Description

Features

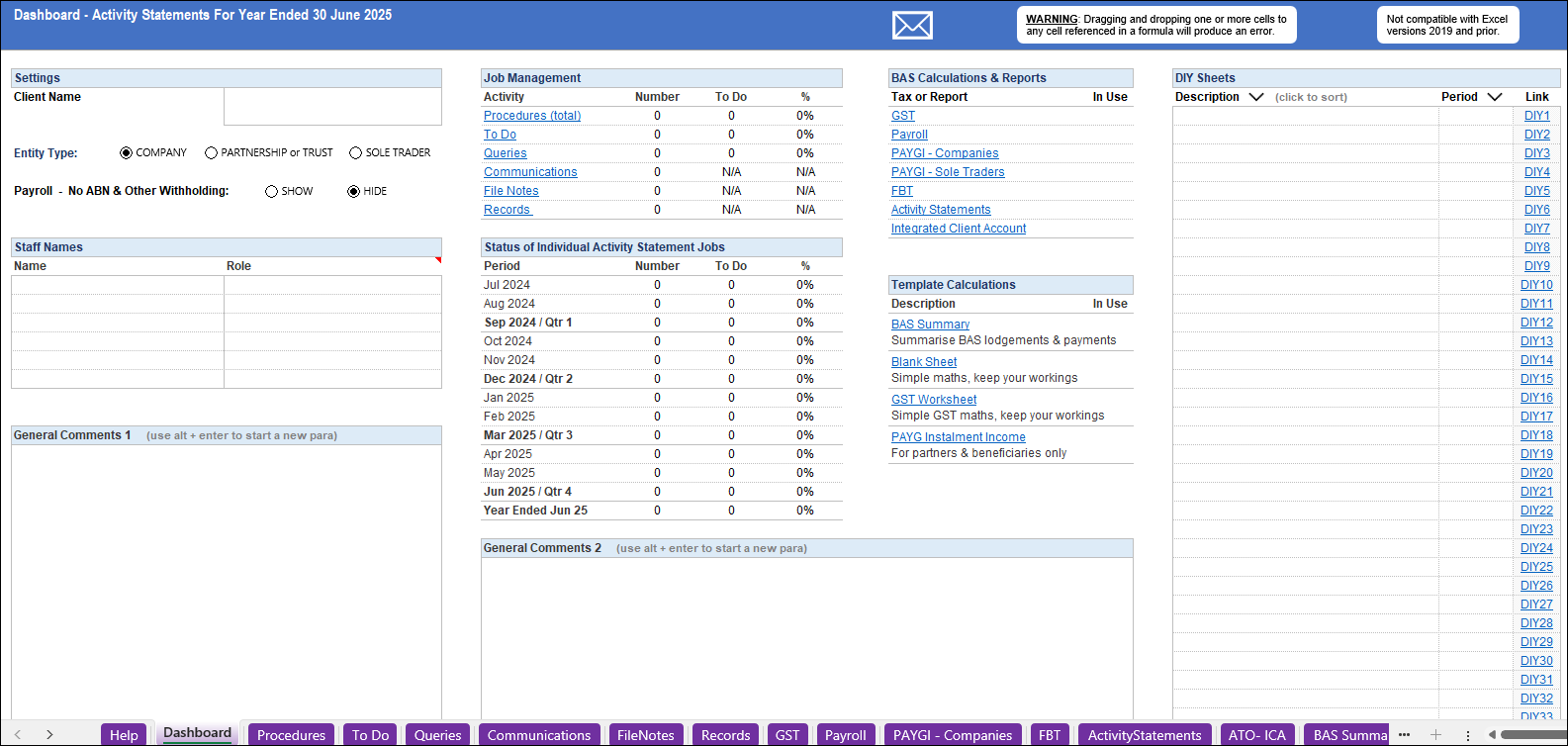

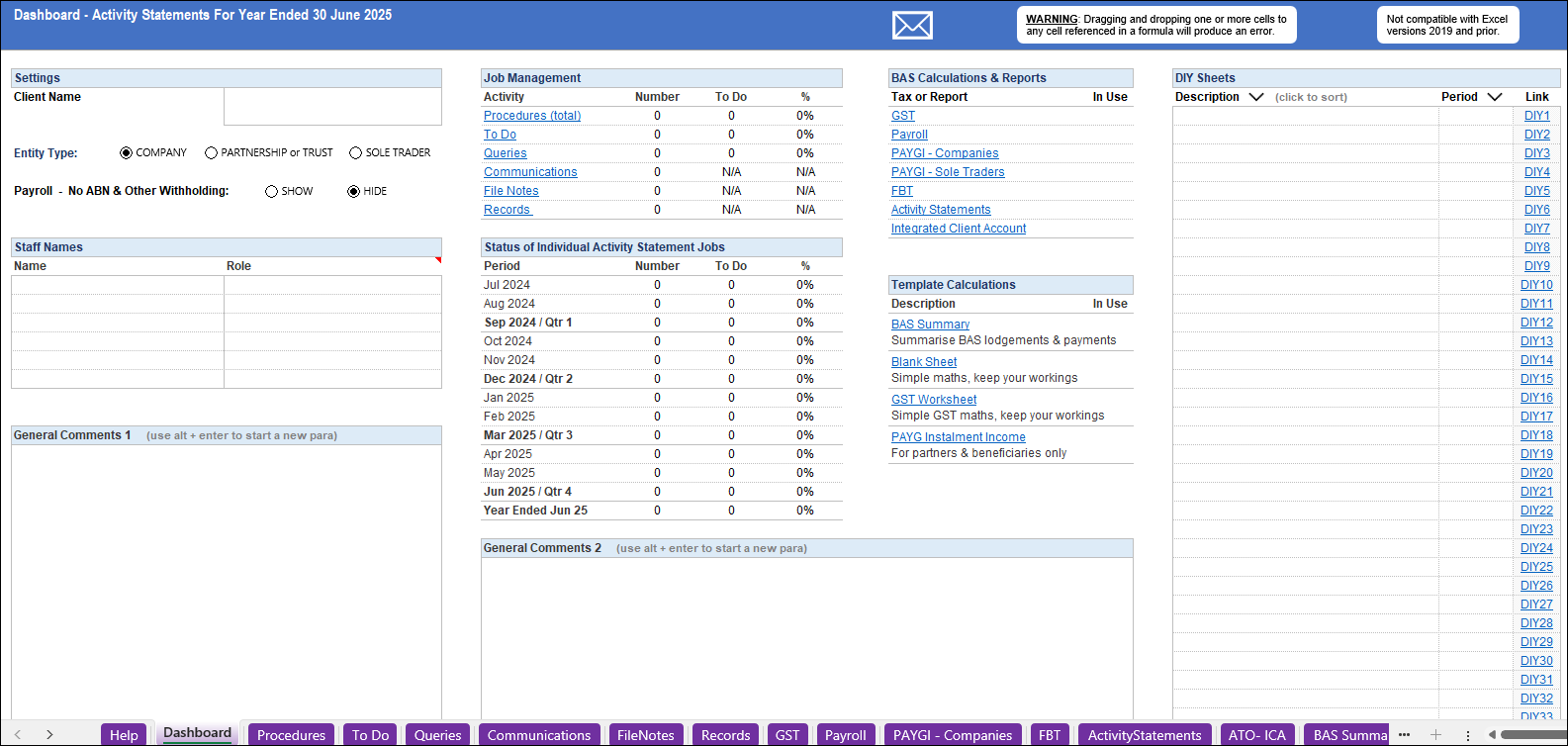

Dashboard

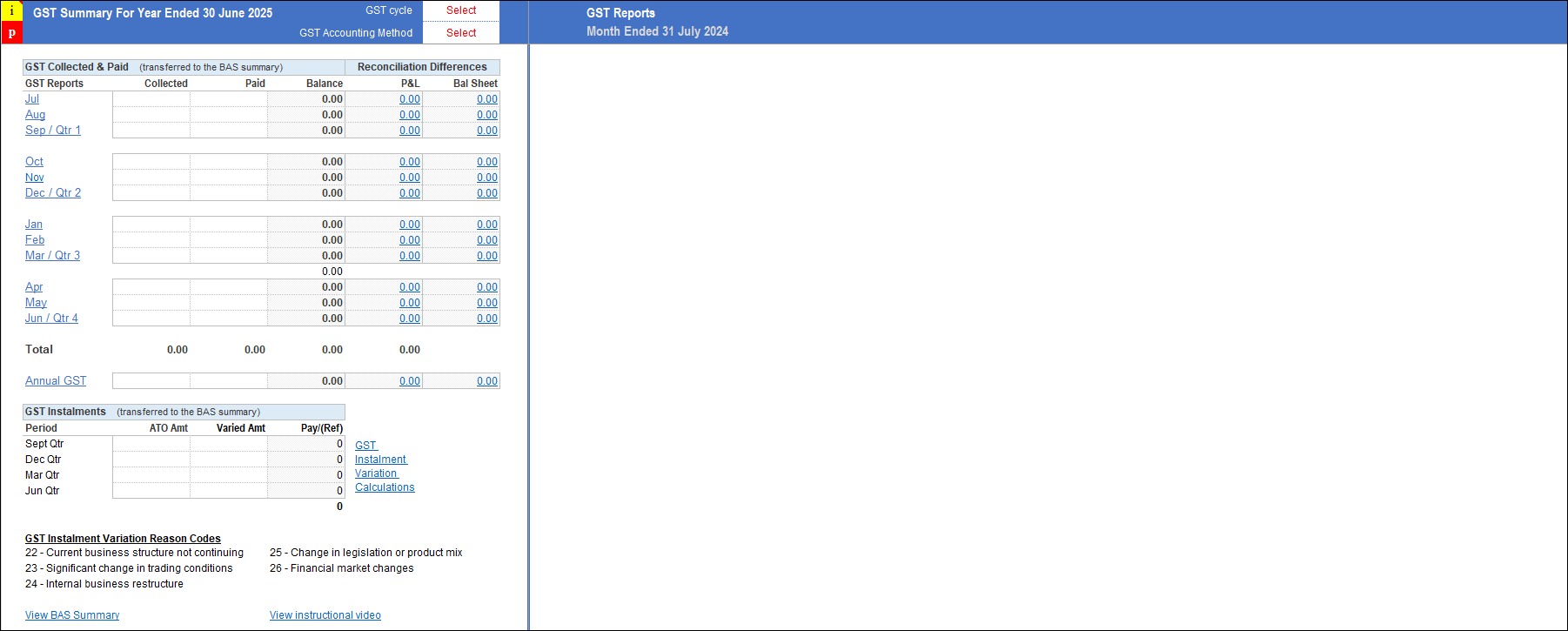

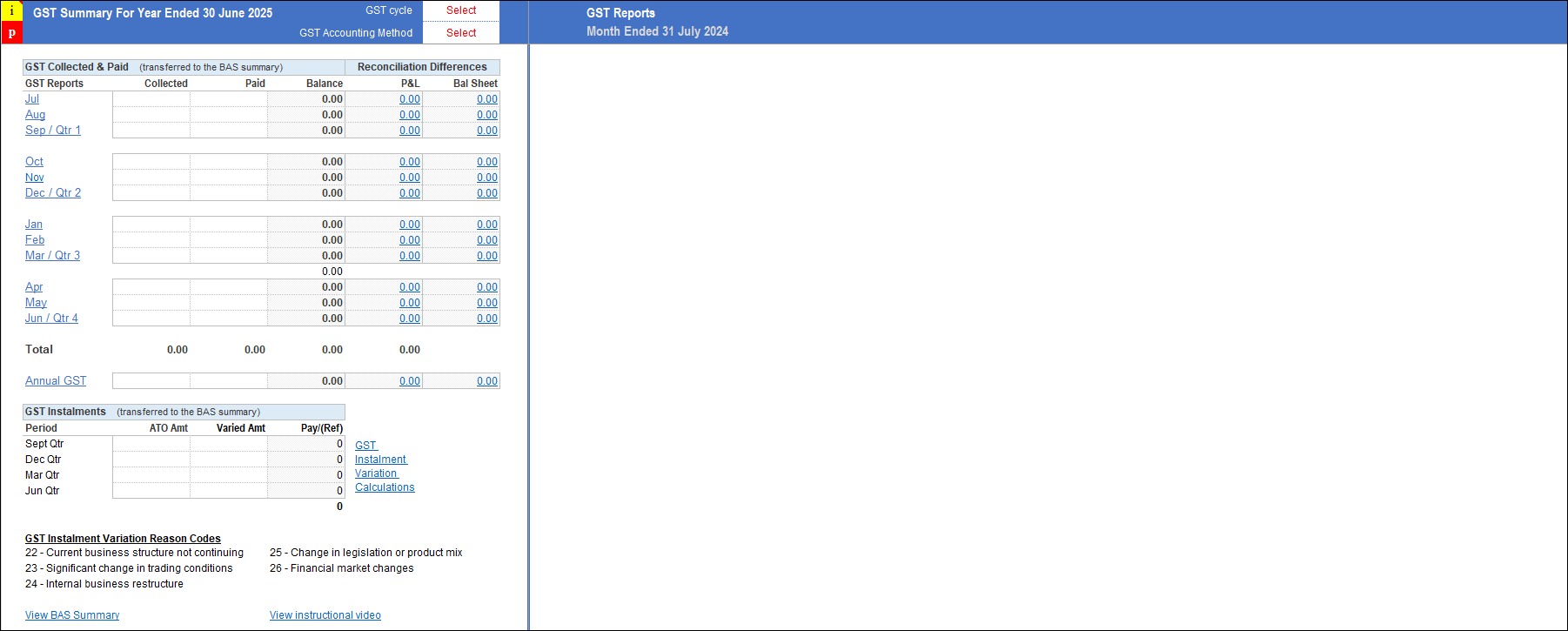

GST Summary

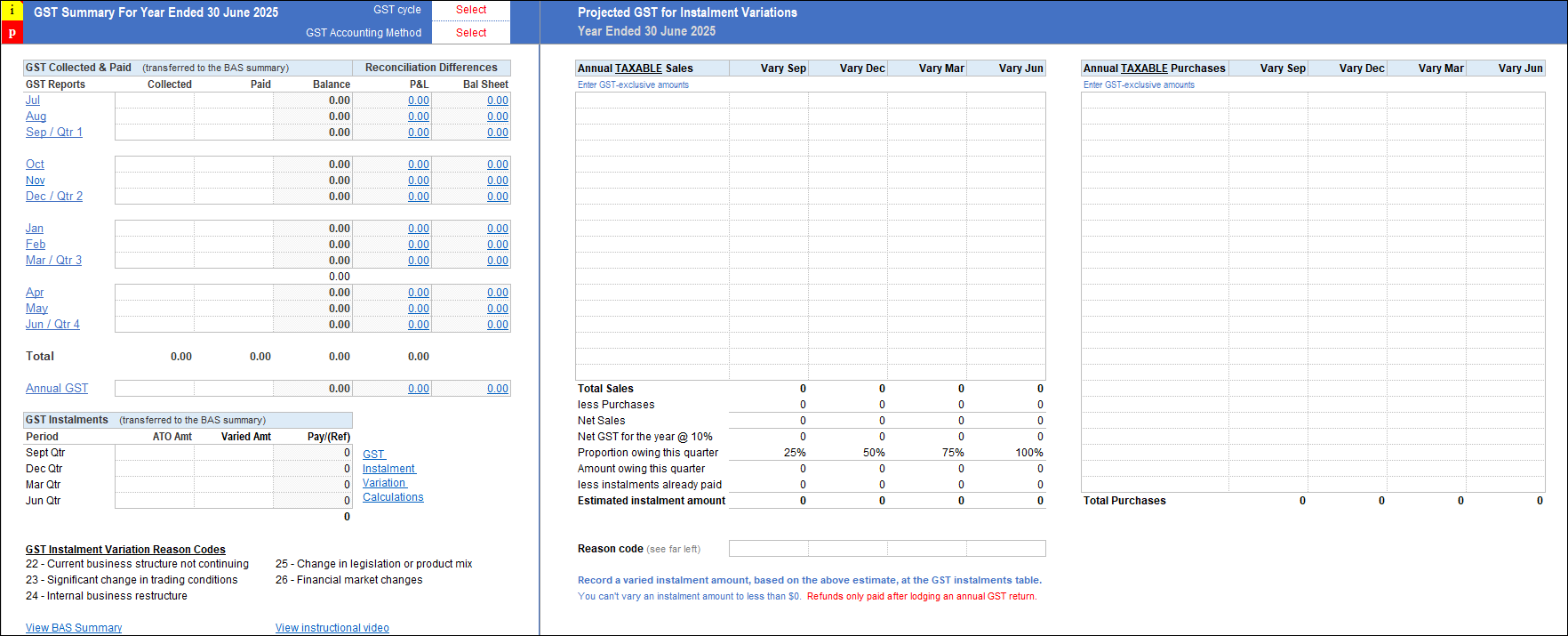

