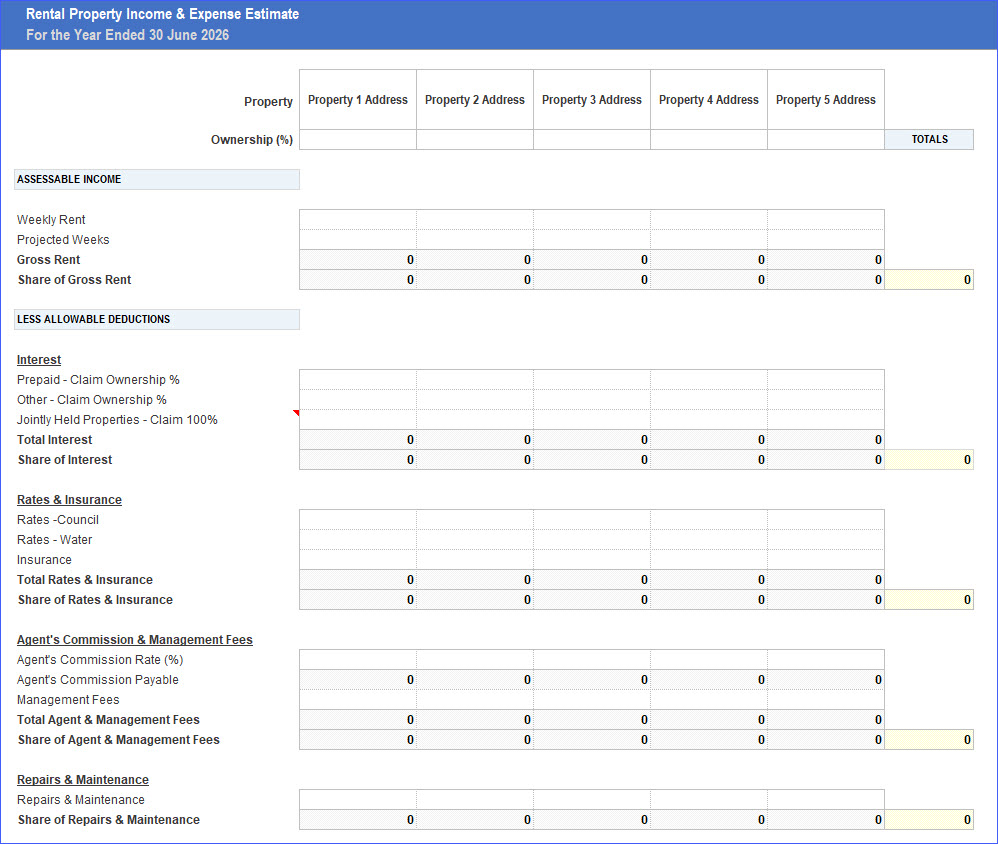

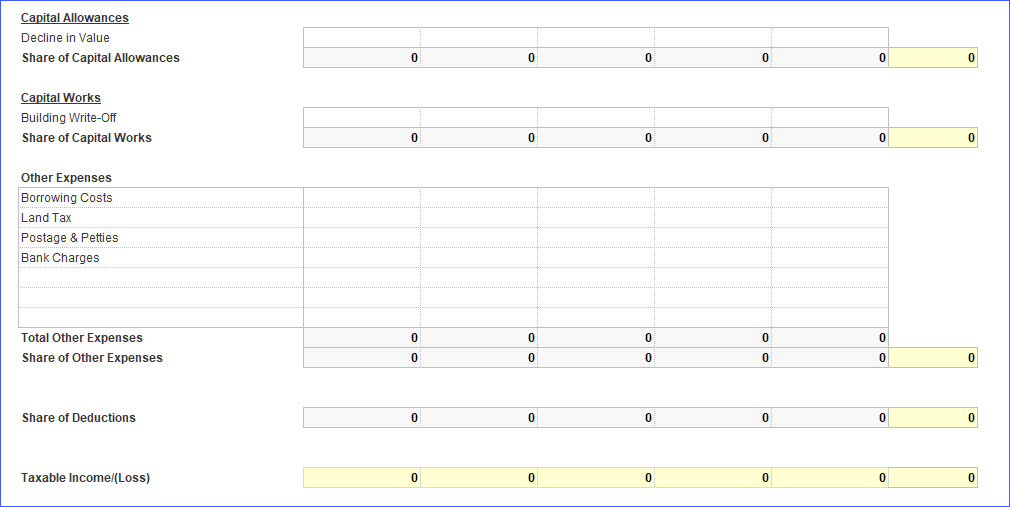

Description

Features

- Unlimited use within your practice

- All updates to the file after purchase

