Description

Features

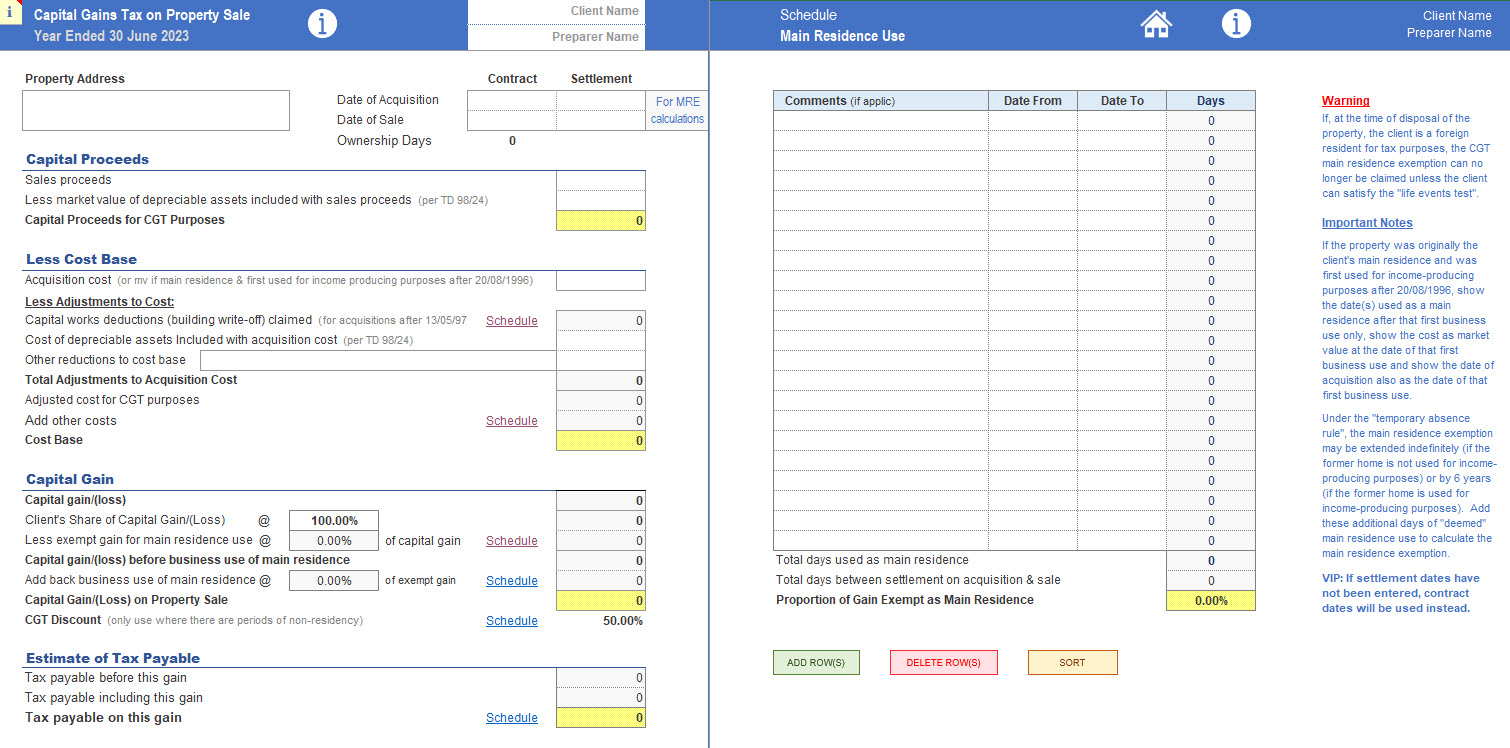

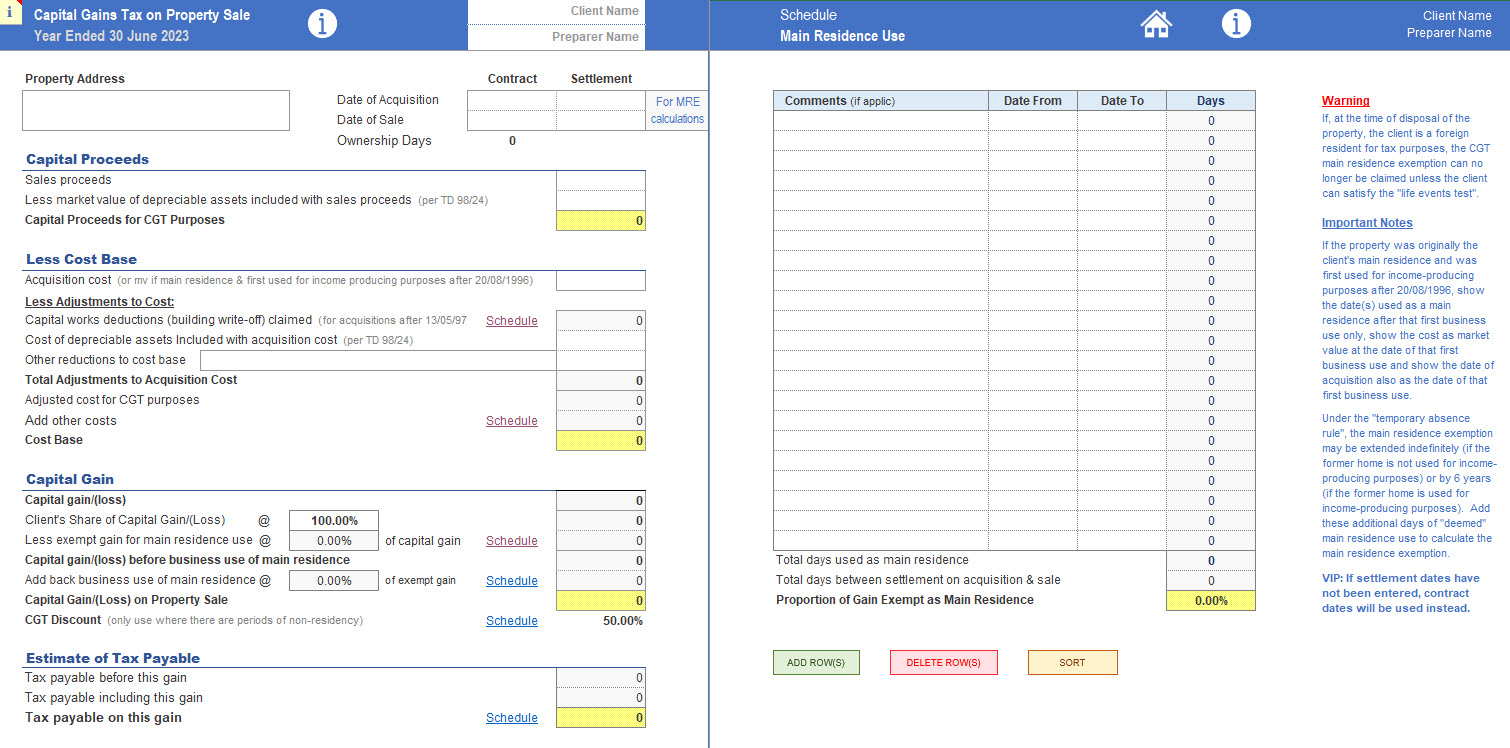

Property

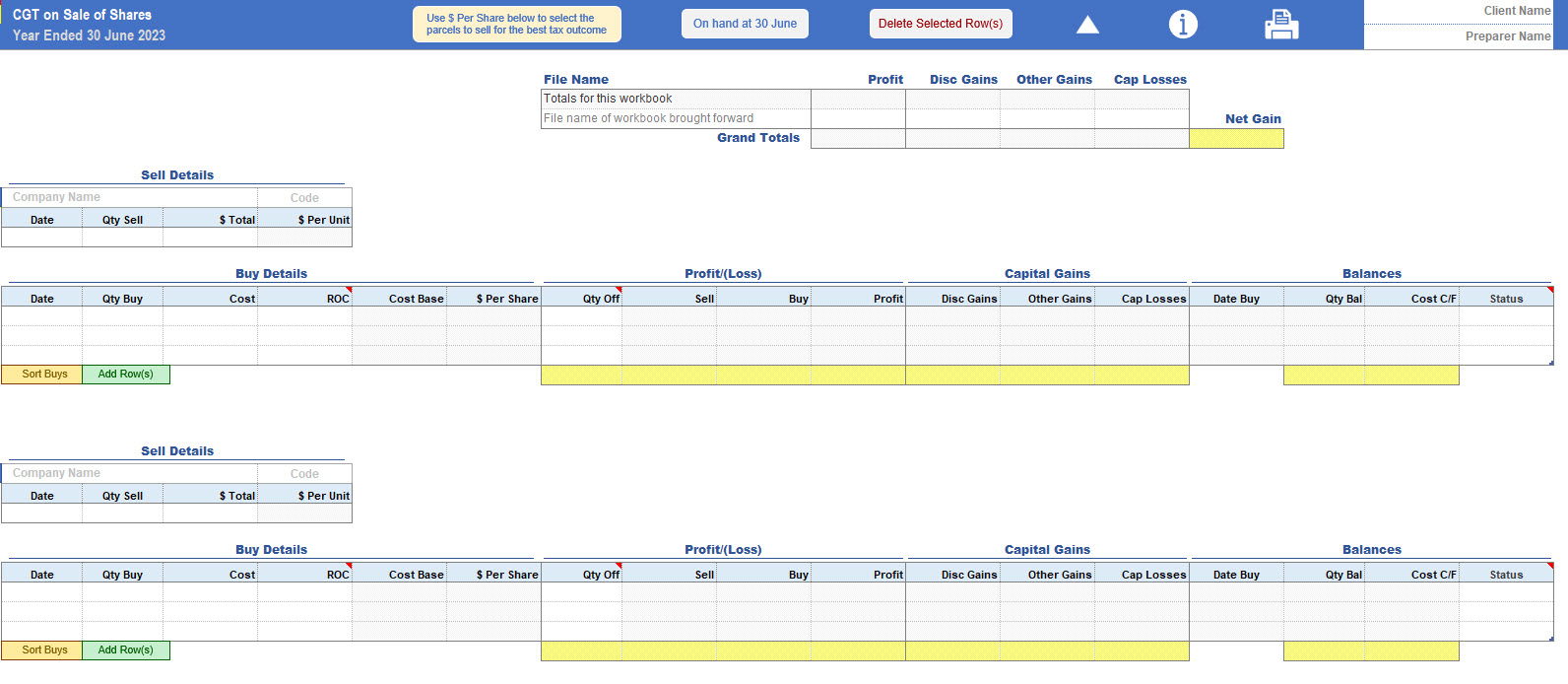

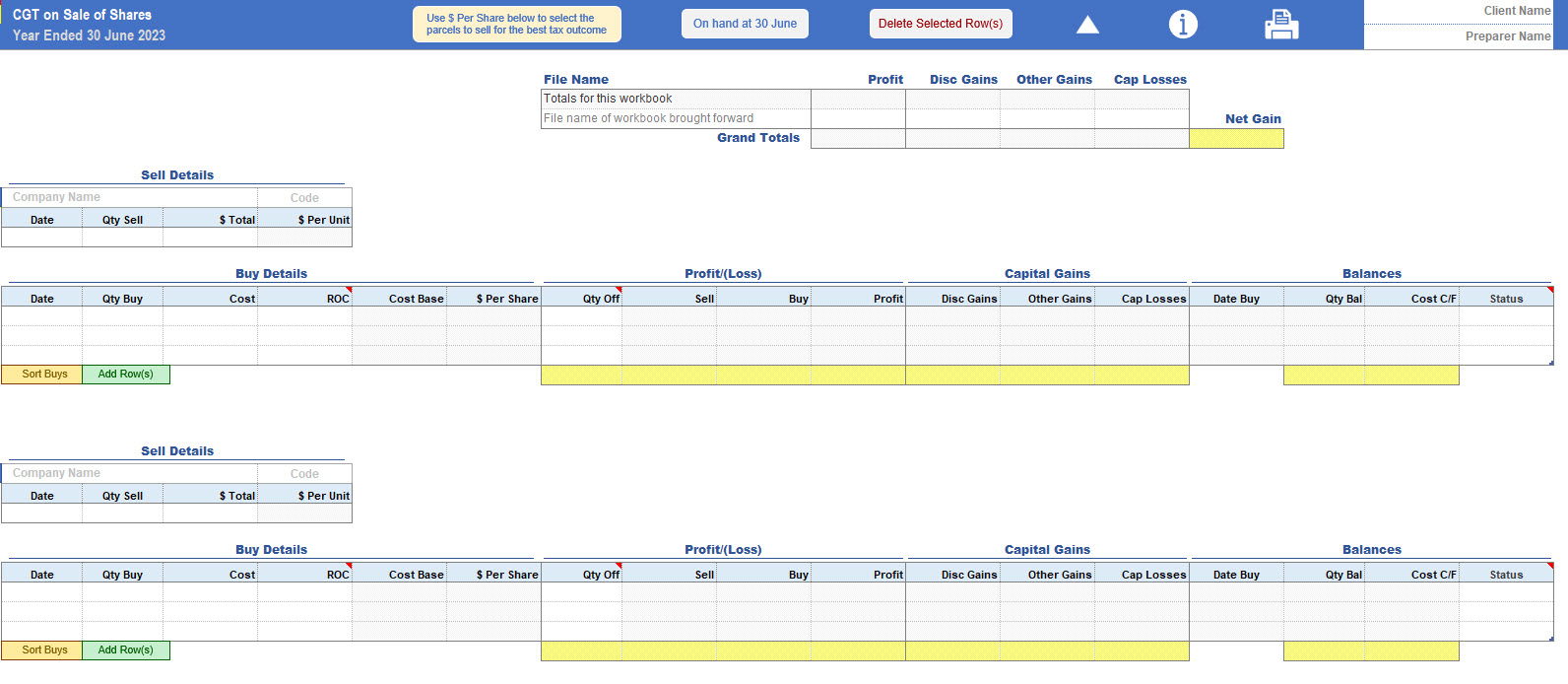

Shares

