Member Updates

Scroll down to see the following recent site updates and reminders about upcoming lodgement due dates.

- Tax Planning

- New Look Letters

- Related Party Loans

- Practice Reminders

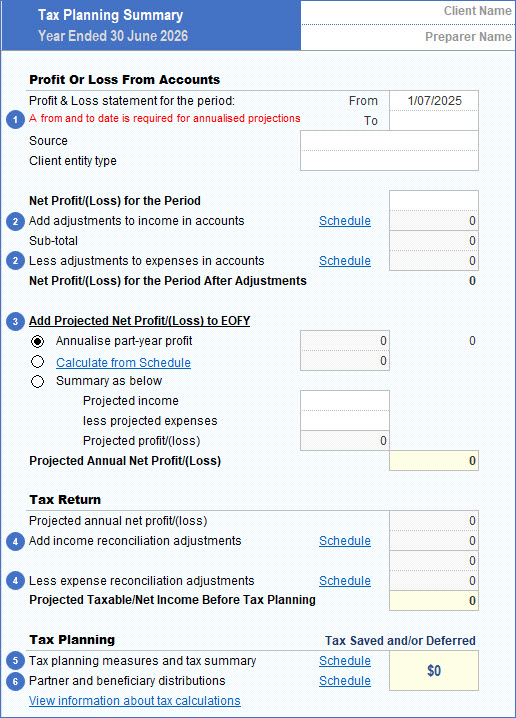

Our 2026 Tax Planning calculator is now available for download. Click here to watch a brief demonstration video on YouTube.

Designed for practical client work, this workbook helps you identify tax-planning opportunities and calculate potential savings by enabling you to –

- Analyse part year accounts and where they were prepared by your client, adjust for any errors to arrive at a true profit for the period.

- Project annual profit by choosing from these three options –

- Annualise YTD profit;

- Enter details of projected income and expenses to the end of the year; or

- Enter a summary of projected income and expenses to the end of the year.

- Adjust the projected annual profit for tax reconciliation items and calculate taxable/net income.

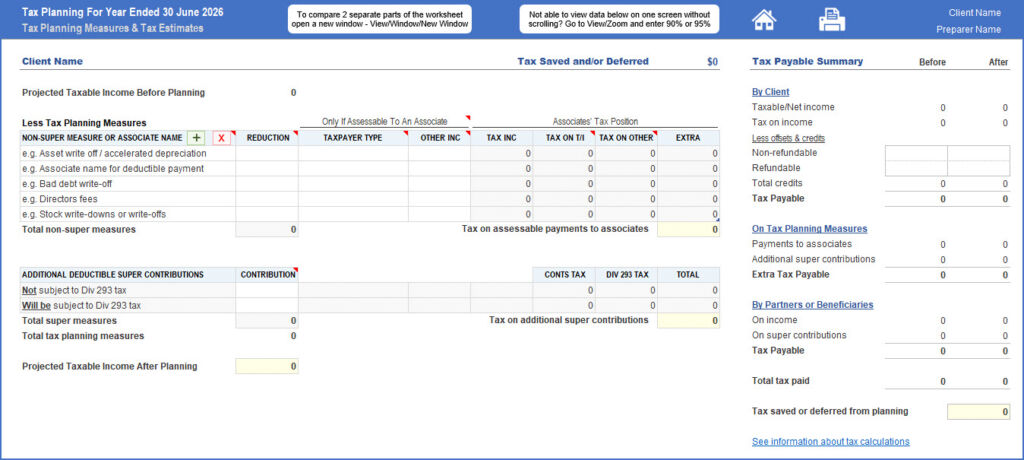

- Apply tax planning measures including deductible payments to related parties. Calculate the additional tax payable by those taxpayers to see the overall tax saved by the client group.