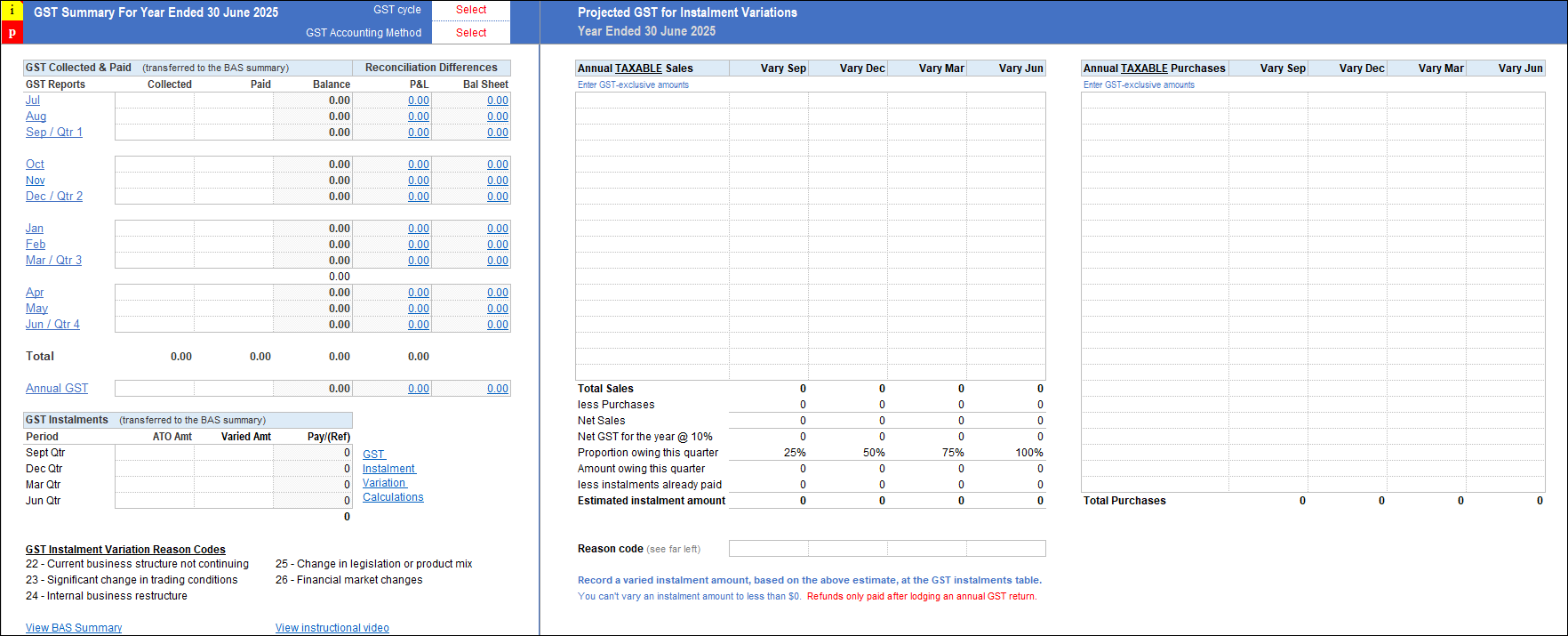

GST Instalment Variation

Payroll

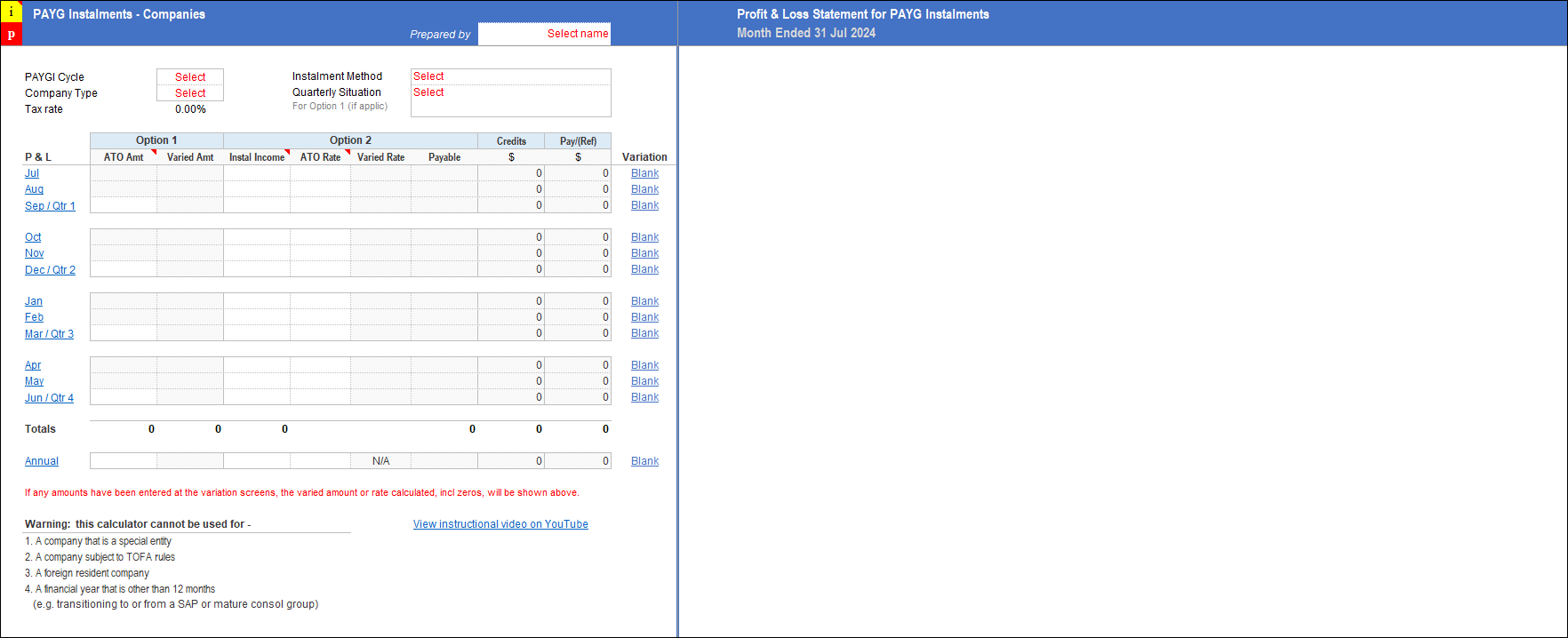

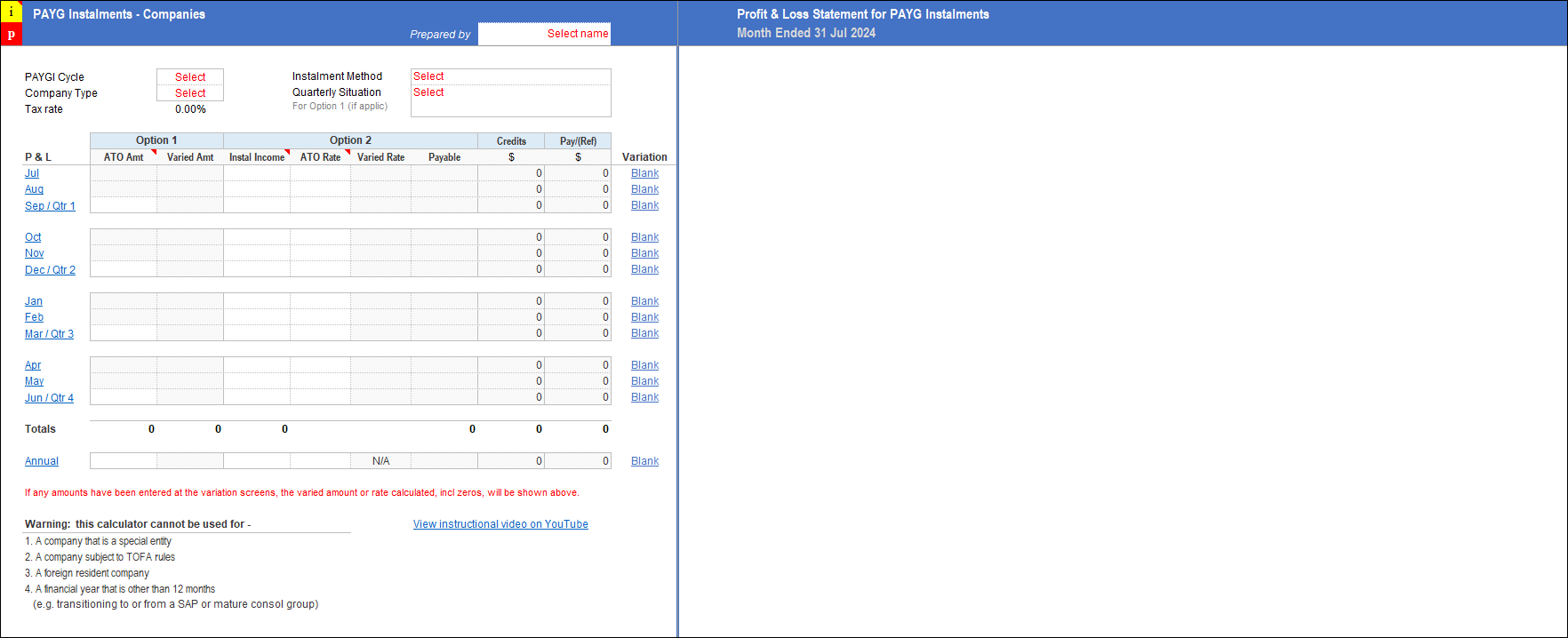

PAYG Instalment

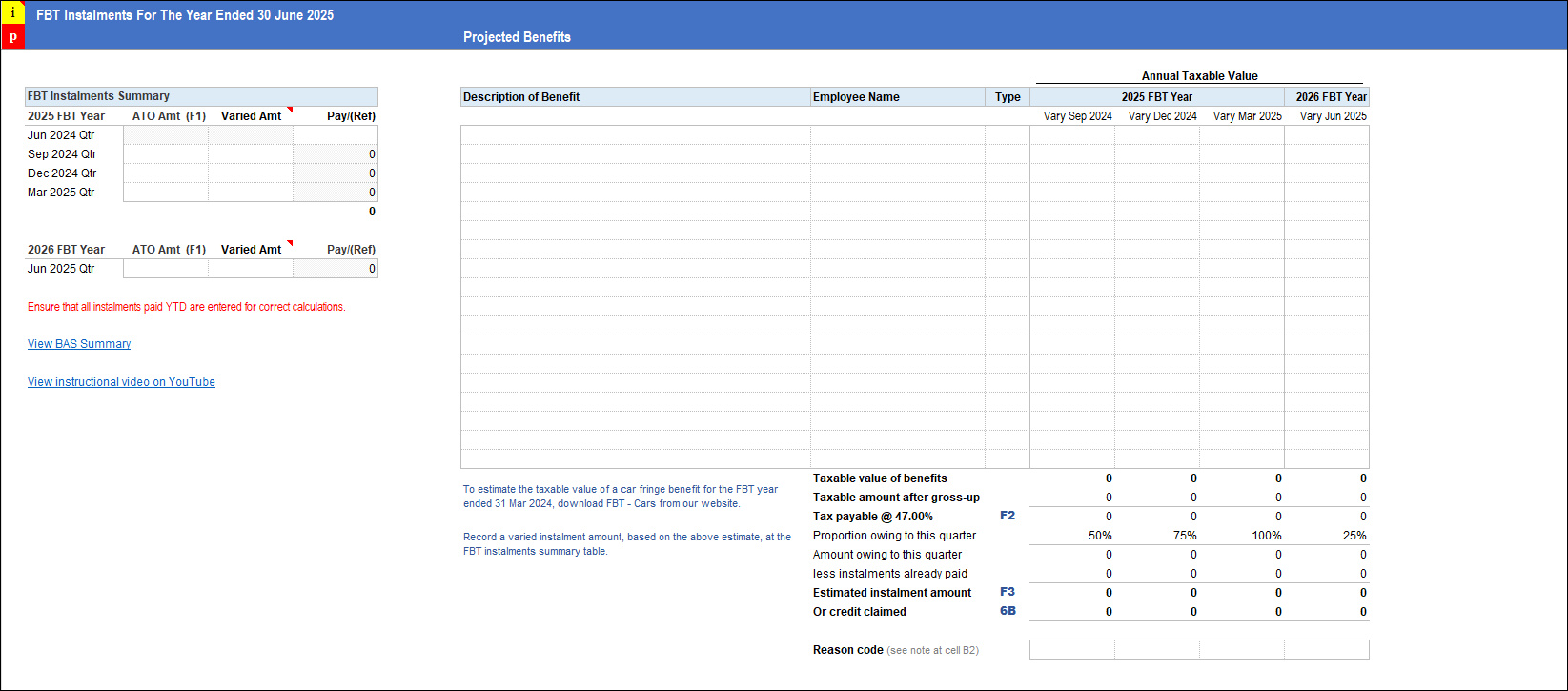

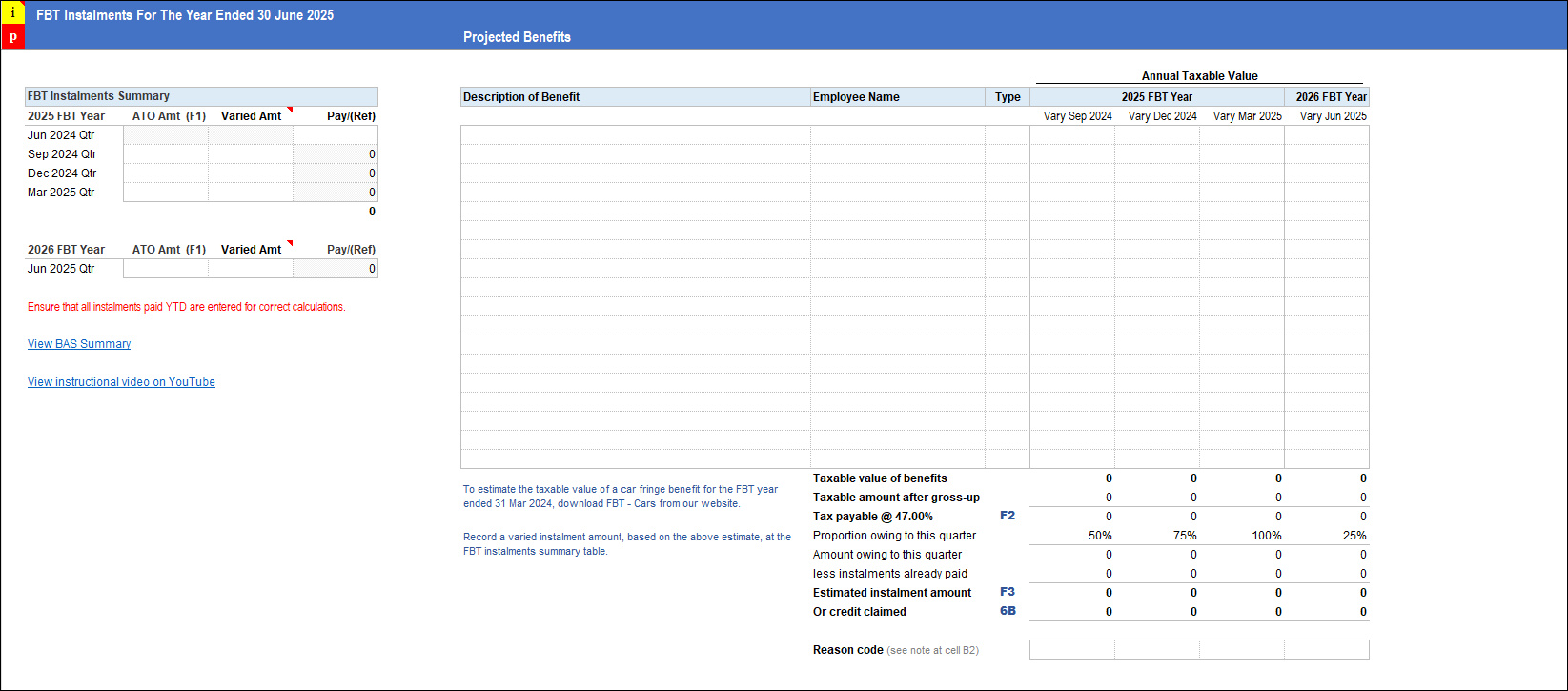

