Description

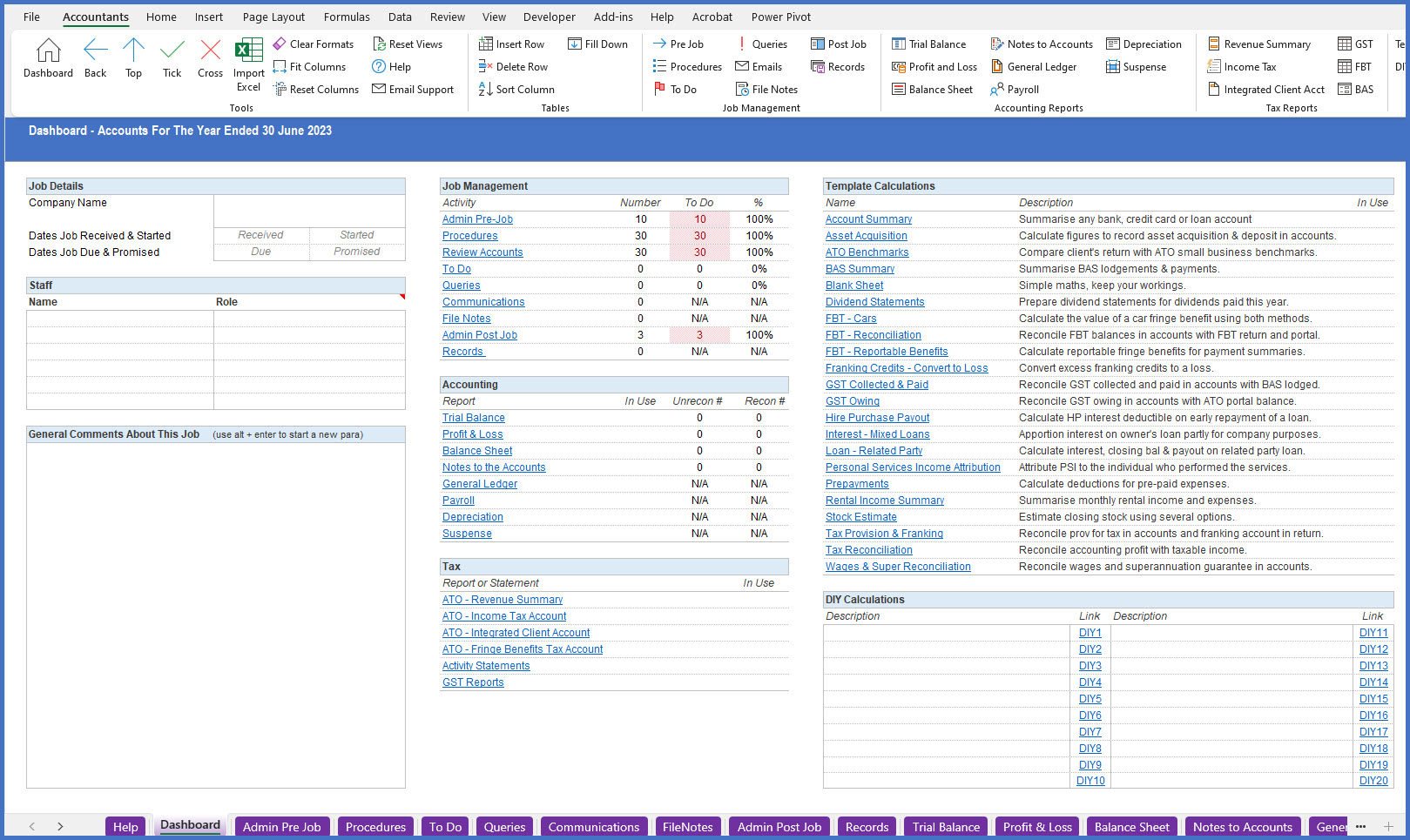

Sheet Preview – Dashboard

Accountants Desktop Templates Pre-Loaded

Templates 1

- Accounts Summary

- Asset Acquisition

- ATO Benchmarks

- BAS Summary

- Blank Calculations Sheet

- Depreciation – OWDV Calculator (I)

- Dividend Statements (C)

- FBT – Car Benefits

- FBT – Reconcile With Accounts

- FBT – Reportable Benefits

- Franking Credits – Convert to Loss (C)

- GST Collected & Paid Reconciliation

- GST Owing Reconciliation

- Hire Purchase Payout

Templates 2

- Interest on Mixed Loans

- Interest LRBA (S)

- Partners’ Salaries (P)

- Pension Payments (S)

- PSI Attribution

- Prepayment Calculator

- Rental Income Summary

- Stock Estimate

- Stock Private Use (I & P only)

- Tax Provision & Franking Account (C)

- Tax Reconciliation

- Trust Discretionary Distributions (T)

- Wages & Super Reconciliation

(C) – Companies | (S) – Sole Traders | (P) – Partnerships | (S) – SMSFs | (T) – Trusts