Description

Features

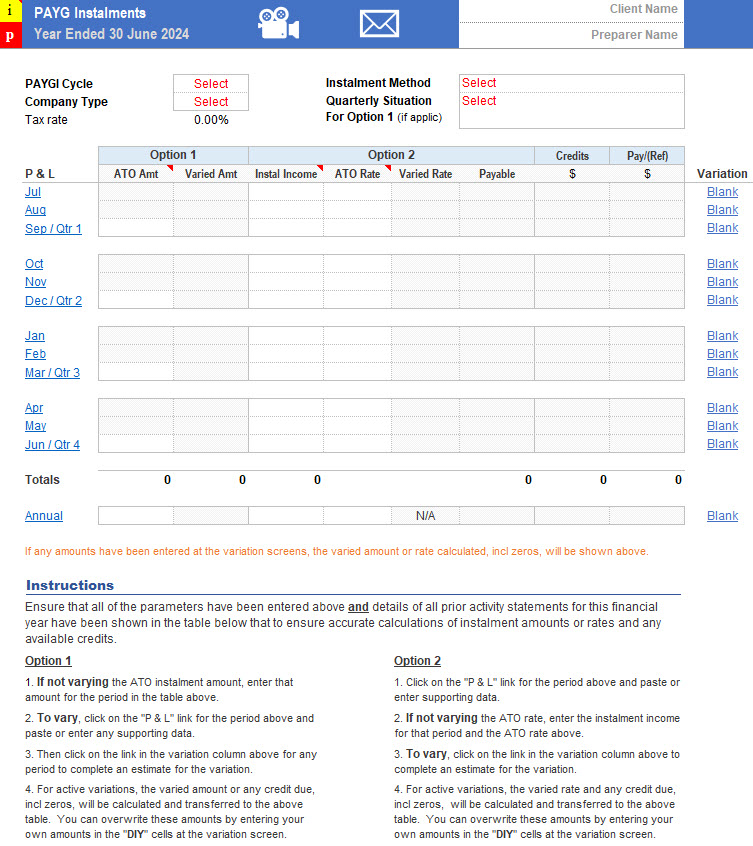

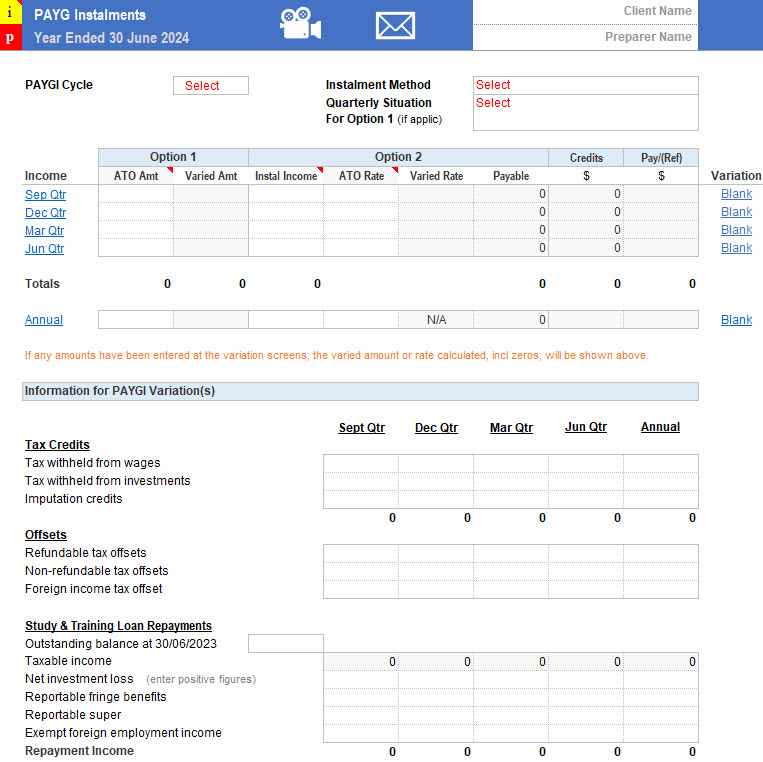

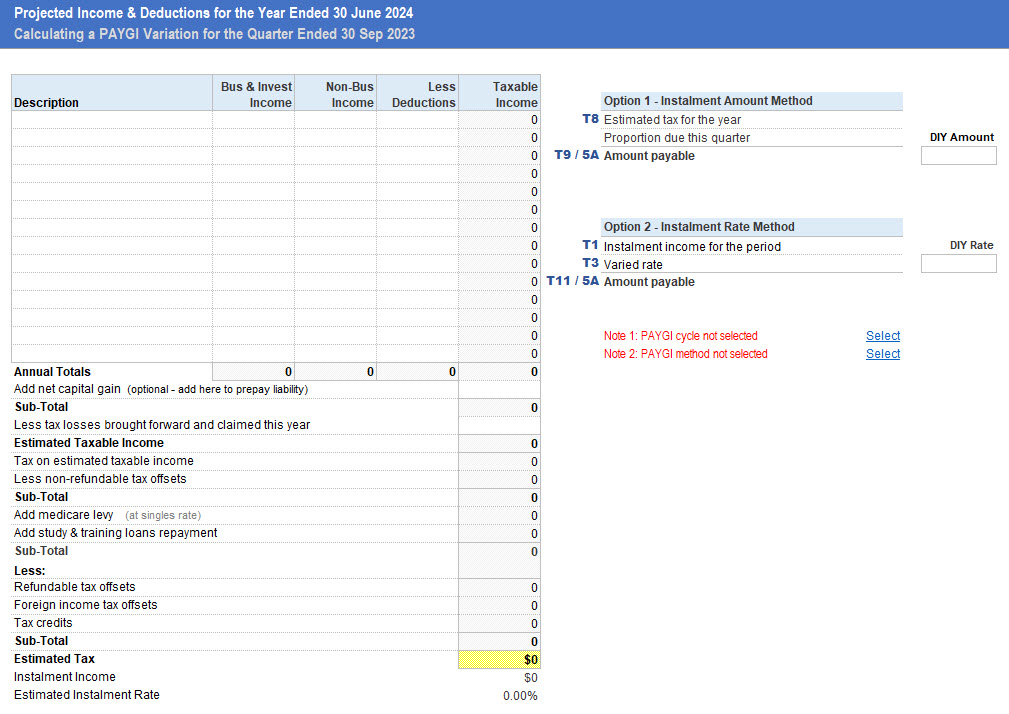

- For individuals and companies

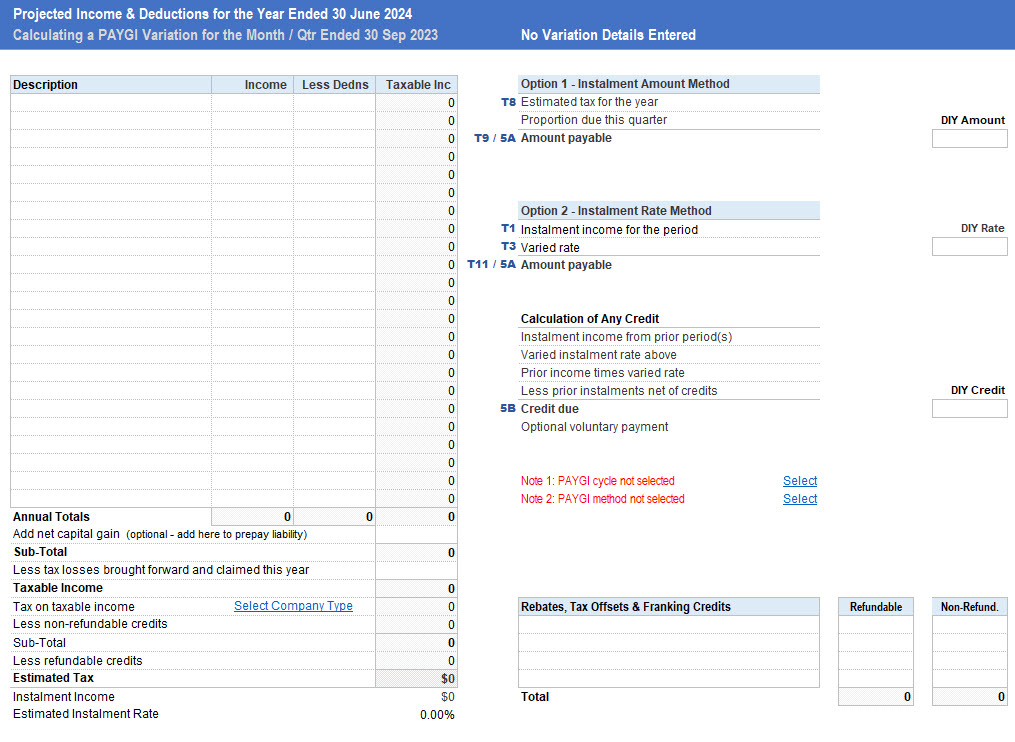

- Estimate taxable income for the year

- Calculate tax on estimated income

- Identify instalment income

- Calculate varied instalment rate or amount for the period

- Calculate instalment amount payable or credit due

- Easily calculate later variations.