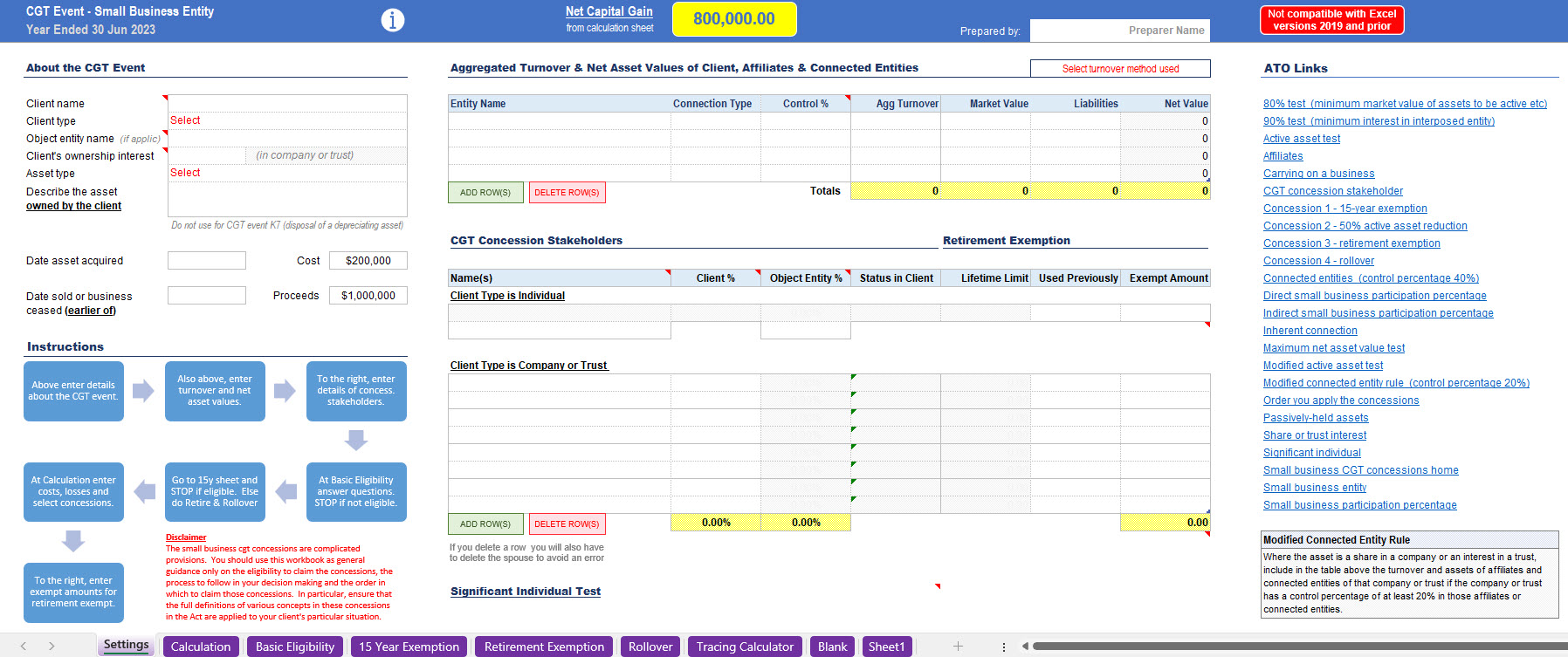

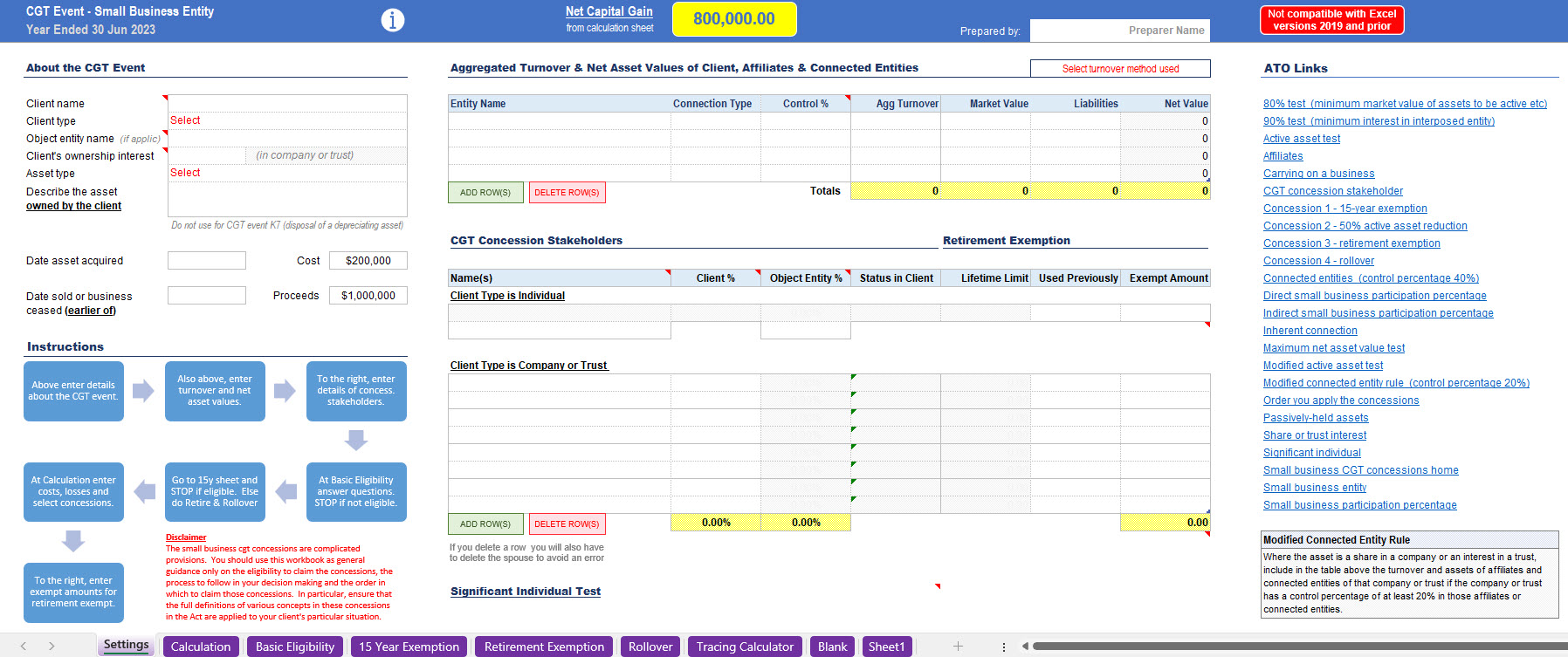

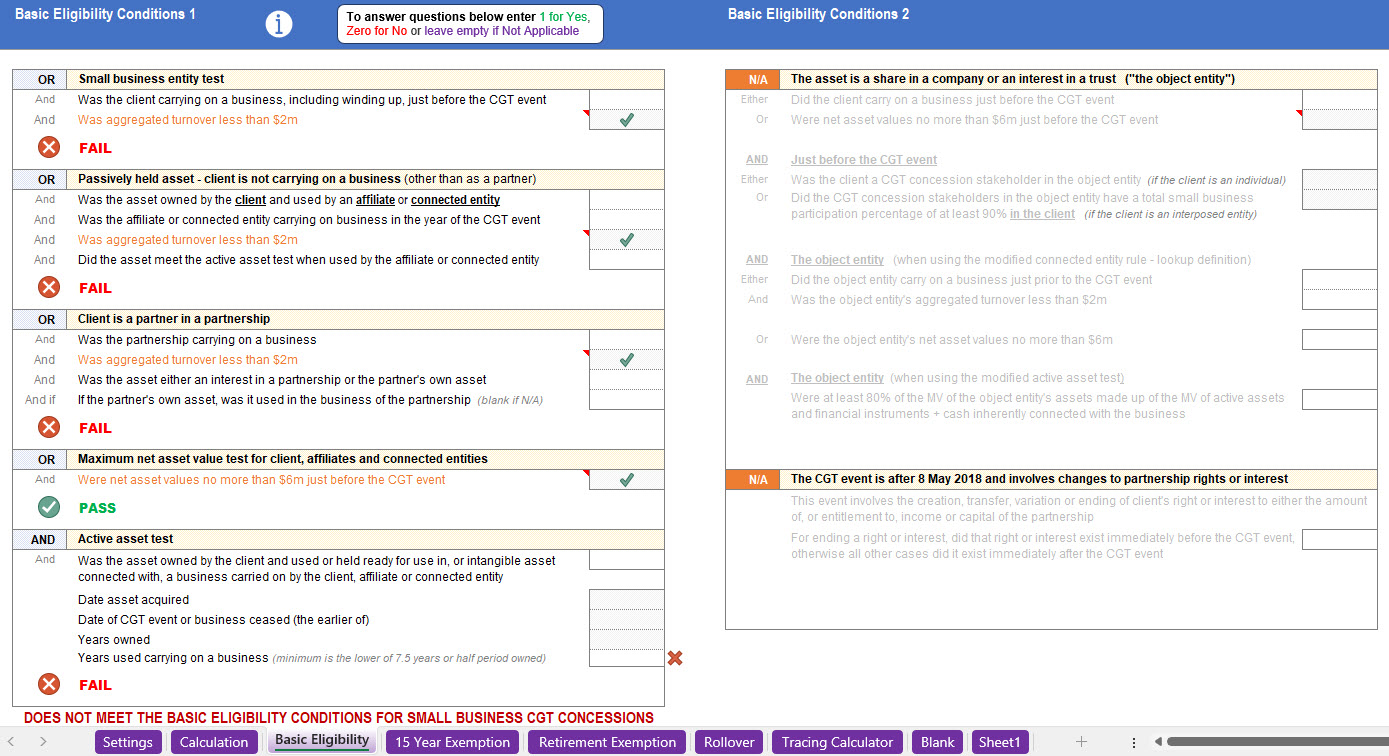

Small Business Concessions – Summary

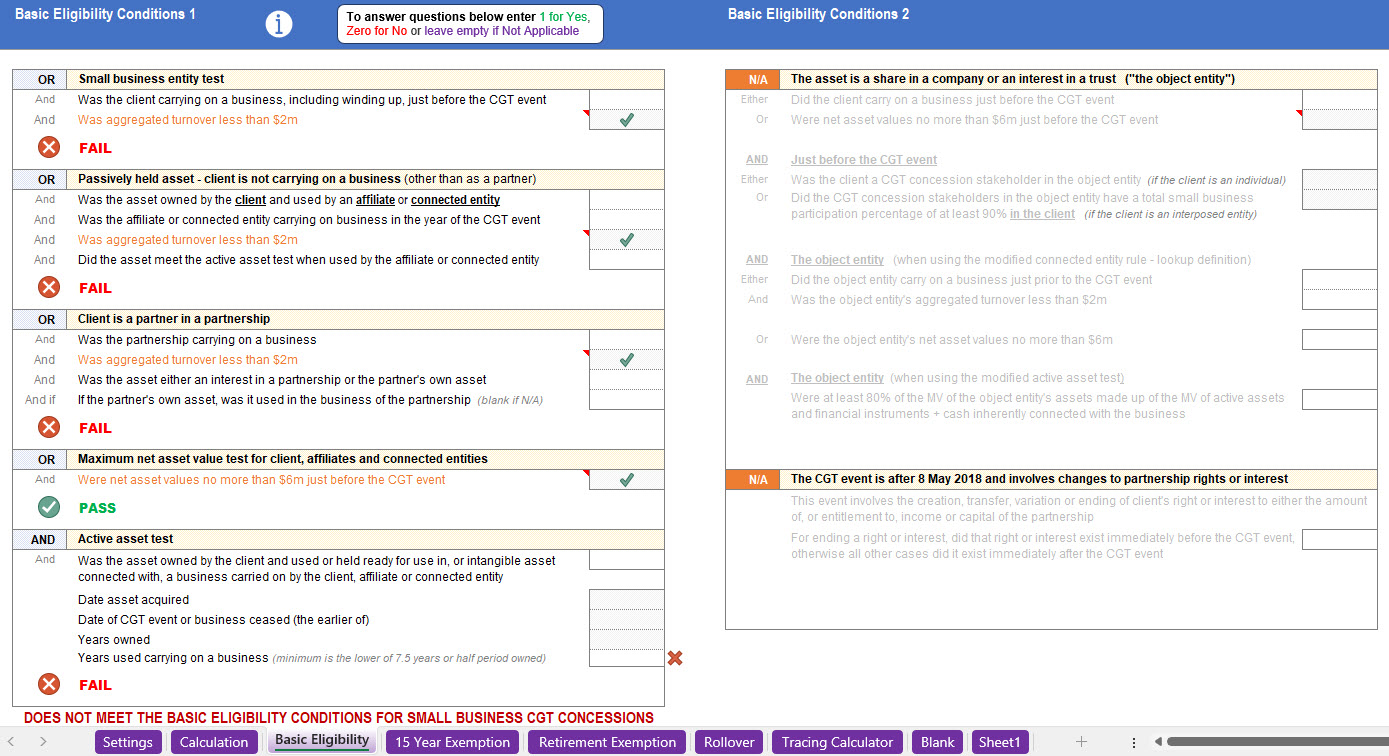

