Description

Features

- Unlimited use within your practice

- All updates to files after purchase

- One file for all entity types

- Work without paper

- View in multiple windows

- Use any blank cell

- Import Excel data

- Paste screen shots

- Insert ticks and crosses

- Insert text boxes and callouts

- Sheets to manage your job

- Sheets to store information

- Pre-loaded templates to do your calculations

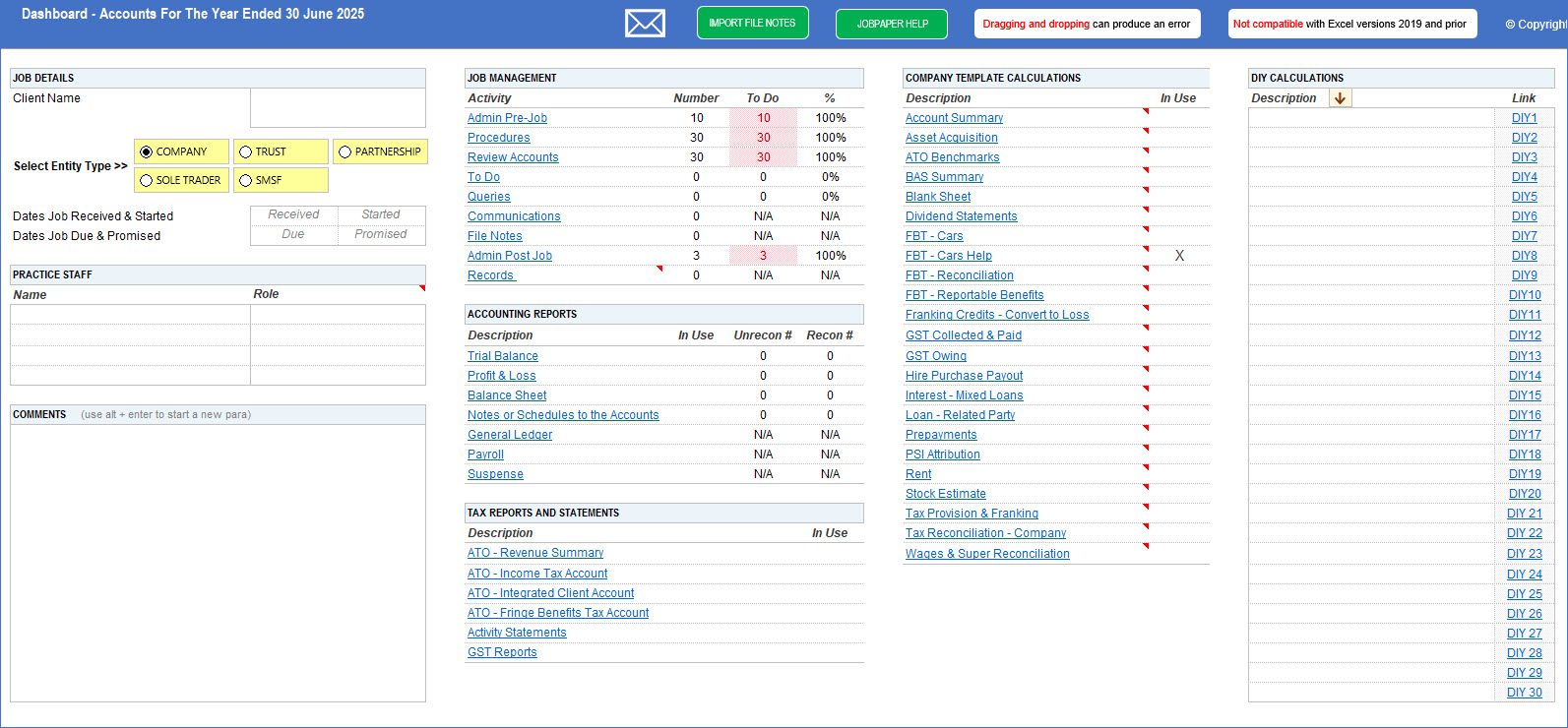

Managing Your Job

- Admin Pre & Post Job

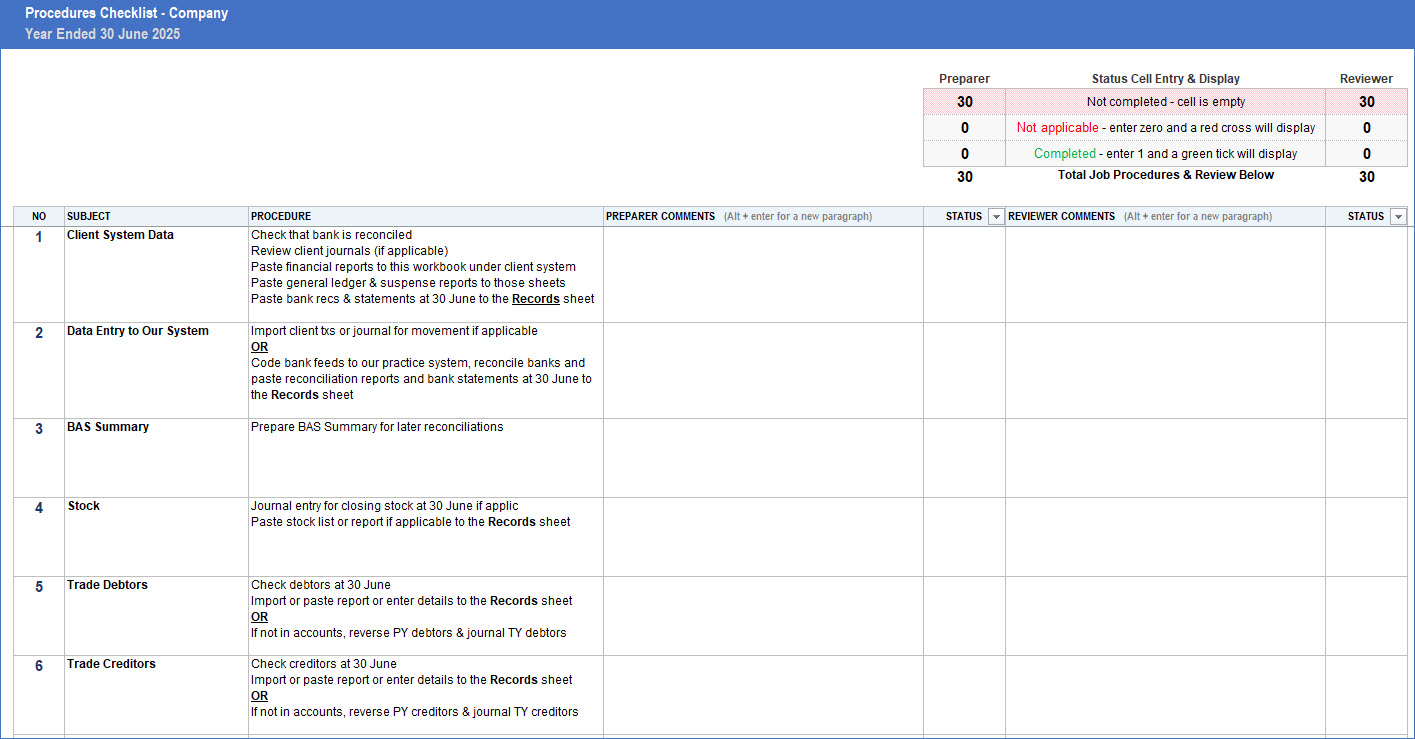

- Procedures checklist

- Review

- To Do

- Queries

- Emails

- File Notes

- Client Records