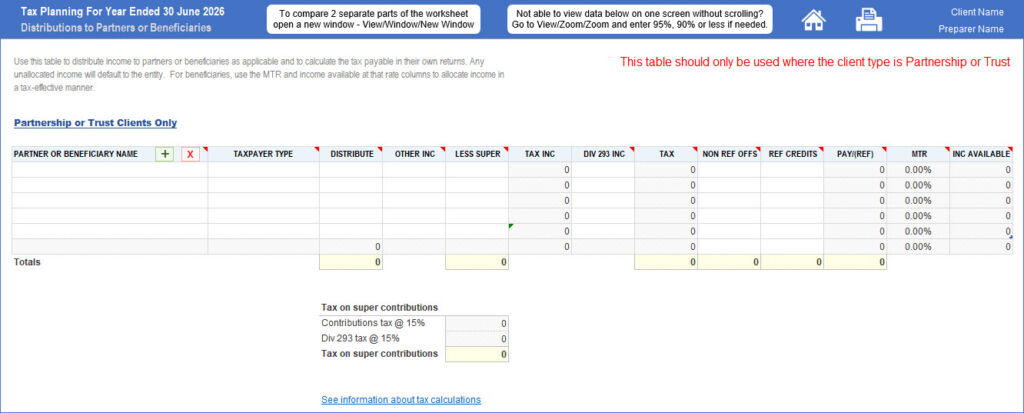

- Calculate projected marginal tax rates (MTRs) and income available at those rates for partners and beneficiaries; and

- Project tax-effective distributions by discretionary trusts to beneficiaries using MTRs and income available at those rates.

Click on the images below for a larger view.

Summary

Tax Planning Table

Partnerships & Trusts

Find it at Calculations/2026/Tax Planning

Our Letters have been redesigned with a fresh look and improved functionality to make them more user-friendly.

The landing page for Letters (About Letters) now has a map showing a complete list of available letters and the menu item under which they can be found. Selecting a letter from that left hand side menu will display the following on your screen –

- Full text of the letter with instructions in red;

- A brief description of its intended use;

- The date last reviewed;

- Any associated forms from our site that should be attached;

- Any other attachments; and

- A link to download the file in Microsoft Word format.

You will now be able to view any letter on screen before downloading the file to assess its suitability for your needs. There are now 2 ways you can use these letters –

- Copy and paste part or all of the letter on screen to your outgoing email or letter; or

- Download the Word file to your computer to customise the text to suit your needs or add it to your own collection of template letters.

Although our letters will be reviewed on a periodic basis, ATO and other notices can change at any time so carefully review our template to ensure that it is appropriate for your circumstances. If you receive a notice not covered by our existing templates, please send us the standard text from that notice, excluding sensitive information, and we will be happy to add a new letter to our collection.

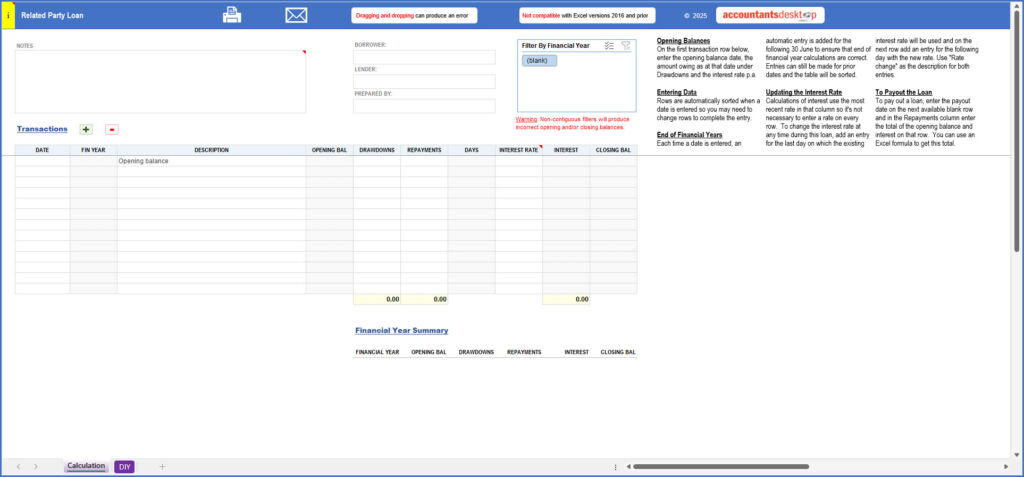

User request

This calculator has replaced the annual calculators of the same name. Find it in Calculations/Financial Calculations. Features include –

- Use for any period and multiple years. (new)

- Amortise a related party (unstructured) loan.