- Use for proposed purchases in the 2026 FY

- Or profile the ideal property for your client

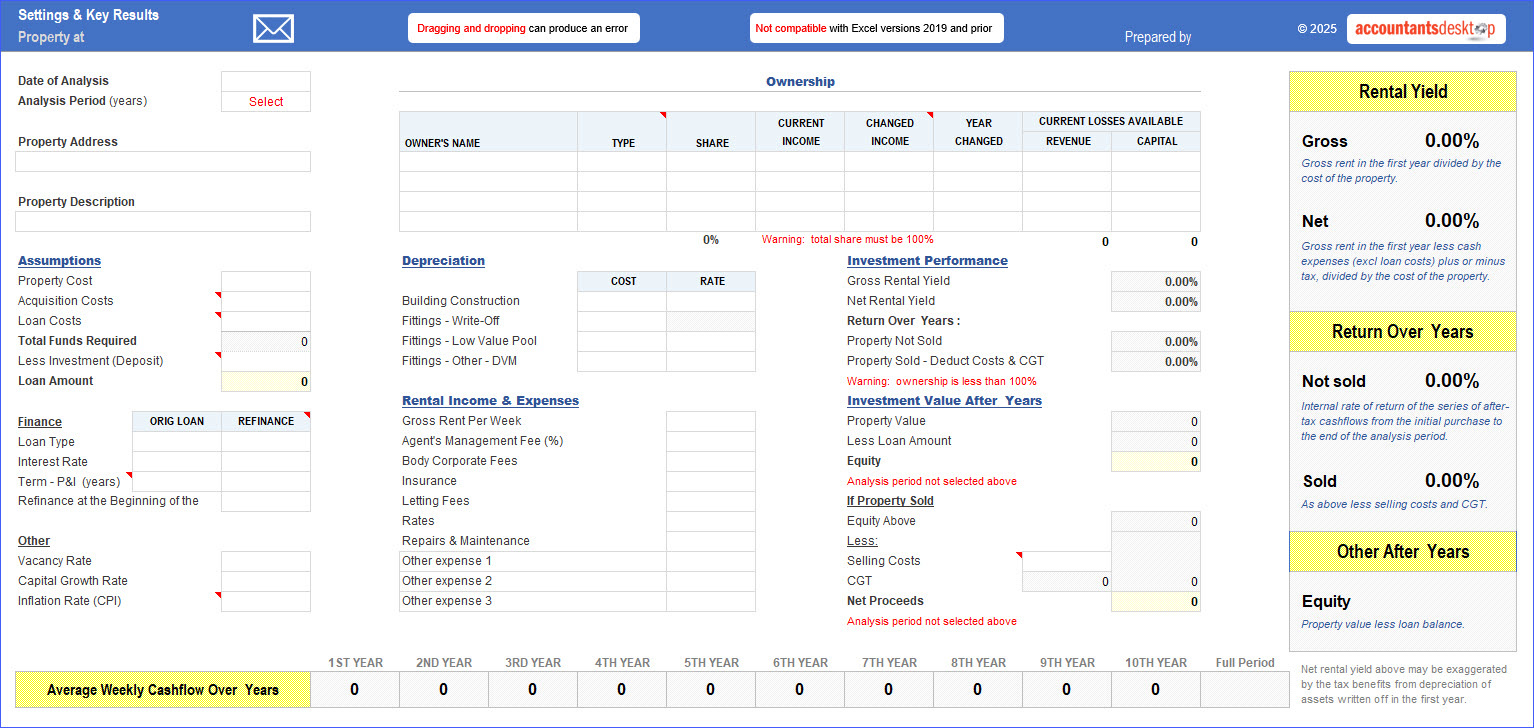

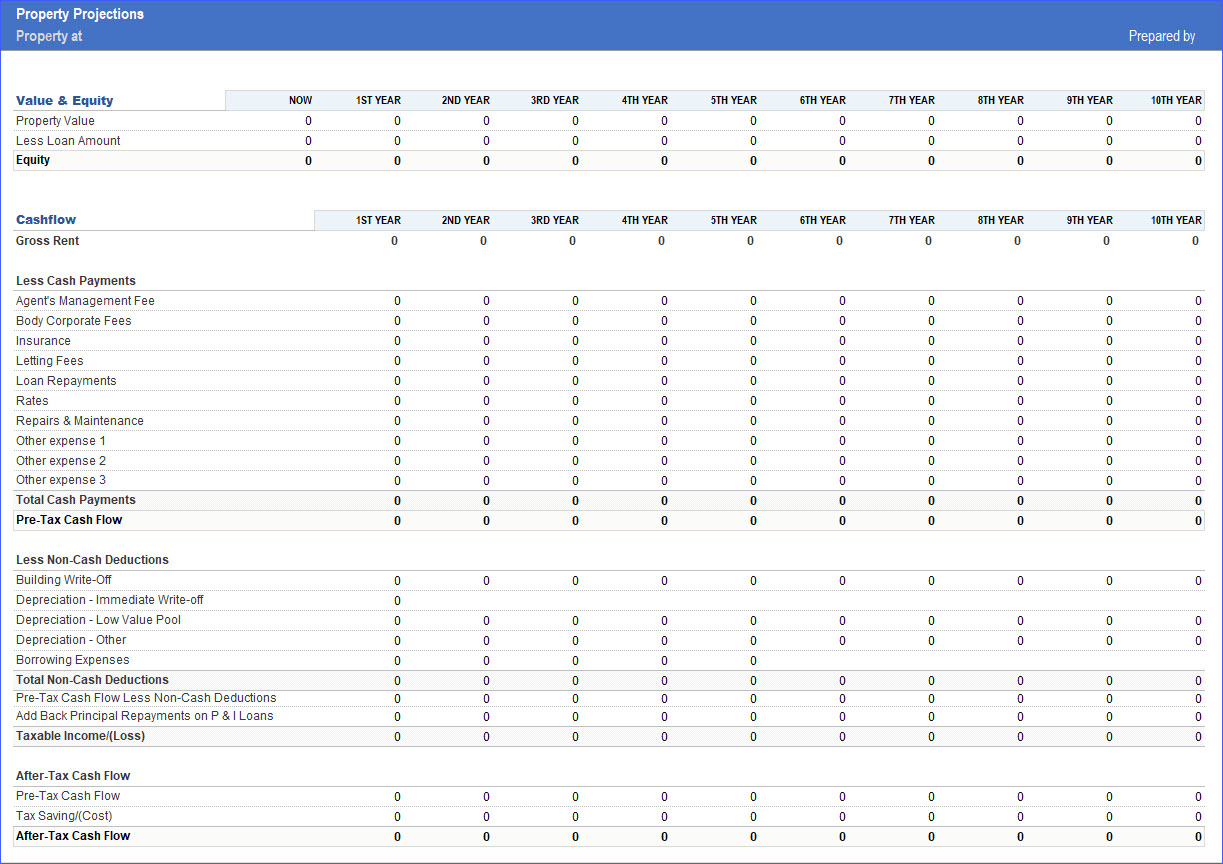

- Investment term between 1 and 10 years

