Description

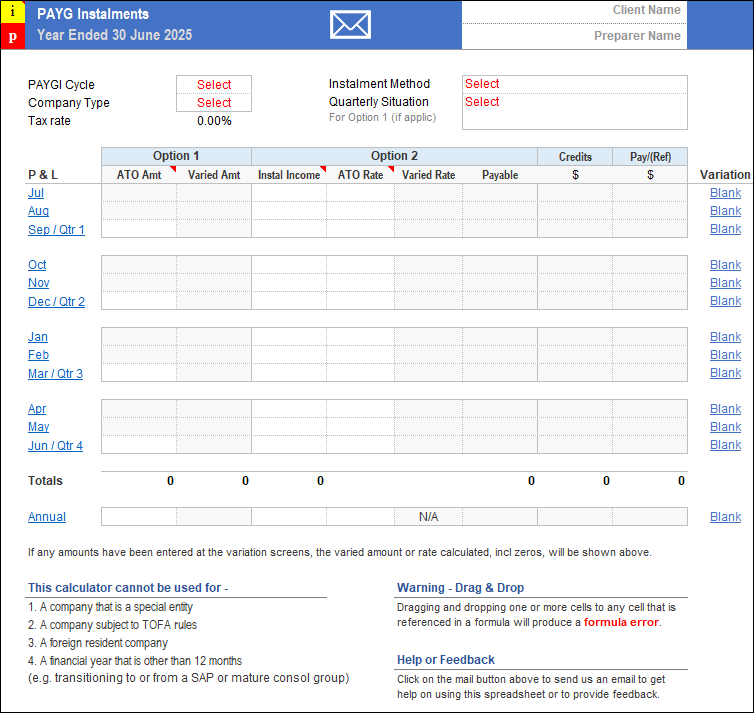

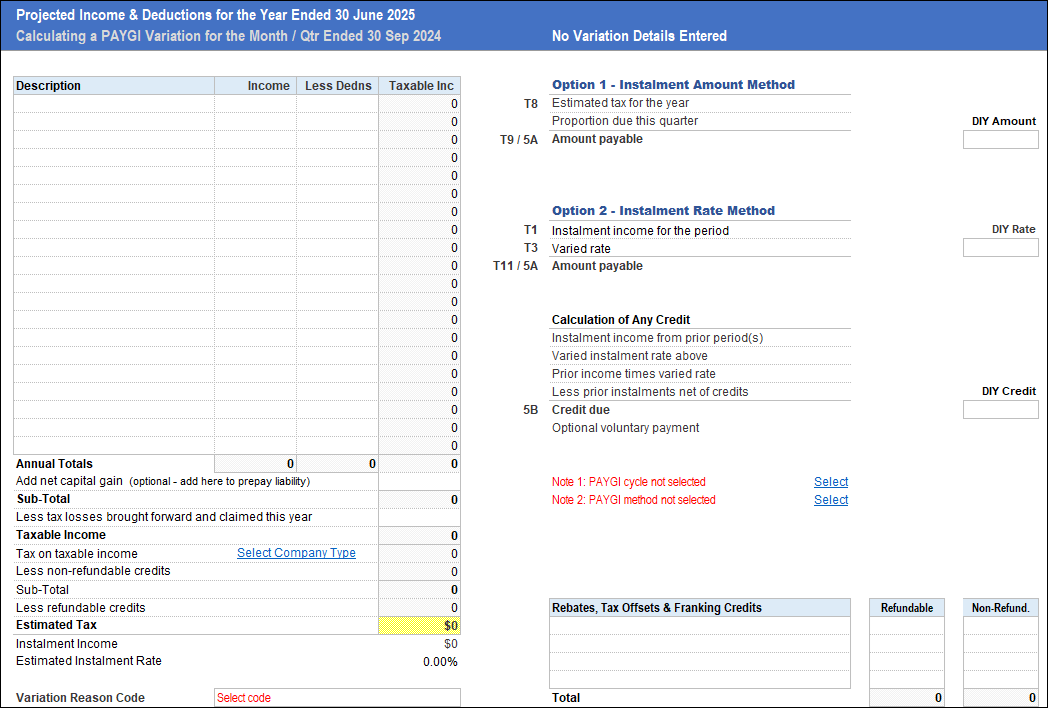

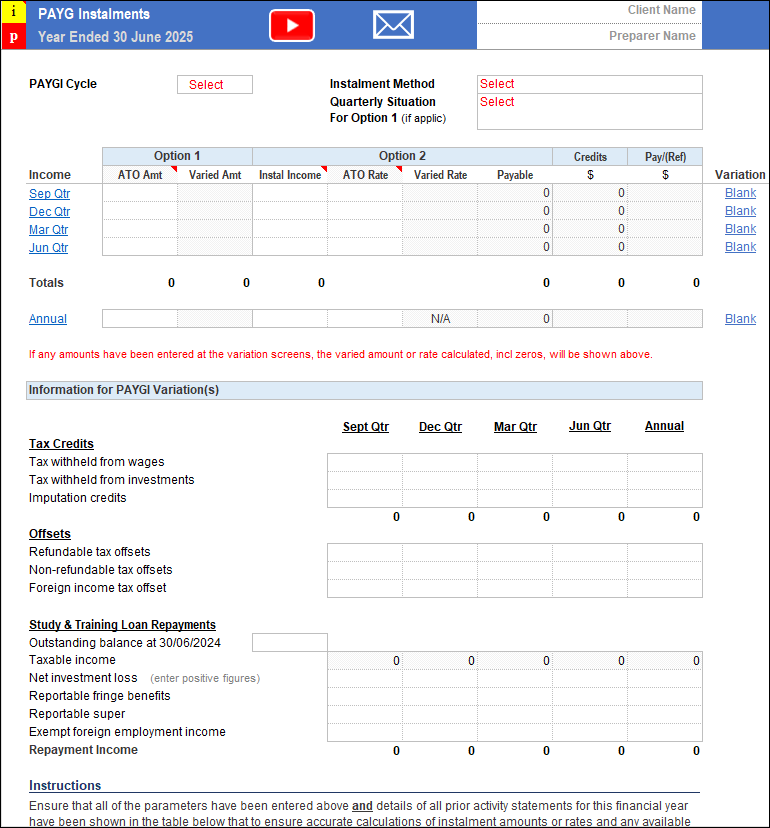

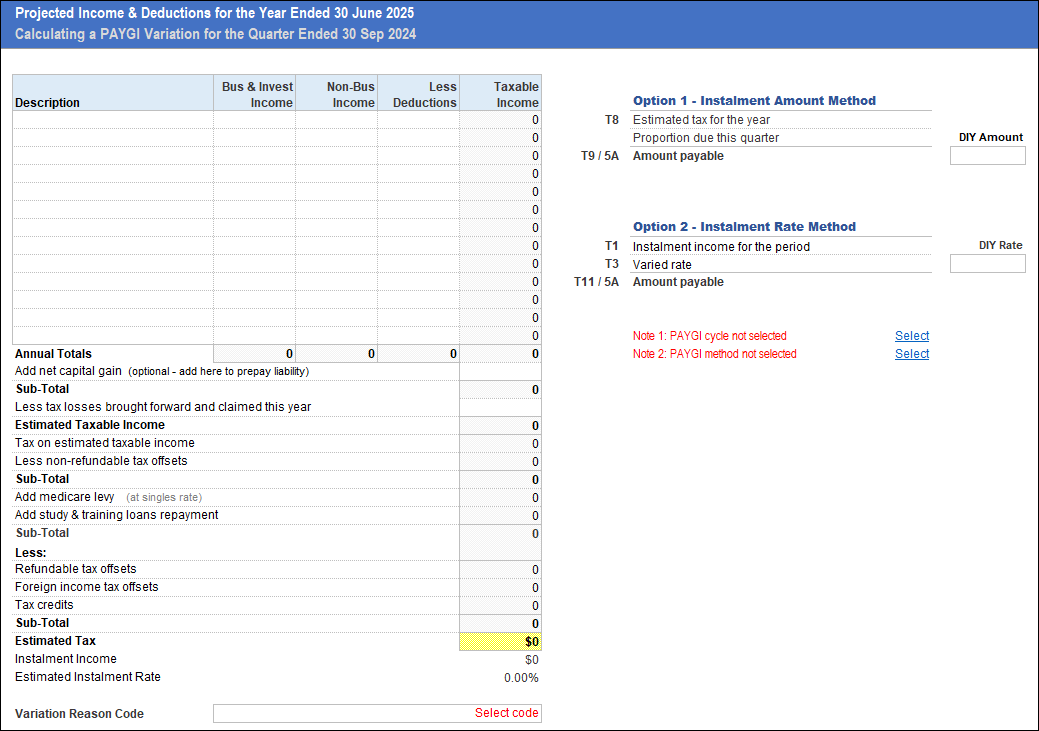

PAYG Instalments

- For individuals and companies

- Estimate taxable income for the year

- Calculate tax on estimated income

- Identify instalment income

- Calculate varied instalment rate or amount for the period

- Calculate instalment amount payable or credit due

- Easily calculate later variations.