- Calculate interest and closing balances for each financial year.

- Calculate the payout amount at any time during the life of the loan.

- Change interest rates as many times as needed (new).

- Sort date columns automatically.

- Automatically add 30 June entries for each financial year needed (new).

- Filter entries by financial year (new).

Click on the image below for a closer look.

RELATED PARTY LOANS

Activity Statements

Lodge and pay December 2025 monthly business activity statement for business clients with up to $10 million turnover who report GST monthly and lodge electronically.

Lodge and pay January 2026 monthly business activity statement.

Income Tax Returns

Lodge tax return for non-taxable large and medium entities as per the latest year lodged (except individuals).

Payment (if required) for companies and super funds is also due on this date. Payment for trusts in this category is due as per their notice of assessment.

Lodge tax returns for new registrant (taxable and non-taxable) large or medium entities (except individuals).

Payment (if required) for companies and super funds is also due on this date. Payment for trusts in this category is due as per their notice of assessment.

Lodge tax return for non-taxable head company of a consolidated group, including a new registrant, that has a member who has been deemed a large or medium entity in the latest year lodged.

Lodge tax return for any member of a consolidated group who exits the consolidated group for any period during the year of income.

Lodge tax return for large or medium new registrant (non-taxable) head company of a consolidated group.

Lodge and pay Self-managed superannuation fund annual return for new registrant (taxable and non-taxable) SMSF, unless they have been advised of a 31 October 2025 due date at finalisation of a review of the SMSF at registration.

Note: There are special arrangements for newly registered SMSFs that do not have to lodge a return – see Super lodgment.

Activity Statements

Lodge and pay quarter 2, 2025–26 activity statement for all lodgment methods.

Pay quarter 2, 2025–26 instalment notice (form R, S or T). Lodge the notice only if you vary the instalment amount.

Annual GST return – lodge (and pay if applicable) if the taxpayer does not have a tax return lodgment obligation.

Note: If the taxpayer does have a tax return obligation, this return must be lodged by the due date of the tax return.

Super Guarantee

Lodge and pay quarter 2, 2025–26 Superannuation guarantee charge statement if the employer did not pay enough contributions on time.

Note: Employers lodging a Superannuation guarantee charge statement can choose to offset contributions they paid late to a fund against their super guarantee charge for the quarter. They still have to pay the remaining super guarantee charge.

Activity Statements

Lodge and pay February 2026 monthly business activity statement.

Income Tax Returns

Lodge tax return for companies and super funds with total income of more than $2 million in the latest year lodged (excluding large and medium taxpayers), unless the return was due earlier. Payment for companies and super funds in this category is also due by this date.

Lodge tax return for the head company of a consolidated group (excluding large and medium), with a member who had a total income in excess of $2 million in their latest year lodged, unless the return was due earlier. Payment for companies in this category is also due by this date.

Lodge tax return for individuals and trusts whose latest return resulted in a tax liability of $20,000 or more, excluding large and medium trusts. Payment for individuals and trusts in this category is due as advised on their notice of assessment.

Activity Statements

Lodge and pay quarter 3, 2025–26 PAYG instalment activity statement for head companies of consolidated groups.

Lodge and pay March 2025 monthly business activity statement.

Activity Statements

Lodge and pay quarter 3, 2025–26 activity statement if lodging by paper.

Pay quarter 3, 2025–26 instalment notice (form R, S or T). Lodge the notice only if you are varying the instalment amount.

Superannuation Guarantee

Make super guarantee contributions for quarter 3, 2025–26 to the funds by this date.

Note: Employers who do not pay minimum super contributions for quarter 3 by this date must pay the super guarantee charge and lodge a Superannuation guarantee charge statement by 28 May 2026.

TFN Report

Lodge TFN report for closely held trusts if any beneficiary quoted their TFN to a trustee in quarter 3, 2025–26.

Lost Members Report

Lodge lost members report for the period 1 July 2024 to 31 December 2025.