Storing Information

- Trial balance

- Profit & loss

- Balance sheet

- Notes to the accounts

- General ledger

- Payroll

- Suspense account

- ATO Portal revenue summary

- ATO Portal income tax account

- ATO Portal ICA

- ATO Portal FBT account

- Activity statements

- GST reports

- 30 unprotected DIY sheets

Dashboard

Procedures Checklist – Company

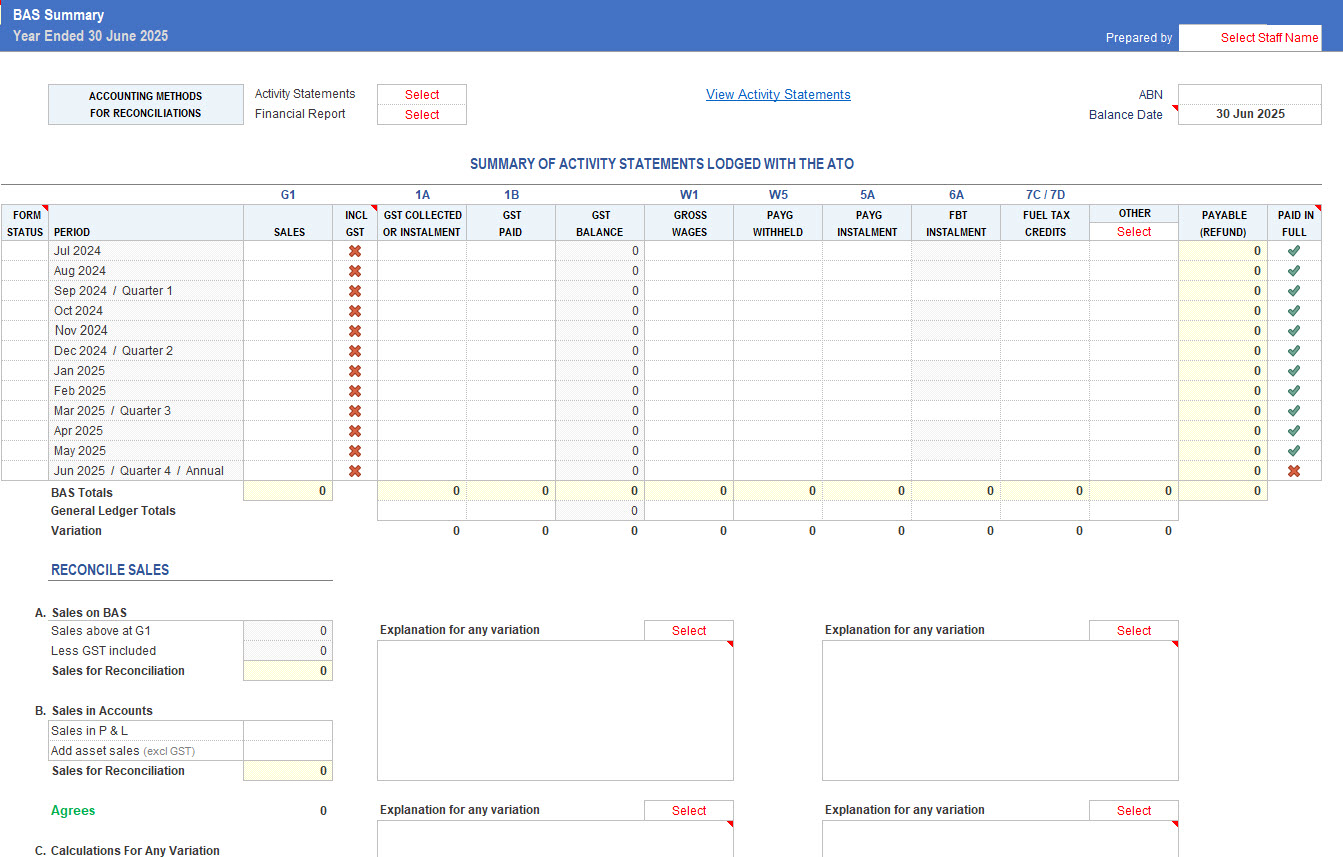

BAS Summary

Pre-Loaded Templates

- Accounts Summary

- Asset Acquisition

- ATO Benchmarks

- BAS Summary

- Blank Calculations Sheet

- Depreciation – OWDV Calculator (I & P only)

- Dividend Statements (C)

- FBT – Car Benefits

- FBT – Reconcile With Accounts

- FBT – Reportable Benefits

- Franking Credits – Convert to Loss (C)

- GST Collected & Paid Reconciliation

- GST Owing Reconciliation

- Hire Purchase Payout

- Interest on Mixed Loans

- Interest LRBA (S)

- Partners’ Salaries (P)

- Pension Payments (S)

- PSI Attribution (C & T only)

- Prepayments Calculator

- Rental Income Summary

- Stock Estimate

- Stock Private Use (I & P only)

- Tax Provision & Franking Account (C)

- Tax Reconciliation

- Trust Discretionary Distributions (T)

- Wages & Super Reconciliation

(C) – Companies | (I) – Sole Traders | (P) – Partnerships | (S) – SMSFs | (T) – Trusts