FBT

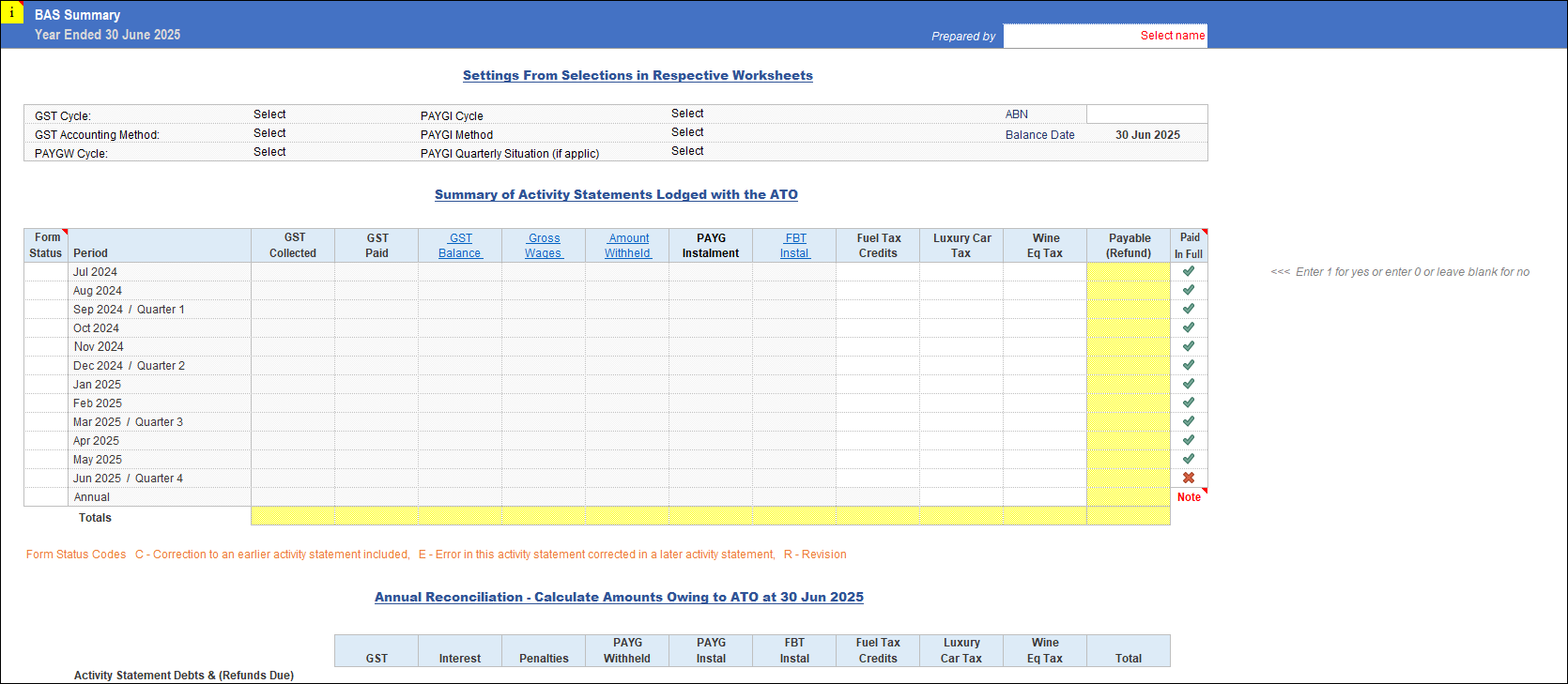

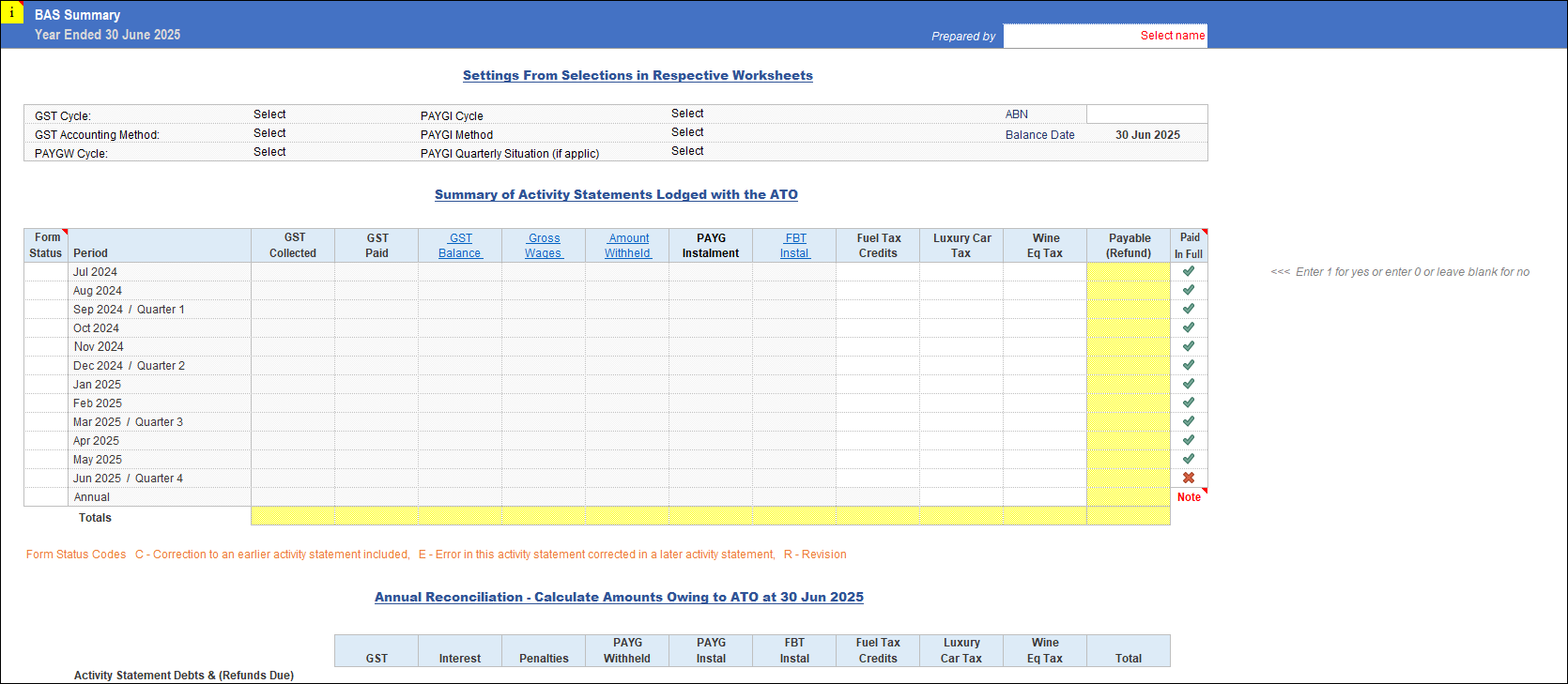

BAS Summary

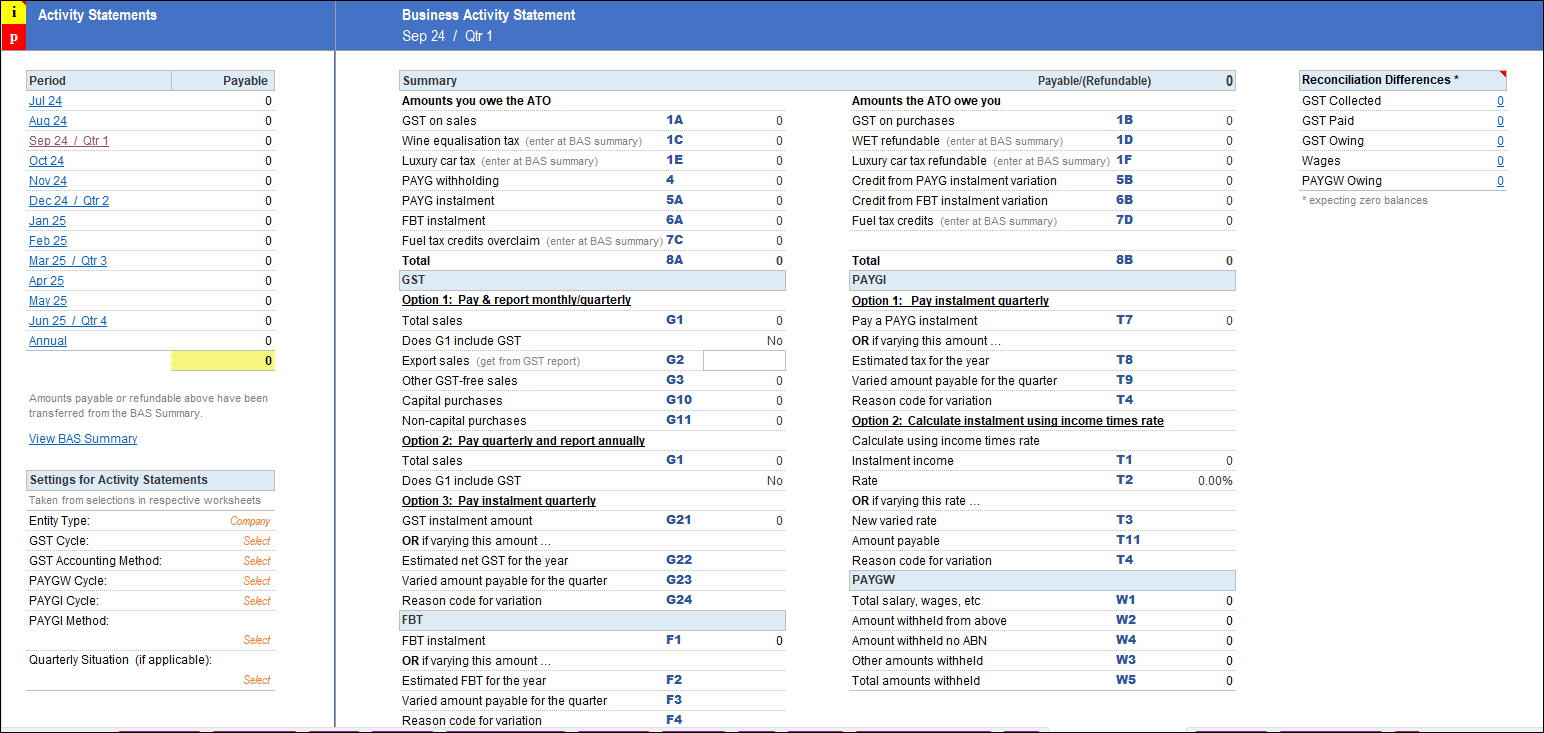

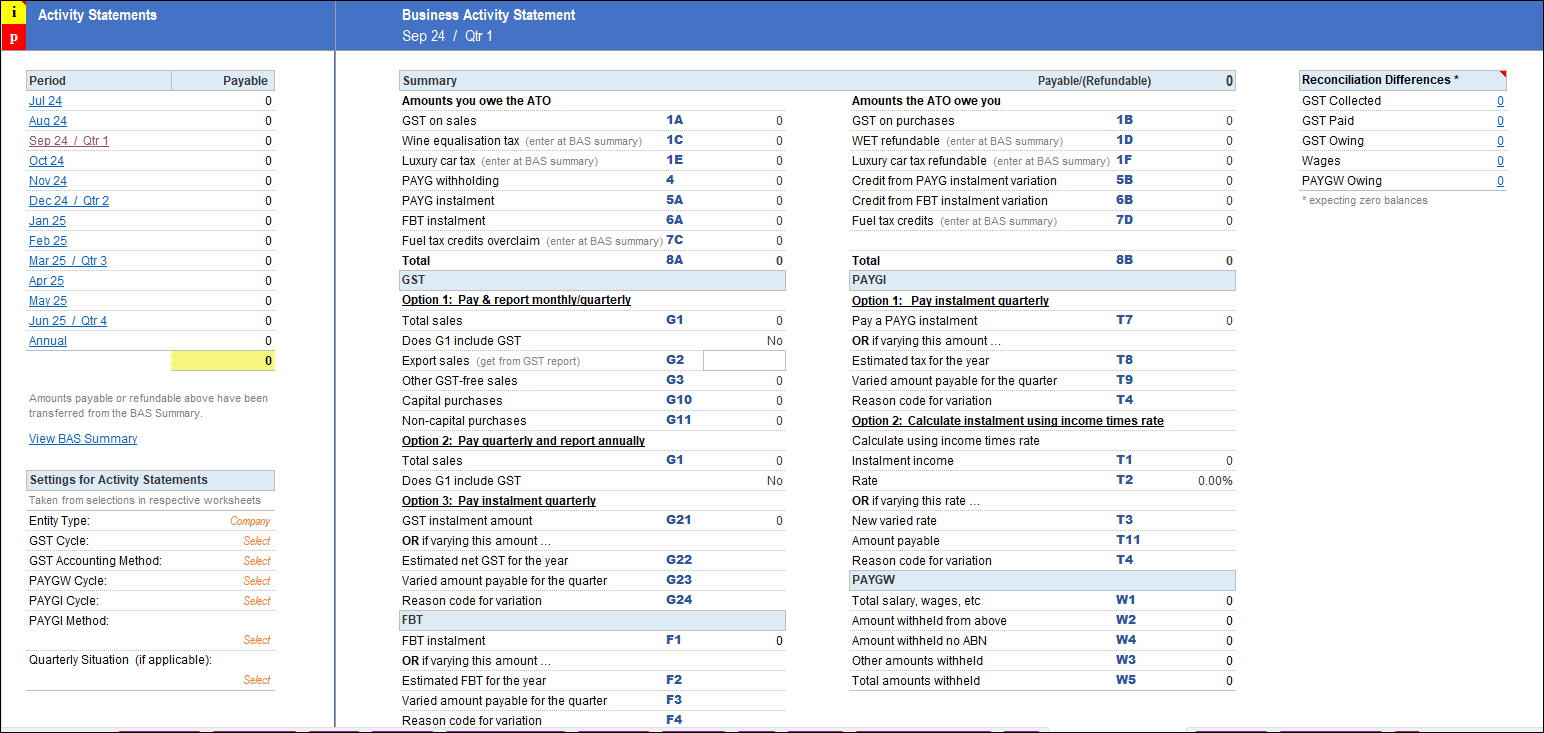

Activity Statement

Our working paper solution for your BAS jobs for the entire year ended 30 June 2025 is a multi-sheet Microsoft Excel file packed with features and saved in your document management system with other client records for easy retrieval.

This calculator offers maximum flexibility in a platform familiar to all accountants. Unused cells in this workbook are not protected allowing you to use them for your own purposes. Also, import other Excel data with just a few clicks as well as insert pictures, callouts, shapes, icons or screen shots to make it easier to follow or review your work. It even contains ticks and crosses to emulate paper-based processing.

For more information, read on and watch our 3 videos below to see our BAS working papers in action, as well as an overview of our JobPaper range and a brief tour of our website.

Warning: this file is not compatible with Microsoft Excel versions 2016 or earlier, or the cloud-based version of Excel, or Excel for Mac, or Google Sheets.

To access all of our content

$1,395.00 P.A. for 5 users!

Monthly plans available

Just fill in the form below and you will get access to our samples page with free downloads.

"*" indicates required fields

(02) 9542 4655

info@accountantsdesktop.com.au

PO BOX 507 Sutherland NSW 1499