Small Business Concessions – Q & A Format Sample

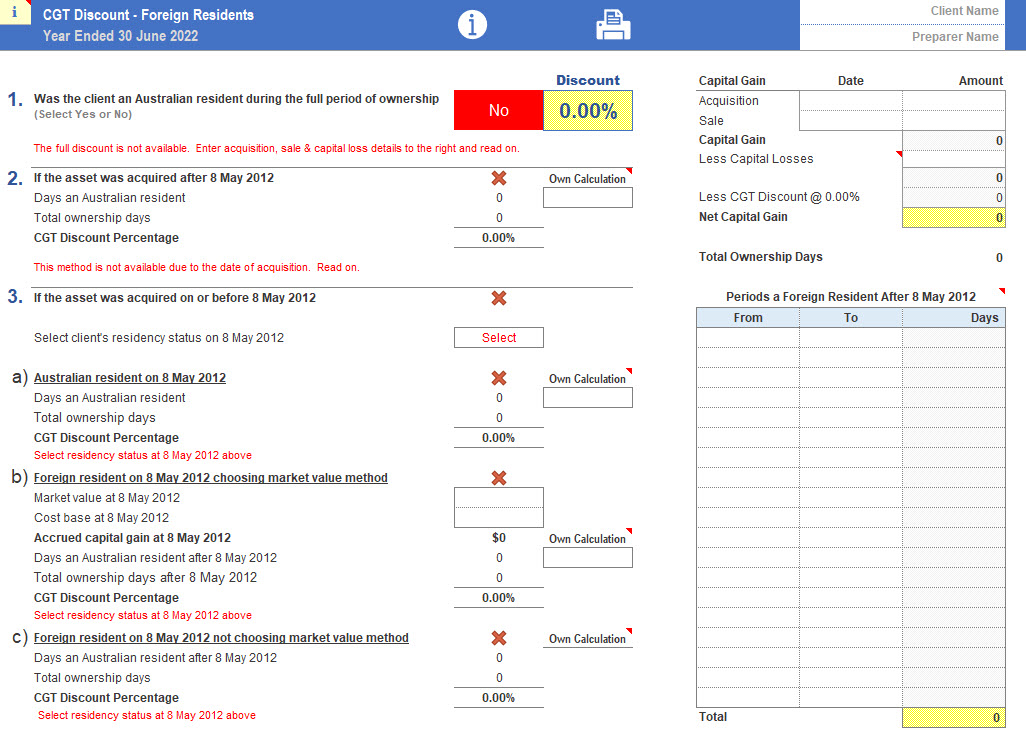

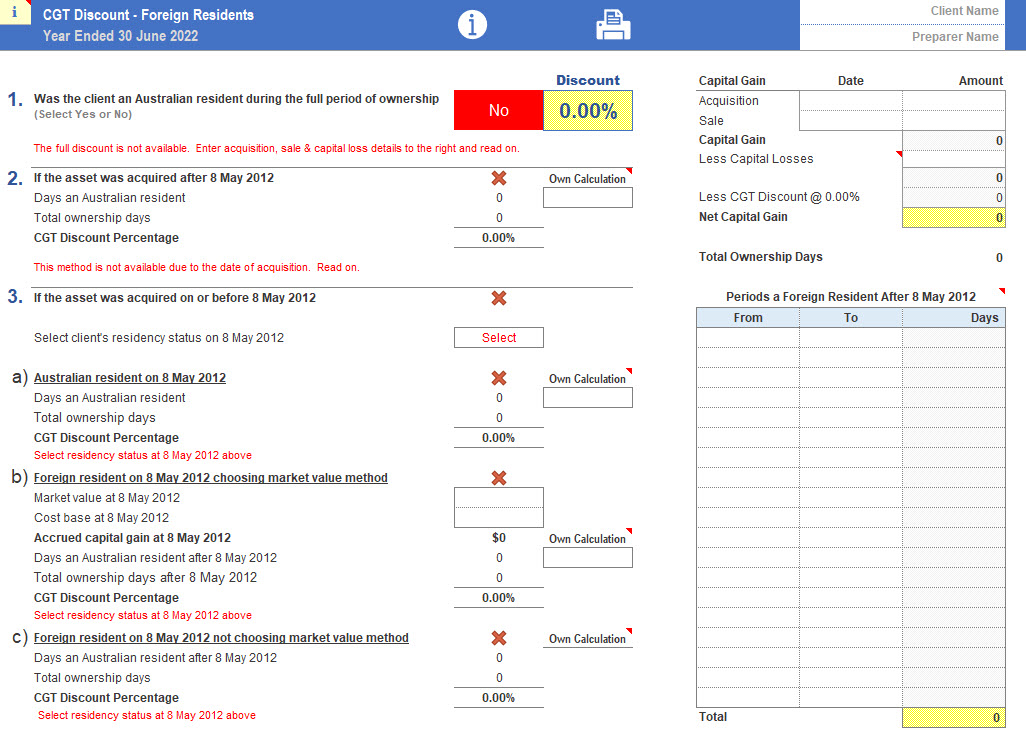

Discount Calculation Where Periods of Foreign Residency

Our CGT calculators are designed for those not so straightforward disposals during the years ended 30 June 2024 and 2023. As with all of our packages, you will have unlimited use of these calculators within your practice and we will provide you with any updates to the files after purchase.

This package includes 10 Excel files with 2023 and 2024 financial year calculations for the sale of Property, Shares and Cryptocurrency as well as a CGT Small Business Concessions calculator and a CGT Discount calculator where there are periods of non-residency.

For more information, read on and watch our videos below for a demonstration of each workbook as well as a brief tour of our website.

Warning: this file is not compatible with Microsoft Excel versions 2019 or the cloud-based version of Excel, Excel for Mac, or Google Sheets.

To access all of our content

$1,395.00 P.A. for 5 users!

Monthly plans available

Just fill in the form below and you will get access to our samples page with free downloads.

"*" indicates required fields

(02) 9542 4655

info@accountantsdesktop.com.au

PO BOX 507 Sutherland NSW 1499