Description

Features

- Unlimited use within your practice

- All updates to file after purchase

- Update YTD profit

- Project YTD profit to the EOFY

- Make tax reconciliation adjustments

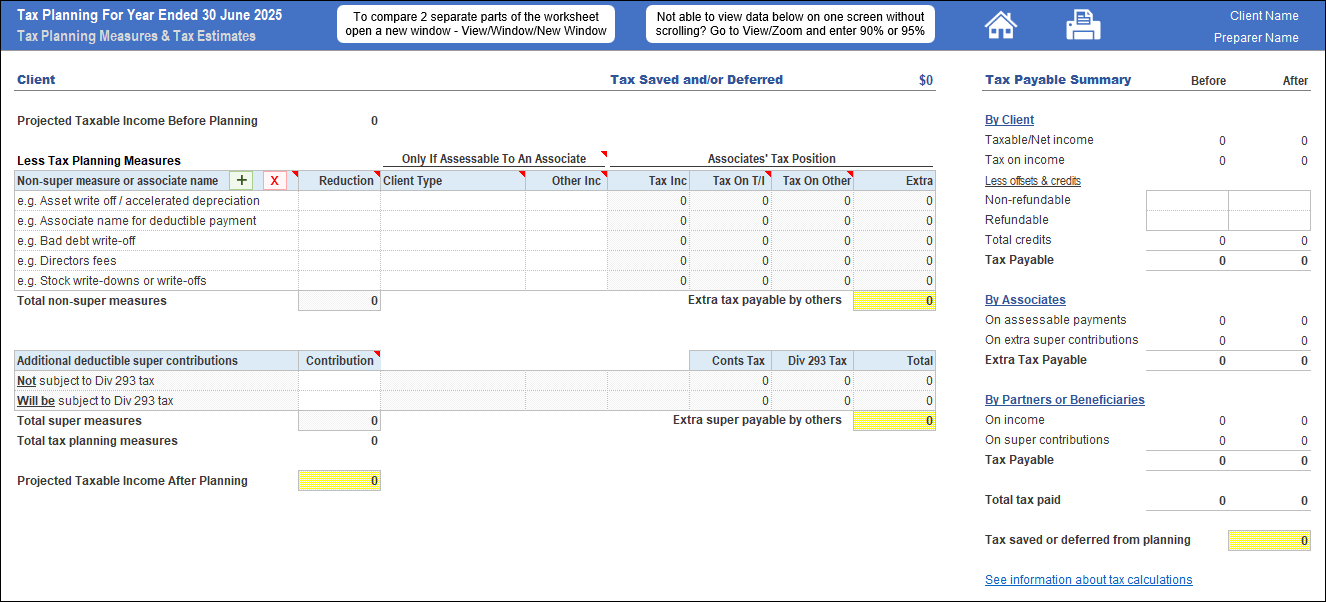

- Explore tax planning opportunities

- Calculate tax payable for all associates

- Super contributions & Div 293 tax calculated

- View MTRs of partners & beneficiaries

- See income available at that rate

- Calculate tax saved or deferred

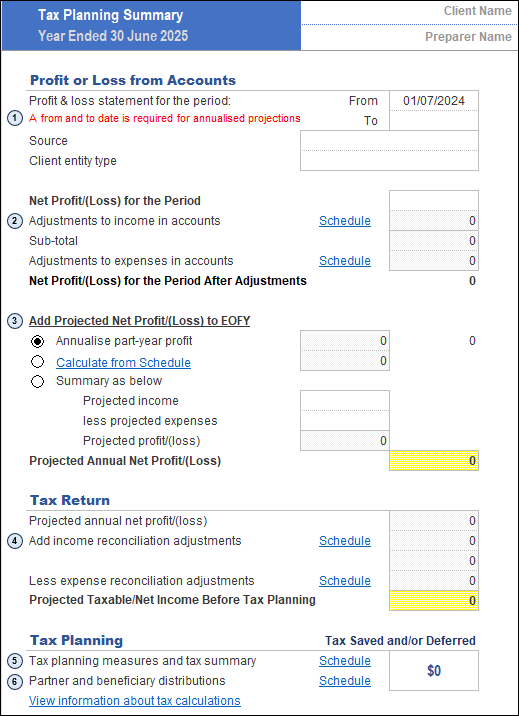

Summary

Tax Planning Table

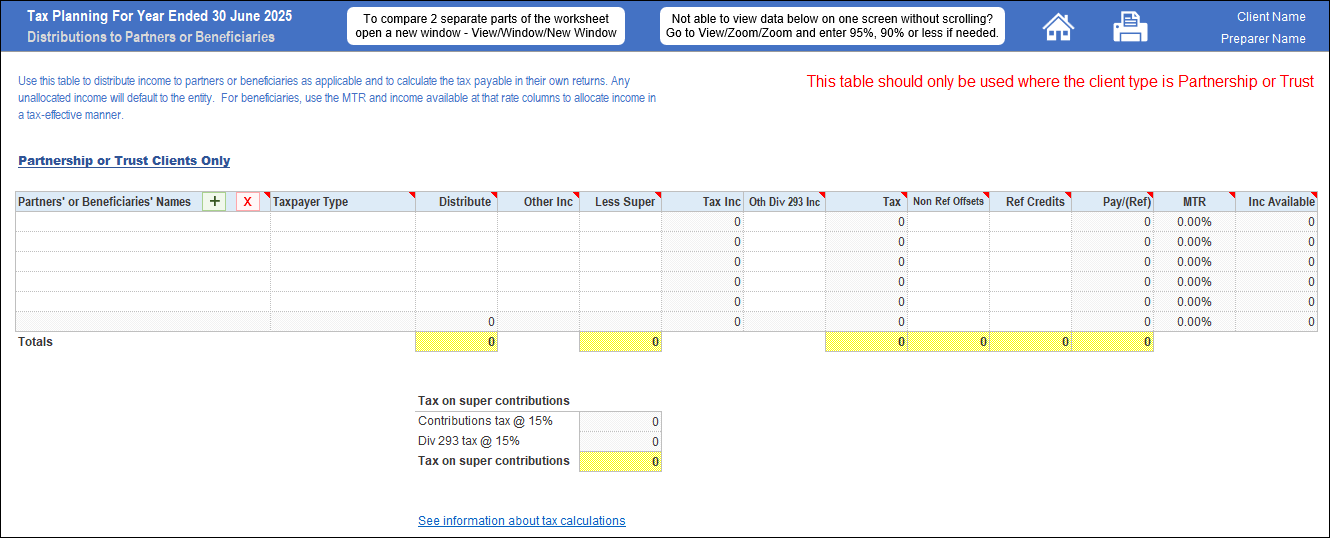

Partnership & Trust Distributions