Income Tax Returns

Lodge 2025 tax returns for all entities that did not have to lodge earlier (including all remaining consolidated groups) and are not eligible for the 5 June concession.

Due date for companies and super funds to pay if required.

Note: Individuals and trusts in this category pay as advised on their notice of assessment.

Activity Statements

Lodge and pay April 2026 monthly business activity statement.

Fringe Benefits Tax

Final date to add new FBT clients to your client list to ensure they receive the lodgment and payment concessions for their fringe benefits tax returns.

Lodge and pay Fringe benefits tax annual return if lodging by paper.

Activity Statements

Lodge and pay eligible quarter 3, 2025–26 activity statements if you lodge electronically.

PAYG Withholding Variations

Request information for PAYG withholding variation applications for 2027 (letter available in “letters” module)

Super Guarantee

Lodge and pay quarter 3, 2025–26 Superannuation guarantee charge statement if the employer did not pay enough contributions on time.

Note: Employers who lodge a Superannuation guarantee charge statement can choose to offset contributions they paid late to a fund against their super guarantee charge for the quarter. They still have to pay the remaining super guarantee charge.

Income Tax Returns

Lodge tax returns due for individuals and trusts with a lodgment due date of 15 May 2026 provided they also pay any liability due by this date.

Lodge tax return for companies and super funds with a lodgment due date of 15 May 2026 provided both the prior year and current year return will be non-taxable or result in a refund.

Note:

- This is not a lodgment due date but a concessional arrangement where failure to lodge on time (FTL) penalties will not apply if you lodge and pay by this date.

- Large and medium taxpayers and head companies of consolidated groups are excluded from this concession.

Activity Statements

Lodge and pay May 2026 monthly business activity statement.

FBT Return

Lodge and pay 2026 Fringe benefits tax annual return for tax agents if lodging electronically.

Super Guarantee Contributions

Super guarantee contributions must be paid by this date to qualify for a tax deduction in the 2025–26 financial year.

Child Care Subsidy and Family Tax Benefit Payments

If any of your clients receive Child Care Subsidy and Family Tax Benefit payments from Services Australia, the client and their partner must lodge their 2024–25 tax return by 30 June 2026, regardless of any deferrals in place. For more information, see the Services AustraliaExternal Link website.

News

Lookup

2025 Return Forms & Instructions

| Individuals Return Instructions Supp Instructions | Partnerships Return Instructions | Trusts Return Instructions |

| Companies Return Instructions | SMSFs Return Instructions | FBT Return Instructions |

2025 Resident Individual Tax Rates

| Taxable Income | Tax + Rate on Margin |

|---|---|

| $0 – $18,200 | NIL + NIL |

| $18,201 – $45,000 | NIL + 16% |

| $45,001 – $135,000 | $4,288 + 30% |

| $135,001- $190,000 | $31,288 + 37% |

| $190,001 and over | $51,638 + 45% |

| Plus Medicare Levy of 2% subject to thresholds |

Work Deductions

| Deduction | 2025 | 2024 |

|---|---|---|

| Motor Vehicle Cents Per Km | 88 cents | 85 cents |

| Work From Home – Fixed Rate Method | 70c/hour | 67c/hour |

| Overtime Meals Per Meal | $37.65 | $35.65 |

| Home Laundry – Work Clothes | $1/load | $1/load |

| Home Laundry – Mixed Load | 50c/load | 50c/load |

Superannuation Contribution Caps

| Component | 2026 | 2025 | 2024 |

|---|---|---|---|

| Concessional | $30,000 | $30,000 | $27,500 |

| Non-Concessional | $120,000 | $120,000 | $110,000 |

Other Rates

| Item | 2026 | 2025 | 2024 |

|---|---|---|---|

| CGT Improvement Threshold | $187,962 | $182,665 | $174,465 |

| Car Depreciation Limit | $69,674 | $69,674 | $68,108 |

| FBT Rate | 47% | 47% | 47% |

| Division 7A Interest Rate | 8.37% | 8.77% | 8.27% |

| Superannuation Guarantee | 12.00% | 11.50% | 11.00% |