Managing Your Job

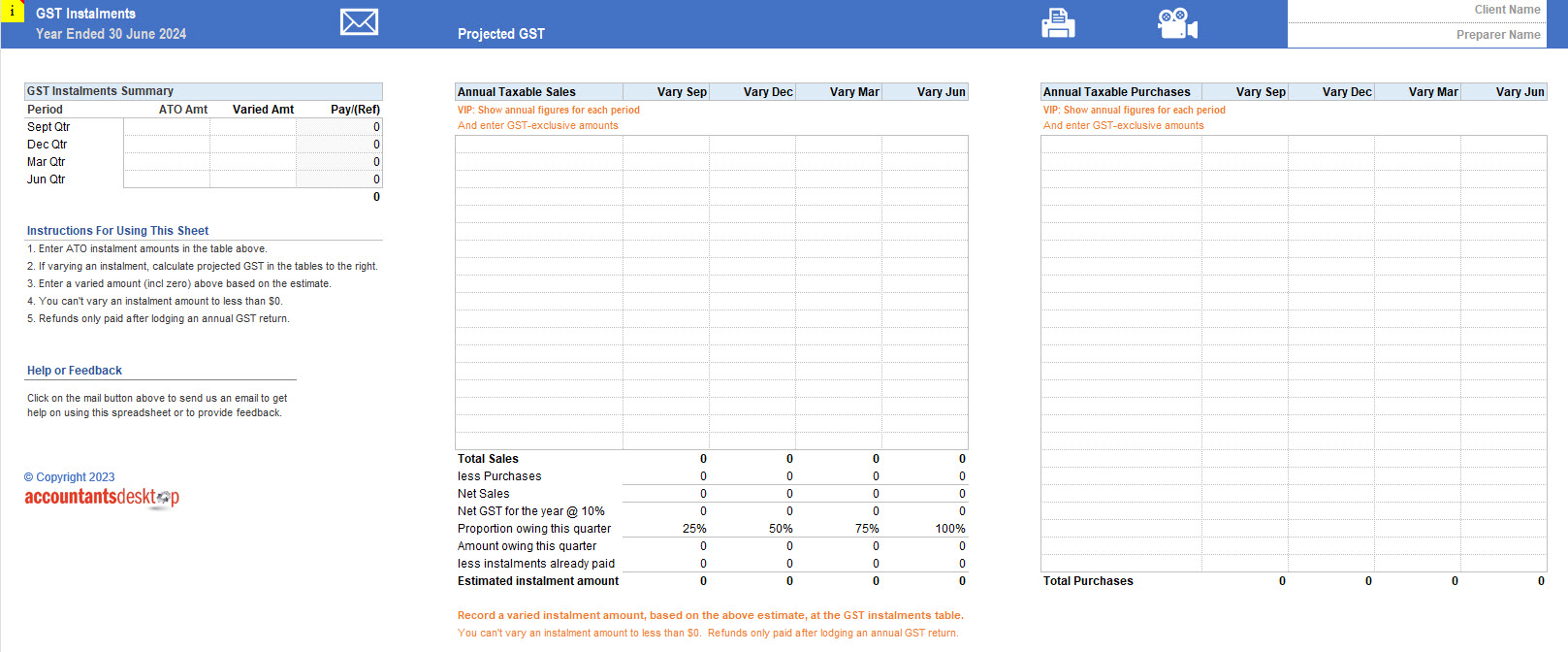

- Estimate annual taxable sales and purchases

- Calculate projected annual GST payable

- Calculate proportion owing to end of quarter

- Calculate amount owing less instalments already paid

- Single table display for quarterly variations

Storing Information

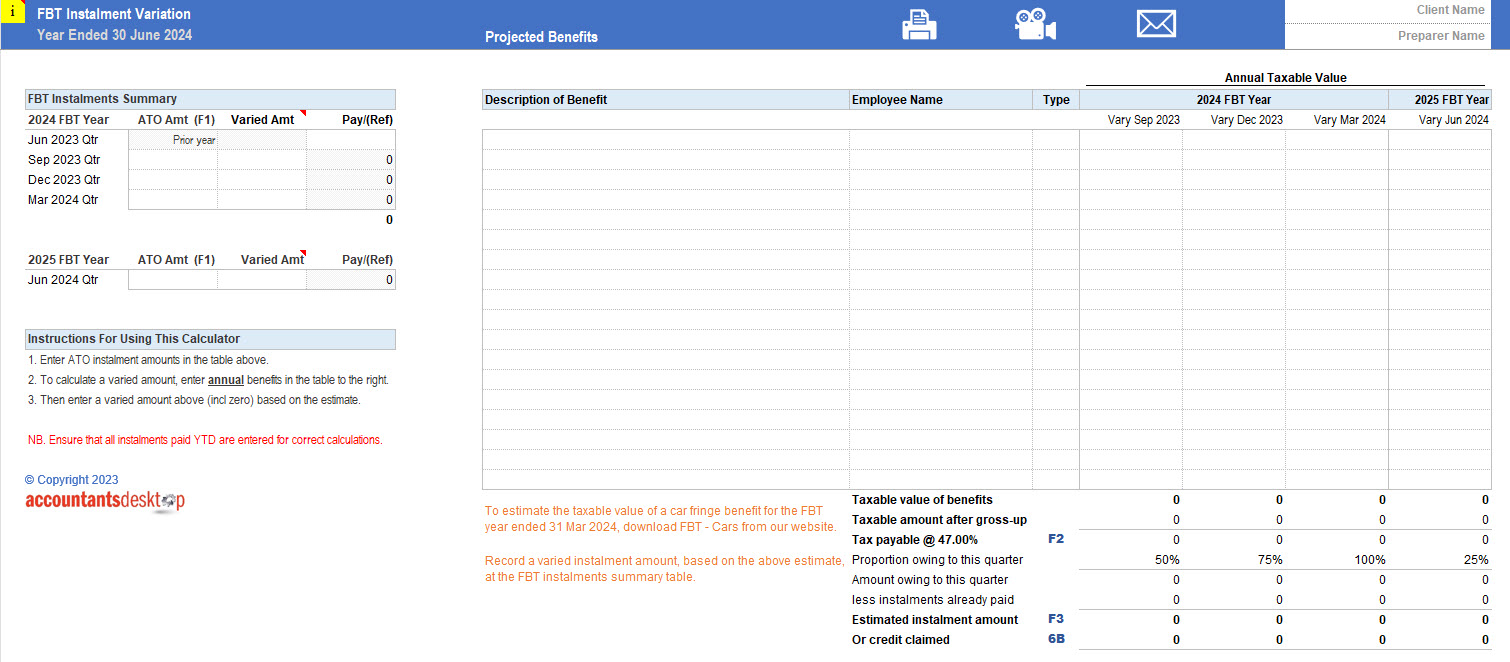

- Estimate annual taxable value of benefits

- Identify benefit types and gross up

- Calculate projected annual FBT payable

- Calculate proportion owing to end of quarter

- Calculate amount owing less instalments already paid

- Single table display for quarterly variations

Sheet Previews – PAYGI Variation for a Company

Sheet Previews – PAYGI Variation for an Individual

Sheet Preview – GST Instalment Variation

Sheet Preview – FBT Instalment Variation