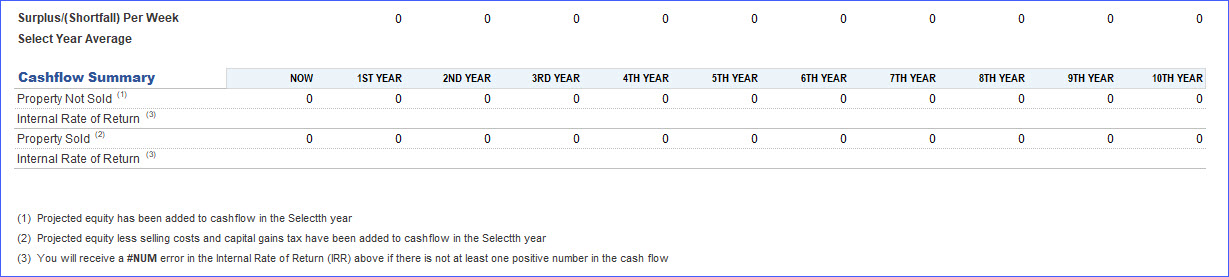

- Pre-tax cashflow

- Projected equity

- IRR if not sold

- IRR if sold

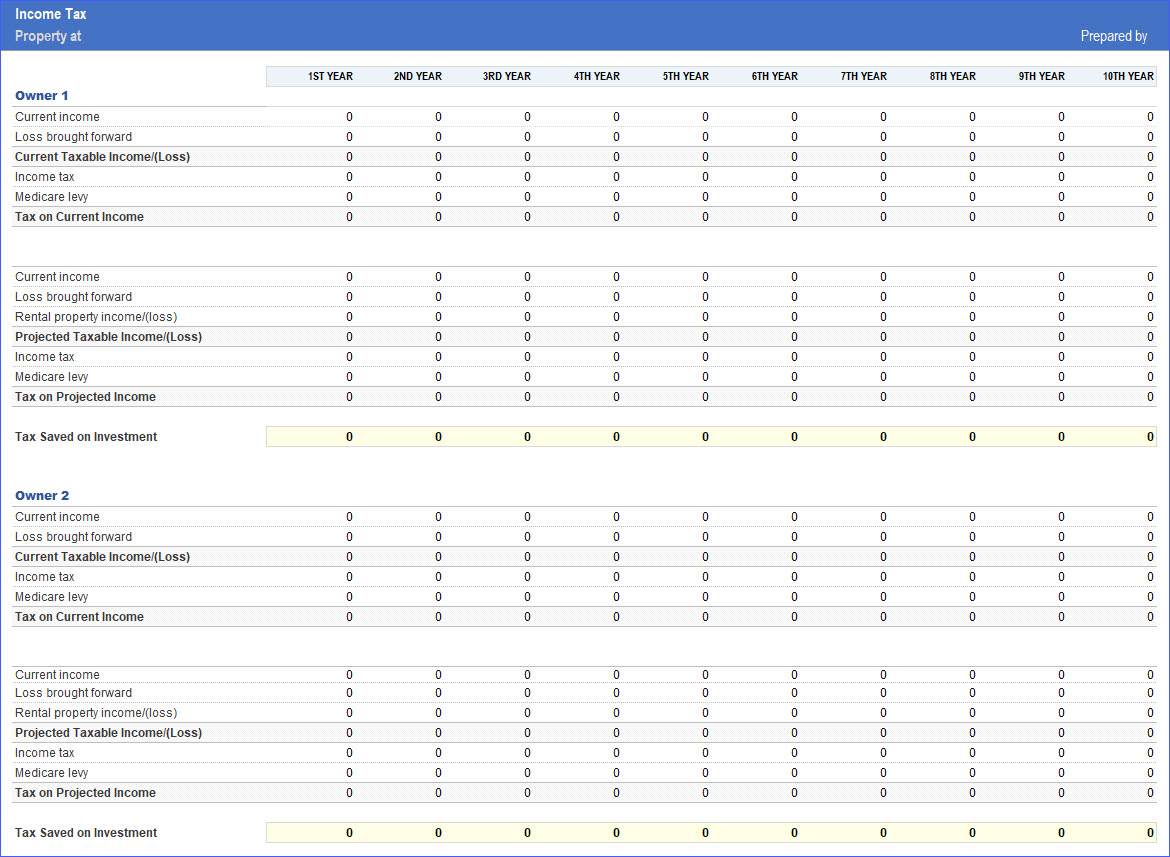

- Use for individuals, companies & SMSFs

