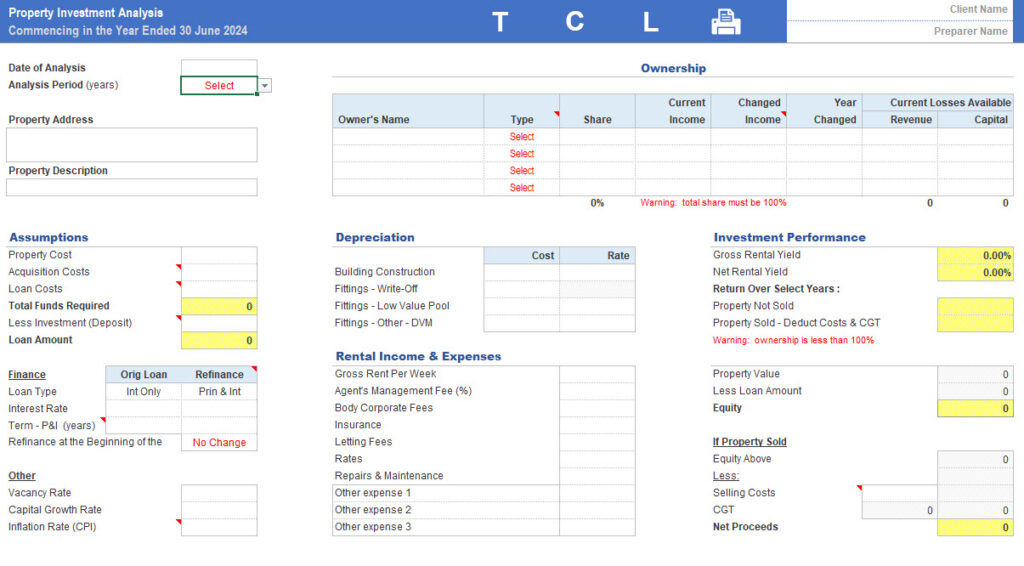

Description

Features

- Unlimited use within your practice

- All updates to the file after purchase

- Use for proposed purchases in the 2024 FY

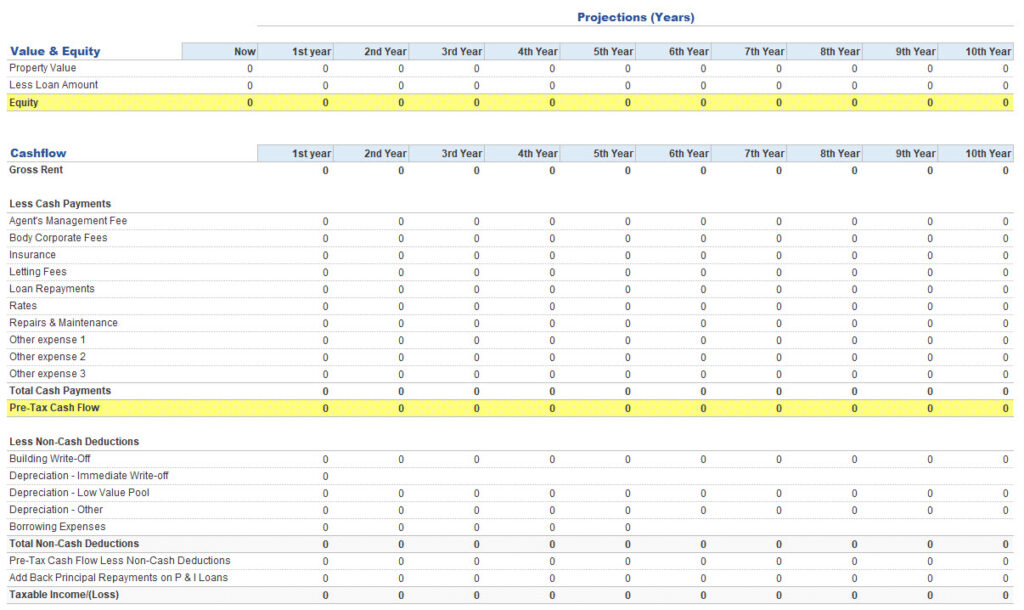

- Investment term between 1 and 10 years

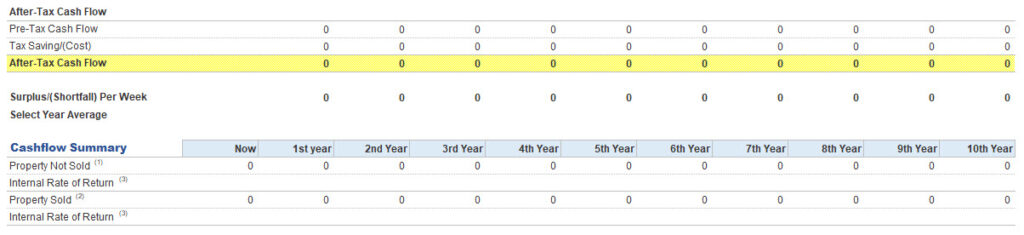

- Pre-tax cashflow

- Projected equity after 10 years

- IRR over 10 years if not sold

- IRR over 10 years if sold

- Use for individuals, companies & SMSFs

- Allow one income change per owner

- Account for revenue & capital losses

- Allow one refinance over the 10 yr period

- SMSFs go into pension mode any year

- Stress test by changing assumptions

Screen Shots