Description

Features

The Process

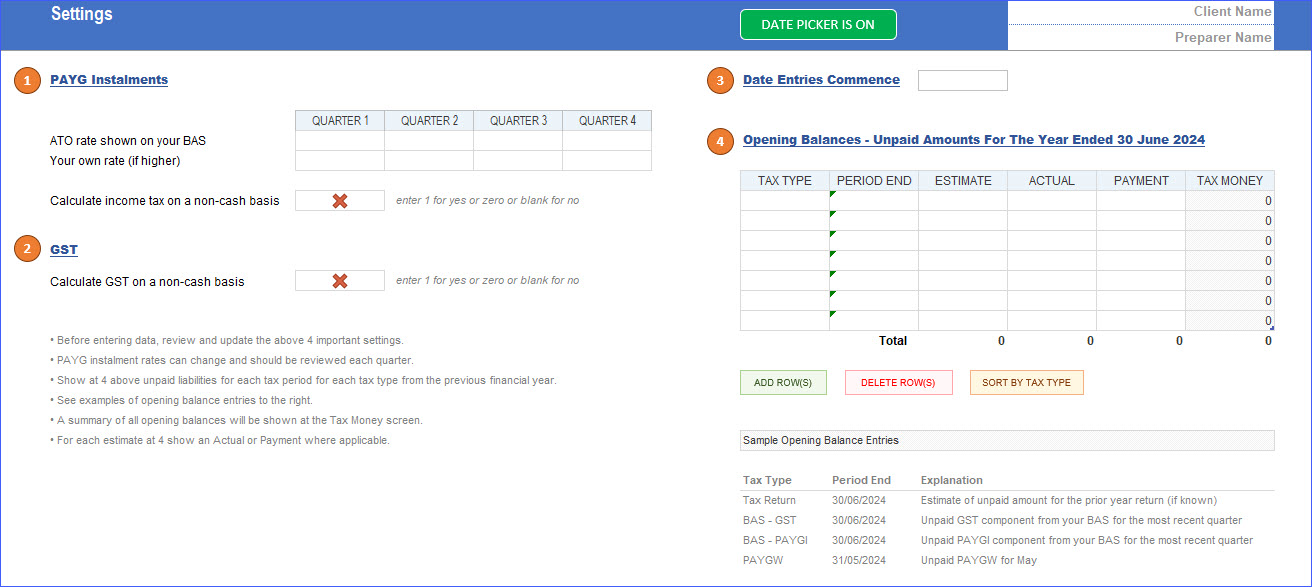

- Start at the beginning of any tax period during the financial year

- Enter unpaid amounts at the start date

- Add a one-line sumary for each BAS before the start date to estimate income tax YTD