- Allow one income change per owner

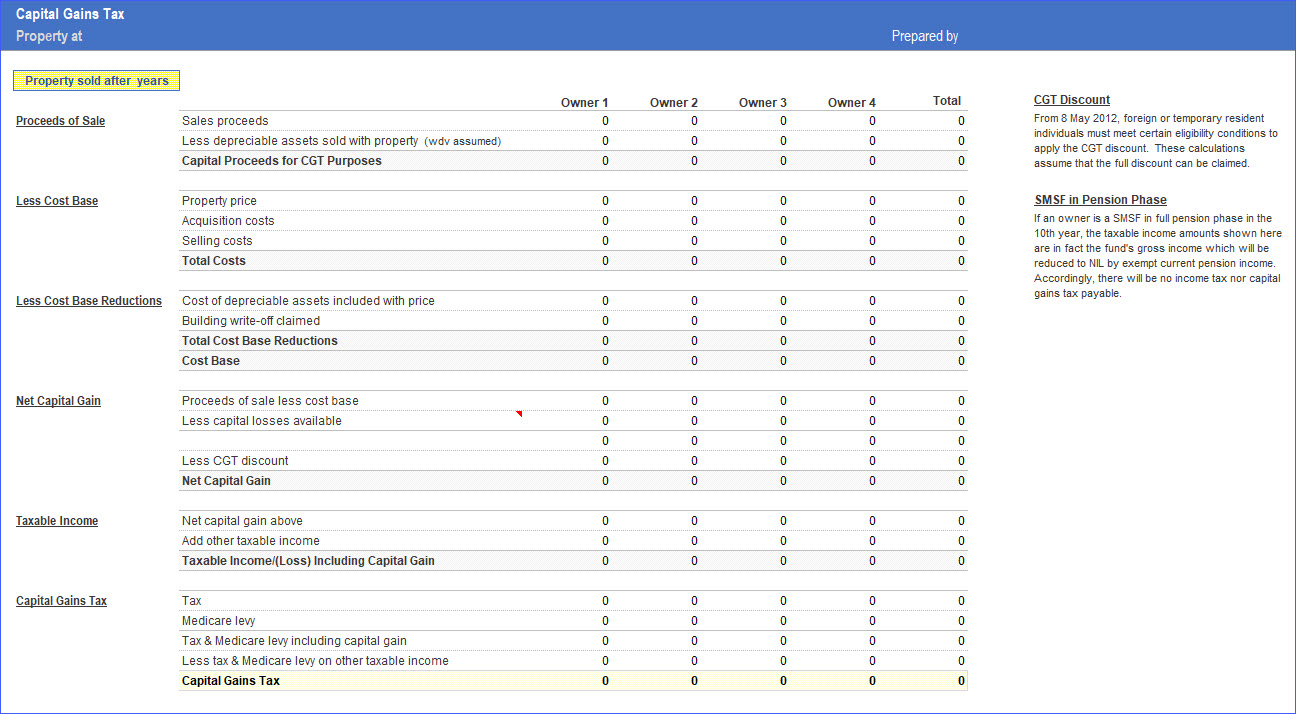

- Account for revenue & capital losses

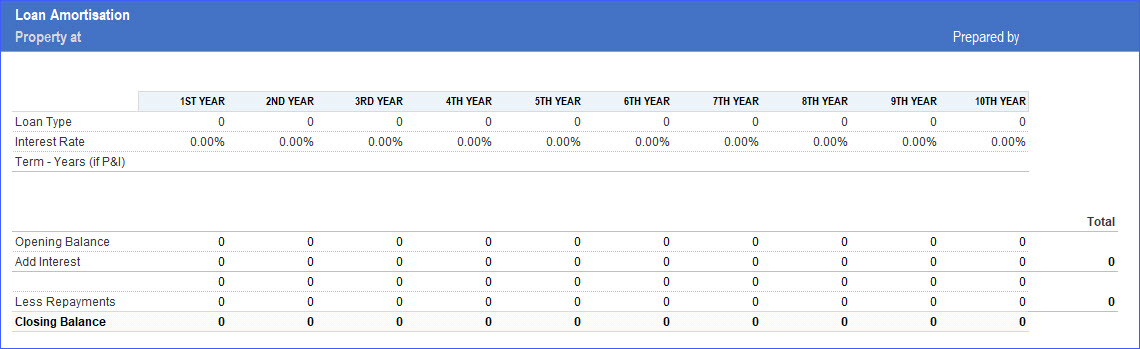

- Allow one refinance

- SMSFs go into pension mode any year

- Stress test by changing assumptions

- Bonus PAYGW variation calculator

Settings

Projections

Income Tax

Capital Gains Tax

Loan Amortisation

PAYGW Variation