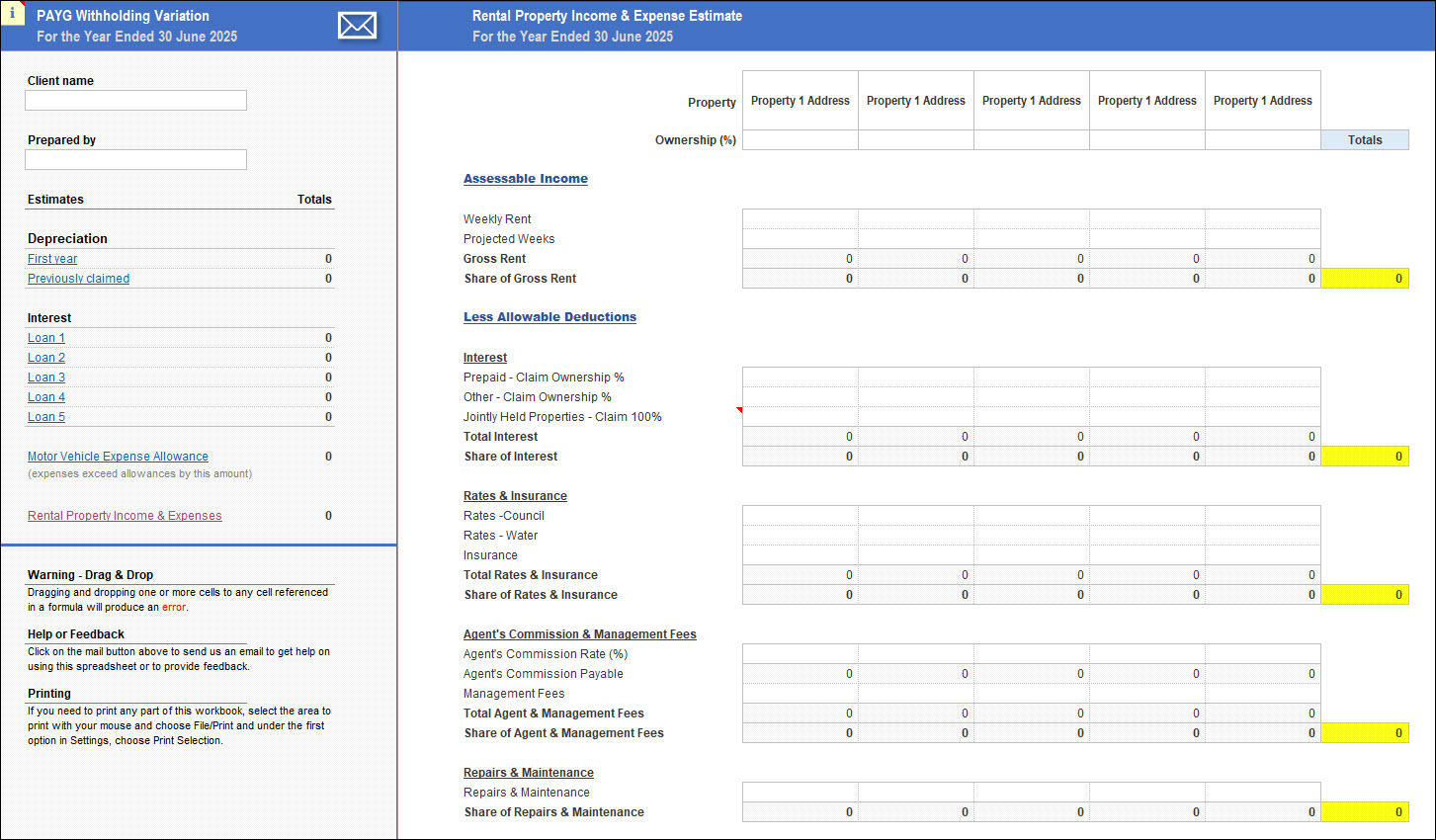

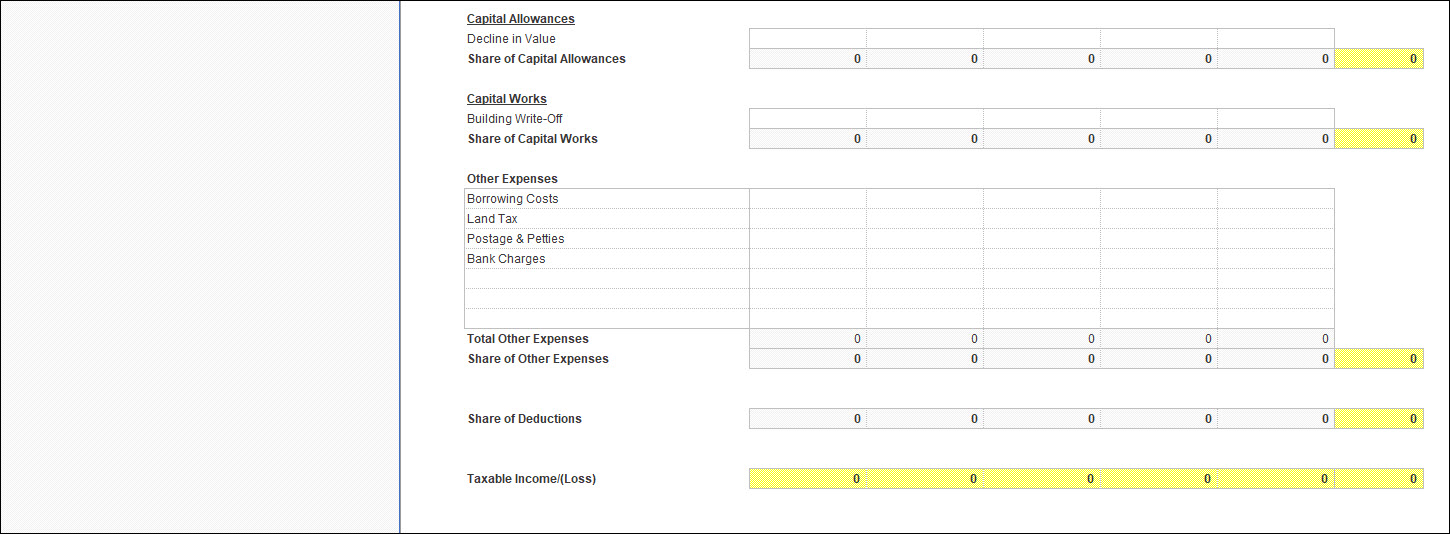

- Bonus PAYGW variation calculator

Property Investment Analysis (1)

Property Investment Analysis (2)

Property Investment Analysis (3)

Property Investment Analysis (4)

Property Investment Analysis (5)

PAYGW Variation