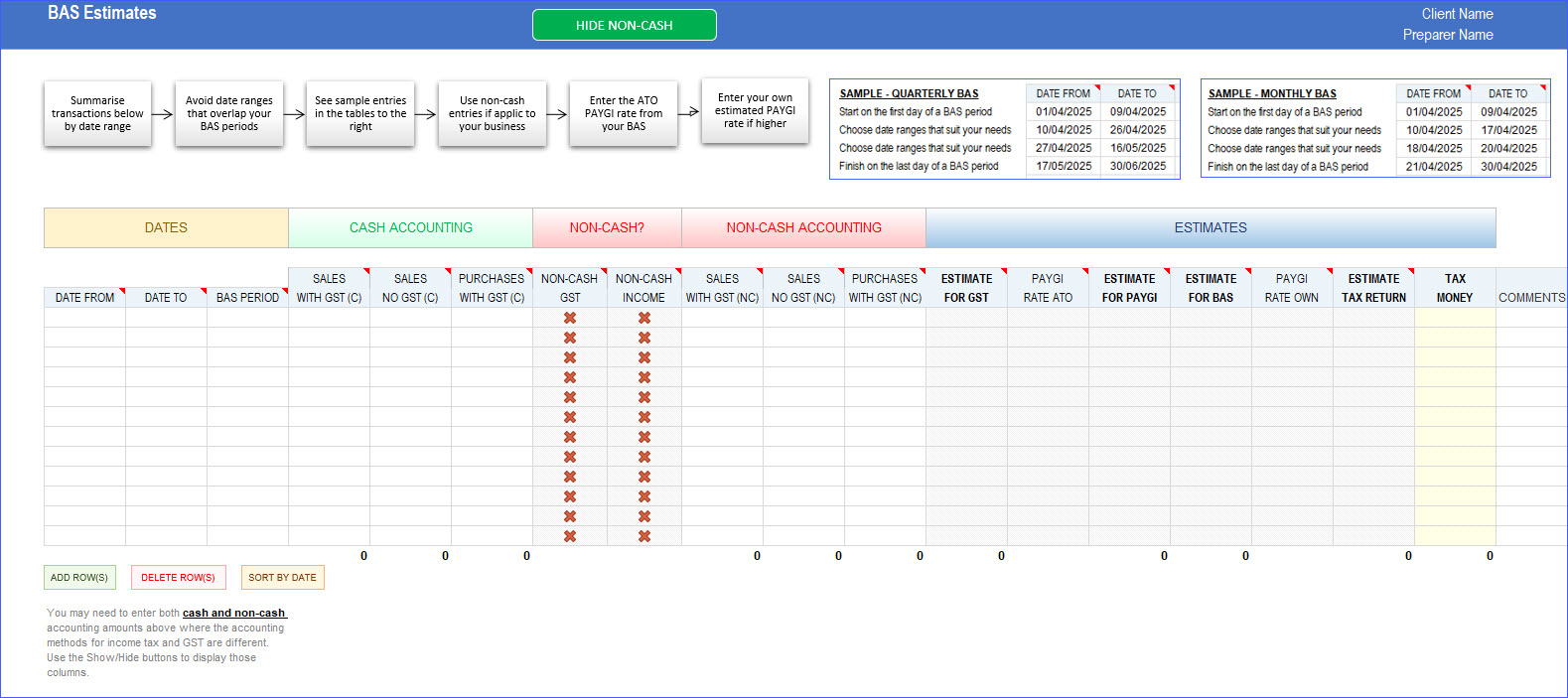

- From the start date, enter a summary of sales and purchases for your BAS by date ranges that suit the needs of your business

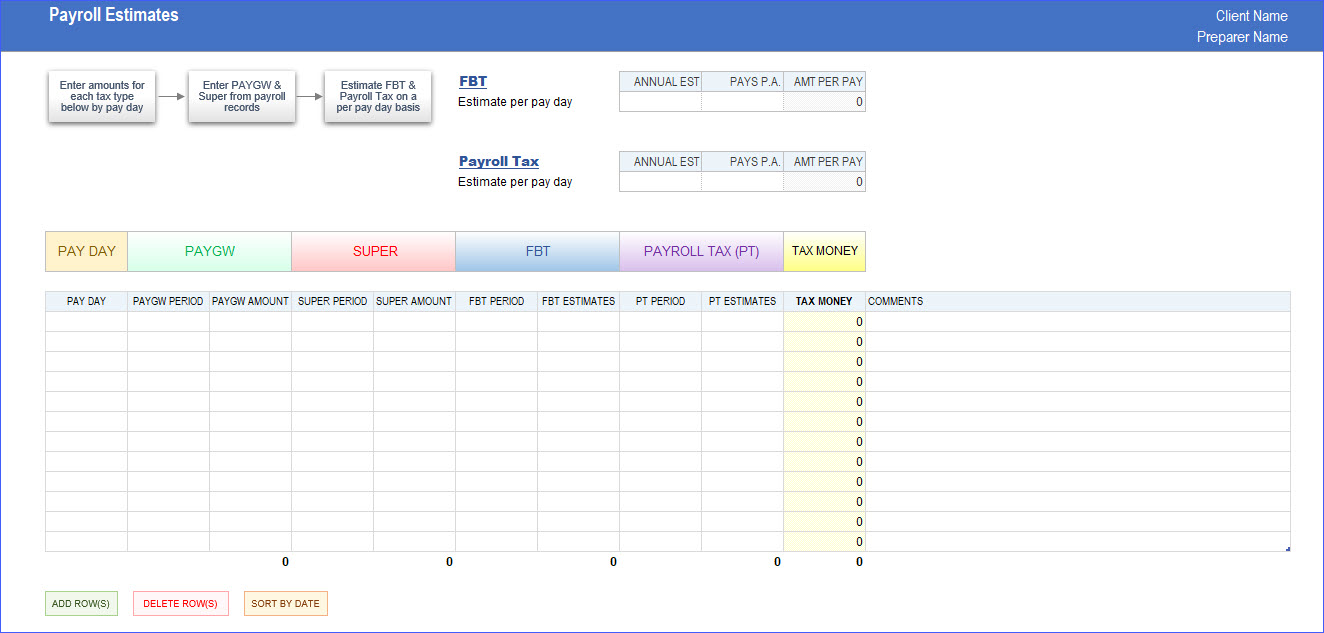

- Enter payroll related data by pay day for a more up to date estimate or grouped by tax period

- Enter actual figures when the related form(s) have been prepared and actuals will replace estimates

- Enter payments when made and actuals are reduced accordingly

- See a real-time estimate to the date of your last entry of “tax money” needed for future payment.