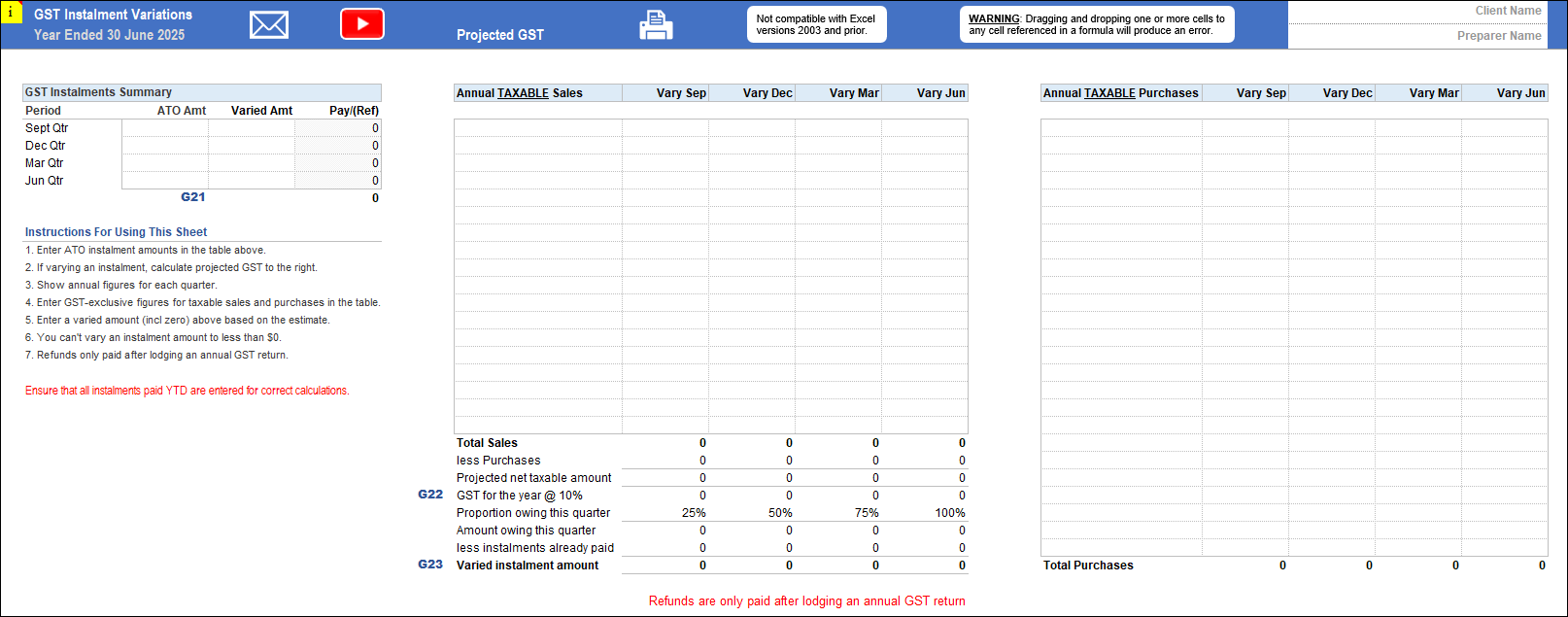

GST Instalments

- Estimate annual taxable sales and purchases

- Calculate projected annual GST payable

- Calculate proportion owing to end of quarter

- Calculate amount owing less instalments already paid

- Single table display for quarterly variations

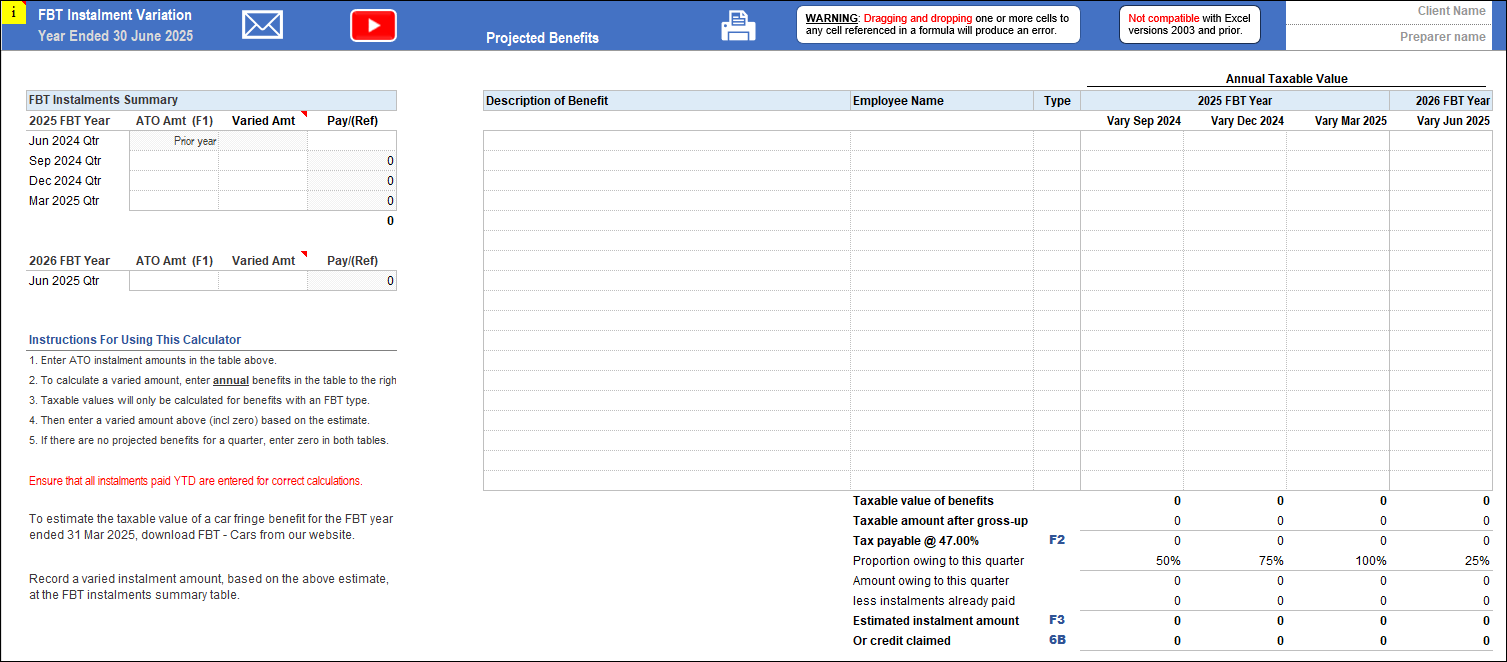

FBT Instalments

- Estimate annual taxable value of benefits

- Identify benefit types and gross up

- Calculate projected annual FBT payable

- Calculate proportion owing to end of quarter

- Calculate amount owing less instalments already paid

- Single table display for quarterly variations

PAYGI Variation for a Company (1)

PAYGI Variation for a Company (2)

PAYGI Variation for an Individual (1)

PAYGI Variation for an Individual (2)

GST Instalment Variation

FBT Instalment Variation