Tax Money Monitored

- BAS – GST

- BAS – PAYGI

- Income tax (at EOFY)

- PAYGW

- Super (it’s just another tax on wages)

- FBT

- Payroll Tax

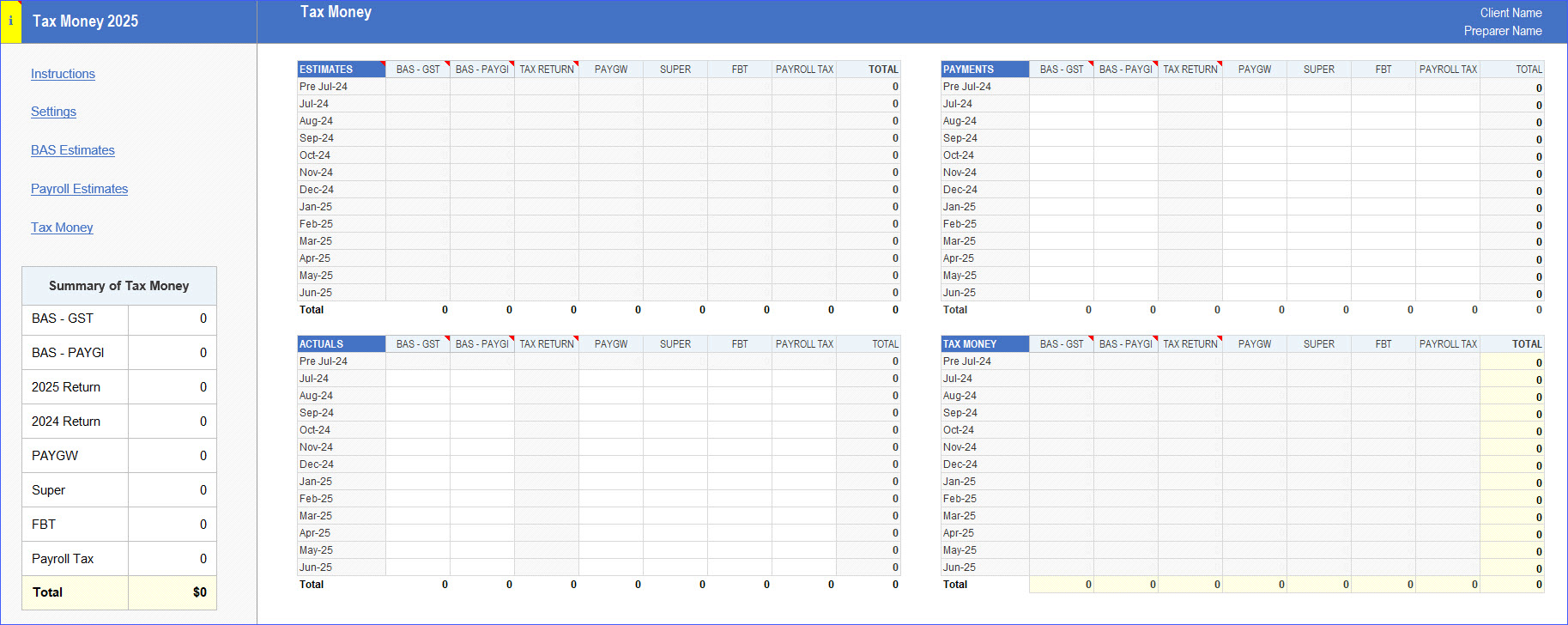

The Outcome

A summary of all taxes are brought together in one screen showing for each tax for each tax period –

- Estimates

- Actuals

- Payments

- Tax Money (the balance)

Licencing

This product is available for unlimited use within your practice and by your client base.

Screenshot – Settings

Screenshot – BAS Estimates

Screenshot – Payroll Estimates

Screenshot – Tax Money